Wedoany.com Report-Aug. 21, Peru’s gold exports to China in the first half of 2025 exceeded the total shipments for all of 2024, according to government data released in August. The significant increase reflects growing global demand for gold, a valuable commodity often sought during periods of economic uncertainty.

A man carrying food for miners, walks towards a gold mine in La Rinconada, the Andes, Peru, October 7, 2019.

In the first six months of 2025, Peru’s gold exports to China reached $947 million, nearly four times higher than the same period in the previous year. This marks a continuation of a rising trend, as Peru exported $885 million in gold to China in 2024, a 410% increase from the $173 million recorded in 2023. “The demand for gold has been steadily climbing, and our exports reflect this global trend,” said a spokesperson from Peru’s Ministry of Energy and Mines.

Globally, Peru’s gold exports for the first half of 2025 totaled $8.57 billion, a 46% increase compared to the same period last year. This growth underscores Peru’s position as a major player in the global gold market. China ranks as the fourth-largest buyer of Peruvian gold, following Canada, India, and Switzerland.

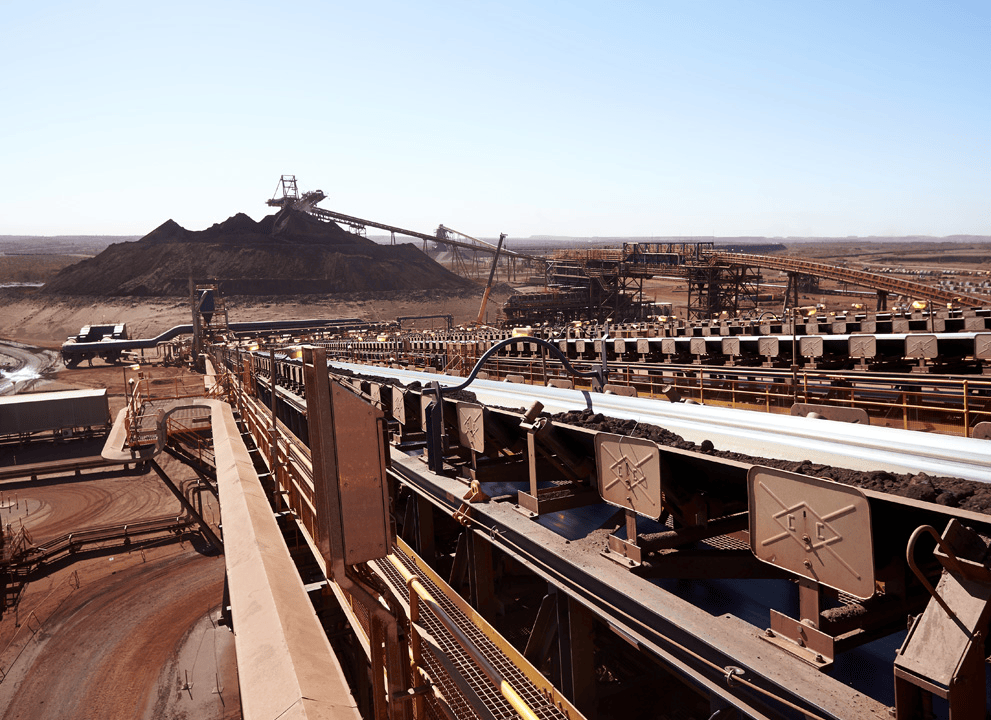

The surge in exports comes as gold prices reached record highs in 2024, driven by strong demand for the metal as a safe haven asset. Investors worldwide have turned to gold amid economic fluctuations, boosting Peru’s export figures. However, the rise in local gold production has raised concerns about the environmental and social impacts of mining activities. Some sources indicate that a portion of the output comes from unregulated mines, which may not comply with environmental standards and could contribute to local challenges.

Peru’s mining sector continues to play a critical role in the country’s economy, with gold being a key export commodity. The data highlights the nation’s ability to meet growing international demand while navigating challenges in sustainable production. Industry observers note that Peru’s strategic focus on expanding its mining operations has positioned it as a reliable supplier in the global market.

As global demand for gold remains robust, Peru’s export growth to China and other markets is expected to continue, supporting economic development while prompting ongoing discussions about sustainable mining practices.