Wedoany.com Report on Feb 4th, Western Digital Corp. recently announced that its board of directors has approved a new $4 billion stock repurchase plan. This decision is primarily based on the sustained increase in demand for memory chips from AI servers. Following the news, the company's stock rose approximately 5% in pre-market trading, bringing its year-to-date gain to 57%, and its stock price more than doubled last year.

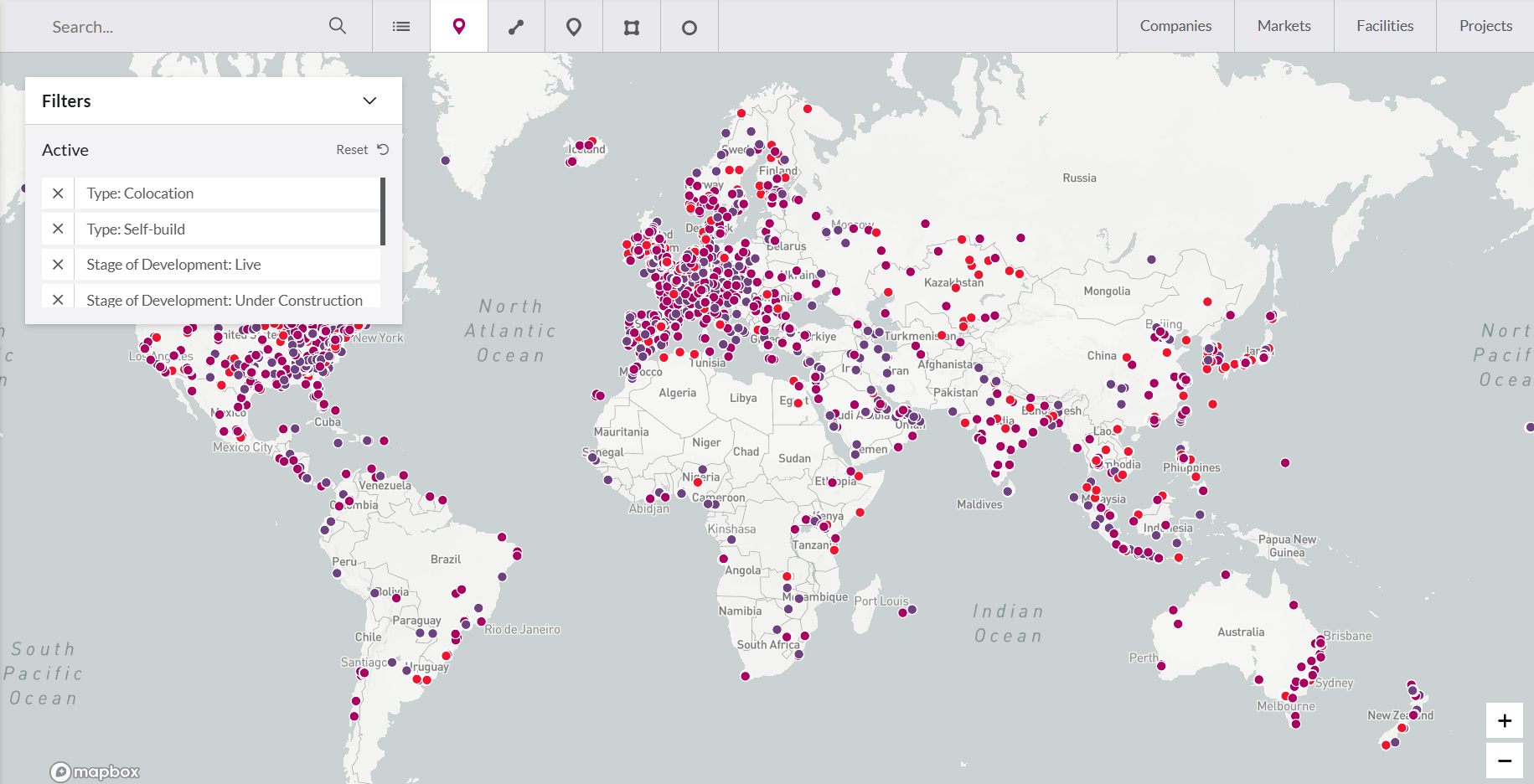

Currently, the global supply of memory chips is tight, with intensified competition for limited resources from the artificial intelligence and consumer electronics industries leading to rising product prices and extended delivery cycles. Manufacturers face challenges in increasing production capacity, further driving up market demand.

Prior to this new repurchase plan, Western Digital still had approximately $484 million available for use from the $2 billion repurchase authorization approved in May of last year. The company's performance forecast released last week indicated that revenue and profit for the third fiscal quarter are expected to exceed market expectations, mainly due to increased sales of hard drives and flash storage products used in AI servers.

As a key component of AI infrastructure, the market prospects for memory chips have garnered widespread attention within the industry. Western Digital's expansion of its stock buyback scale reflects the company's confidence in its business development and industry trends. With the continuous expansion of AI technology applications, demand for related hardware is expected to continue growing.