Wedoany.com Report-Oct. 29, Apple briefly surpassed a $4 trillion market value for the first time on Tuesday, becoming the third major technology company to reach this milestone. The rise came as strong demand for its latest iPhone models eased concerns about its slower advancement in artificial intelligence. Apple’s stock climbed to an intraday high of $269.89, valuing the company at $4.005 trillion, before closing up 0.1% at $3.992 trillion.

Since the new product launches on September 9, Apple’s shares have risen about 13%, reversing earlier declines and turning positive for the year. Chris Zaccarelli, chief investment officer at Northlight Asset Management, said: “The iPhone accounts for over half of Apple’s profit and revenue, and the more phones they can get into the hands of people, the more they can drive people into their ecosystem.”

Apple’s earlier performance this year had been affected by competition in China and uncertainties about U.S. tariff policies on Asian economies such as China and India, where much of its manufacturing is based. However, the launch of the iPhone 17 series and the new iPhone Air has helped the company recover. The latest models attracted strong sales from Beijing to Moscow within weeks of release, with Apple absorbing the additional tariff-related costs.

Analysts noted that the iPhone Air’s lightweight design has strengthened Apple’s position against competitors like Samsung Electronics. According to Counterpoint Research, sales of the iPhone 17 series have exceeded those of the previous generation by 14% in both the U.S. and China. Brokerage Evercore ISI expects the strong demand to allow Apple to exceed market forecasts for the quarter ending in September and to provide positive guidance for the December quarter.

Apple now joins Nvidia and Microsoft as the only companies to have reached the $4 trillion valuation level. Nvidia currently leads the market with a capitalization near $5 trillion. Despite Apple’s impressive sales recovery, investors remain focused on its artificial intelligence strategy. Reports indicate that several senior AI executives have recently departed for Meta, adding to concerns about the company’s progress in this area.

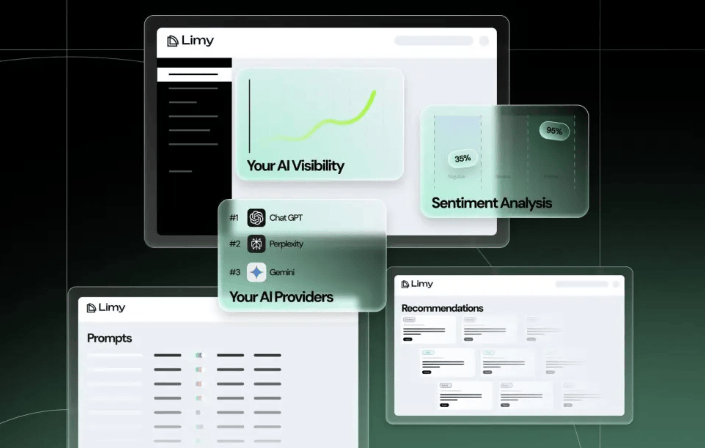

Apple has been developing its Apple Intelligence suite, which includes integration with ChatGPT, though a major AI upgrade for its Siri assistant has been delayed until next year. The company has also been exploring partnerships with Alphabet’s Gemini AI, Anthropic, and OpenAI. Zaccarelli added: “The lack of a well-understood artificial intelligence strategy is clearly one of the things that is an overhang for the stock. If they could figure out how to incorporate artificial intelligence in a way that would excite consumers and the market, you’d see a whole different company.”

Apple achieved strong quarterly results from April to June, recording double-digit growth across key segments and exceeding analysts’ expectations. The company will announce its fourth-quarter earnings on October 30. Its shares currently trade at about 33 times expected earnings for the next 12 months, compared with 27 times for the Nasdaq 100. Despite recent gains, Apple’s 7% rise this year lags behind the Nasdaq’s 23% increase.