Wedoany.com Report-Feb 13, The Australian Government's Future Made in Australia (Production Tax Credit and Other Measures) Bill 2024 passed the Senate.

Wedoany.com Report-Feb 13, The Australian Government's Future Made in Australia (Production Tax Credit and Other Measures) Bill 2024 passed the Senate.

This legislation implements production tax incentives for renewable hydrogen and critical minerals.

The incentives are:

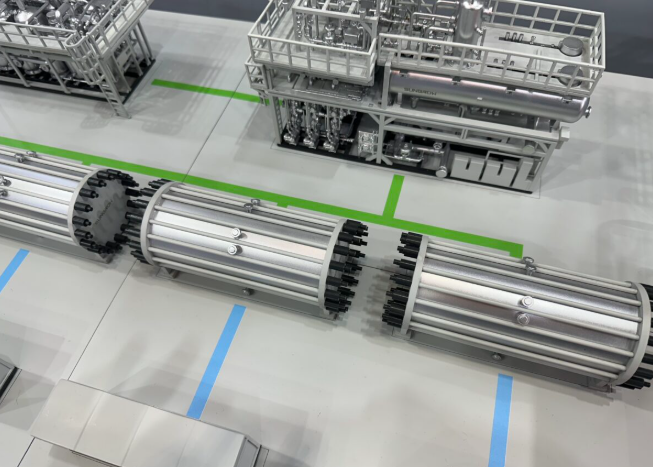

1. Hydrogen Production Tax Incentive worth $2 per kilogram of renewable hydrogen produced between 2027-2028 and 2039-40 for up to ten years per project.

2. Critical Minerals Production Tax Incentive worth ten per cent of relevant processing and refining costs for Australia's 31 critical minerals, for critical minerals processed and refined between 2027-28 and 2039-40, for up to ten years per project.

The incentives will support Australia's efforts to decarbonise our industries, and produce and process more of the minerals needed for the energy transition.

The incentives will only be provided once projects are up and running, producing hydrogen or processing critical minerals used in products like wind turbines, solar panels and electric vehicles.

Critical minerals are also vital to the defence industry and are needed for the construction of submarines and aircraft.

We recognise that the best opportunities for Australia and its people lie at the intersection of industry, energy, resources, skills and our ability to attract and deploy investment.

These tax incentives will leverage traditional strengths and encourage and enable new industries which help maximise our opportunities in the global net zero transformation.