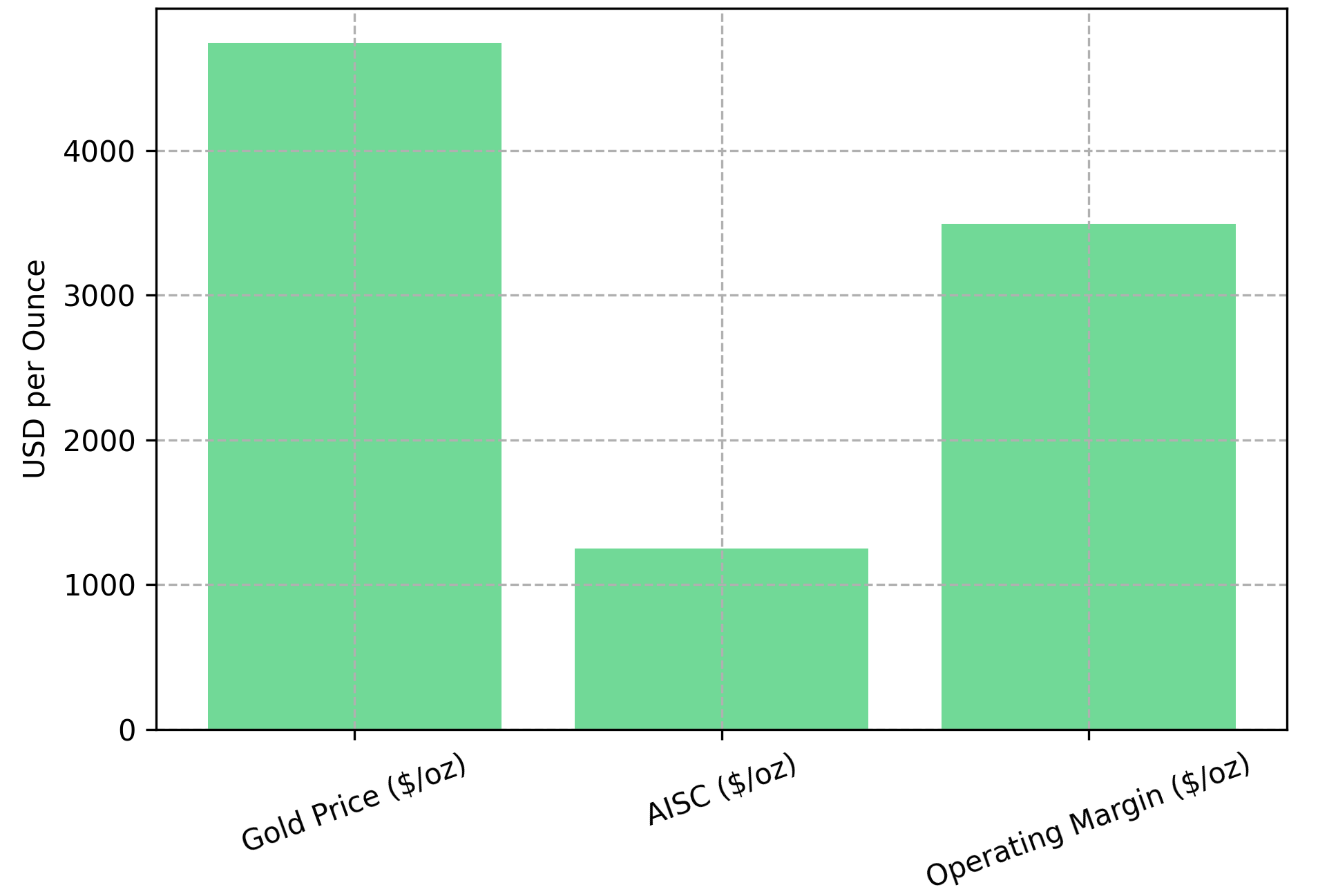

On Tuesday, the global precious metals market continued its upward trend driven by persistently rising risk-aversion sentiment. Trading data from the New York Mercantile Exchange showed that the actively traded March delivery silver futures price broke through the key level of $80 per ounce at the close, finally settling at $81.039 per ounce, marking a single-day gain of 5.72%. Meanwhile, the February delivery gold futures price also recorded an increase, closing at $4496.10 per ounce, up 1%.

Market analysis widely links this synchronized rise in gold and silver prices to uncertain factors in the recent global economic environment. Investors are inclined to shift funds into traditional safe-haven assets such as gold and silver to seek asset preservation. The international silver price rose significantly on Tuesday, breaking through an important psychological barrier. The gold price also maintained a steady upward trajectory, reflecting continued strong demand for precious metal allocation in the market.

This price fluctuation shows that as the global financial market faces numerous variables, the role of precious metals as safe-haven instruments remains prominent. The coordinated rise of silver and gold further confirms the market's current preference for safe assets.