Wedoany.com Report-Aug. 14, Lithium Argentina and Ganfeng Lithium Group have signed a framework agreement to form a joint venture (JV) that will consolidate their lithium projects in Argentina under the name PPG. The venture will combine Ganfeng’s Pozuelos-Pastos Grandes project with Lithium Argentina’s Pastos Grandes and Sal de la Puna projects.

The JV will assess the potential for both lithium carbonate and lithium chloride production.

Under the agreement, Ganfeng will hold a 67% interest in PPG, while Lithium Argentina will own the remaining 33%. The development plan targets a production capacity of up to 150,000 tonnes per annum (tpa) of lithium carbonate equivalent (LCE), to be achieved in three phases.

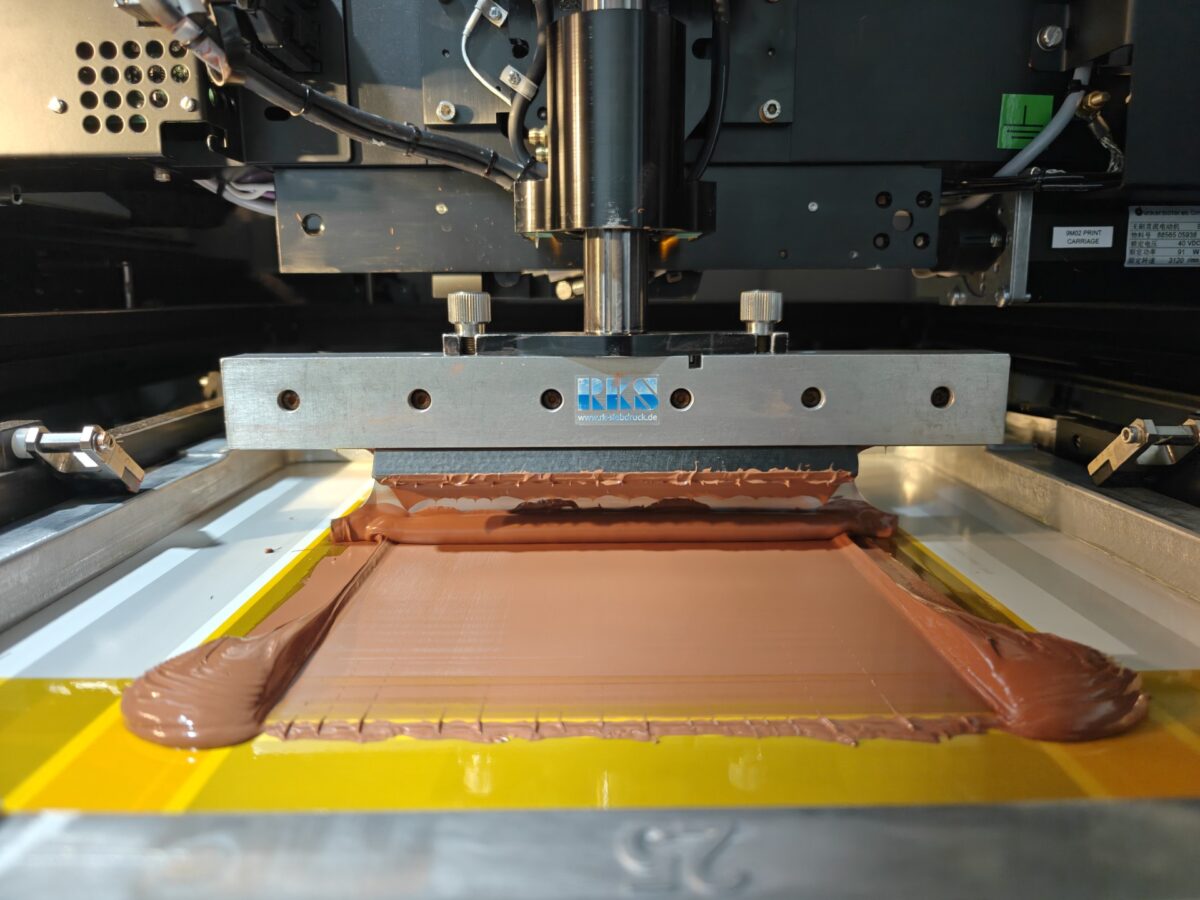

A feasibility study, expected to be completed by the end of 2025, will evaluate the potential for producing both lithium carbonate and lithium chloride, addressing different segments of the battery market. The study will also support an application under Argentina’s Incentive Regime for Large Investments (RIGI), planned for submission in the first half of 2026. The proposed hybrid processing flowsheet will integrate direct lithium extraction and solar evaporation methods to enhance scalability and efficiency.

The partners are exploring funding options including offtake agreements, minority equity participation, and project financing in cooperation with potential customers and strategic partners.

Lithium Argentina president and CEO Sam Pigott said: “This transaction builds on our successful partnership with Ganfeng at Cauchari-Olaroz, Argentina’s largest lithium operation. With this transformative step forward, we are increasing our ownership into the Pozuelos basin and aligning our interests around a substantially larger-scale operation. The new JV will provide access to advanced technologies, increased financial flexibility and meaningful operating synergies. It represents an important milestone in our strategy to develop a diversified, scalable and sustainable global lithium supply chain while strengthening our balance sheet and creating lasting value for our shareholders.”

Ganfeng has also agreed to provide Lithium Argentina with a $130 million (932.66 million yuan) six-year debt facility at a secured overnight financing rate (SOFR) plus 2.5%. This facility will support corporate debt refinancing and strengthen the company’s balance sheet. Under the arrangement, up to 50% of Lithium Argentina’s offtake from PPG’s initial development phase—capped at 6,000 tpa of LCE—will be supplied to Ganfeng at market prices. The debt is prepayable without penalties and secured by Lithium Argentina’s equity in PPG, with terms allowing subordination to future corporate debt financings.

Completion of the JV will require several conditions, including final agreements, a development plan, and a loan agreement for the debt facility, as well as regulatory and stock exchange approvals. The transaction is expected to close by the first quarter of 2026.

In December, Lithium Argentina announced plans to relocate its corporate domicile to Switzerland to enhance financing flexibility and support long-term growth.