Wedoany.com Report-Nov. 29, Montage Gold (TSX: MAU) has entered a binding agreement to fully acquire Australian-listed African Gold (ASX: A1G), significantly expanding its footprint in Côte d'Ivoire and adding a high-potential exploration asset to its portfolio.

Ongoing work at the Koné gold project in Côte d'Ivoire.

Announced on Friday, the transaction will be executed through a court-approved scheme of arrangement under Australian law. Montage will issue 0.0628 of its own common shares for each African Gold share it does not already own, valuing African Gold at A$0.50 per share – a 54% premium to the 10-day volume-weighted average price. The deal carries an implied enterprise value of approximately $170 million.

Upon closing, existing African Gold shareholders will hold about 27.7 million shares, representing 7.1% of the enlarged Montage.

Montage shares responded strongly, opening higher and reaching an all-time peak of C$8.35 on the Toronto Stock Exchange before settling midday at C$8.30, up 5.3%, for a market capitalisation of nearly C$3 billion ($2.1 billion).

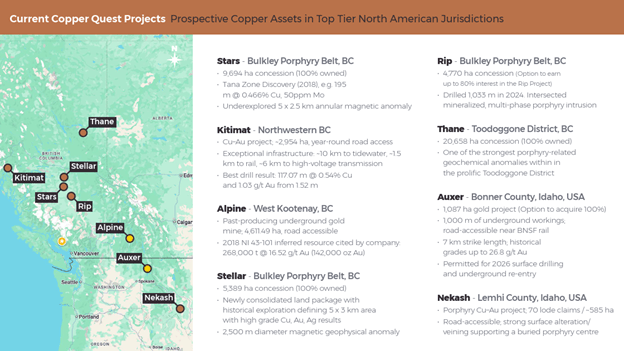

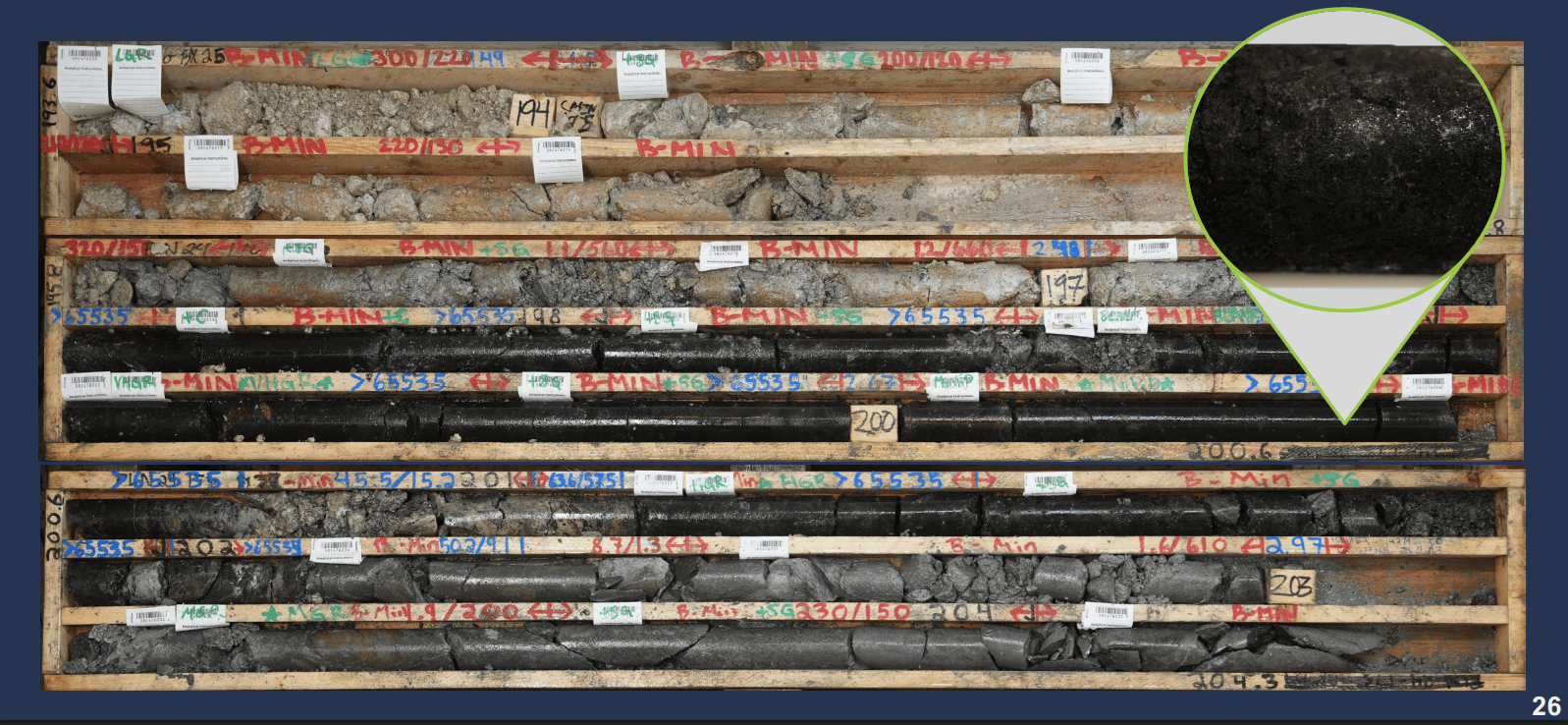

The acquisition brings the early-stage Didievi project into Montage's 100% ownership. Didievi currently hosts an inferred resource of 12.4 million tonnes grading 2.5 g/t gold, containing 989,000 oz. Montage has operated the project under an existing earn-in agreement since March 2025, during which it acquired an initial 17.3% stake in African Gold and conducted extensive exploration work.

The company views Didievi as offering substantial discovery potential and possible future standalone development, complementing its flagship Koné project, which is under construction and scheduled for first production in 2027. A 2024 feasibility study for Koné outlined a 16-year mine life with average annual output exceeding 300,000 oz. during the first eight years.

Montage CEO Martino De Ciccio stated: "With the build of our Koné project tracking on budget and well on schedule, we are pleased to further enhance our portfolio through the addition of the high-quality Didievi project, thereby strengthening our presence in Côte d'Ivoire."

Recent drilling has also boosted Koné's resource base. Indicated resources now stand at 269 million tonnes grading 0.63 g/t, containing 5.5 million oz. of gold – a 13% increase from the 2024 feasibility study figures.

The transaction remains subject to customary approvals, including from African Gold shareholders and the Australian court, with completion expected in the first quarter of 2026.