Wedoany.com Report on Feb 4th, The current memory market is undergoing a structural transformation, not merely a supply crisis. The era of cheap memory has ended, with rising prices and tight supply turning procurement from a routine operation into a strategic challenge.

Market focus is shifting towards the fastest-growing workloads, particularly AI training and inference applications. This is elevating memory from a background component to a critical element influencing project prioritization, scheduling, and competitive positioning.

The real constraint is not insufficient factory capacity, but a fundamental shift in production focus. The memory industry is transitioning from DDR5 to High Bandwidth Memory (HBM), which has become core infrastructure for AI data centers.

HBM production requires more specialized manufacturing processes and complex packaging technologies, with downstream demand concentrated among a few large buyers. As HBM consumes more wafer capacity, the production of each AI data center stack directly reduces the available supply for other markets.

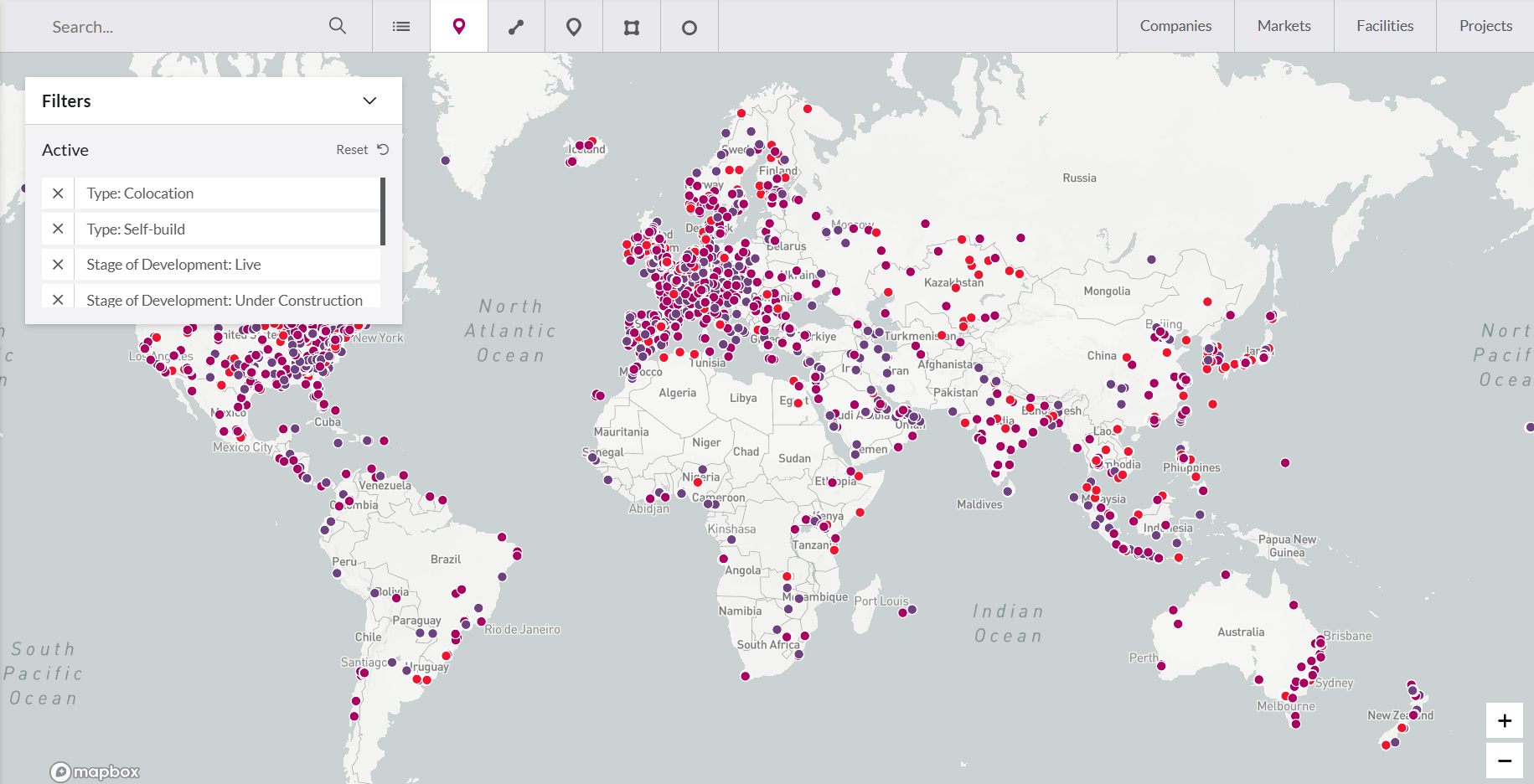

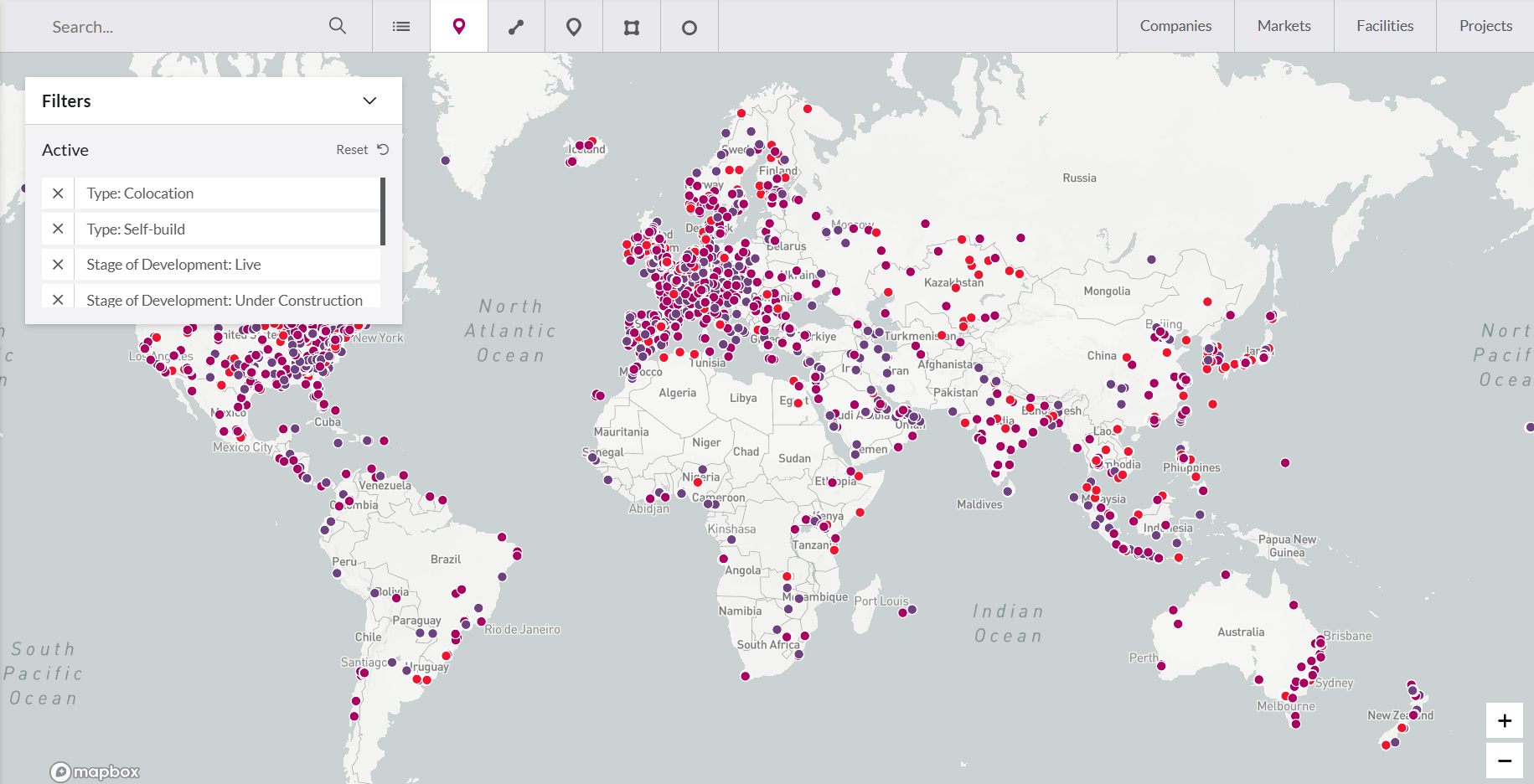

Large operators are locking in supply through multi-year, large-scale contracts, intensifying market fragmentation. For instance, certain large AI projects may consume a significant portion of global memory output, forcing consumer hardware vendors and enterprise IT teams to face higher premiums and longer lead times.

As HBM becomes a specialized, high-cost asset, traditional hardware refresh cycles are being challenged. Industry thinking is shifting towards efficiency optimization: extending infrastructure lifespan, improving software memory efficiency, and implementing risk-based pricing based on supply certainty.

HBM's efficiency characteristics support sustained performance, and its lower power consumption reduces thermal constraints in high-density environments. In settings where power and cooling are critical factors, these traits directly impact actual capacity utilization.

This transformation is prompting all stakeholders to adjust their decision-making processes. Operators must more precisely match architecture to workloads; investors are focusing more on execution certainty than pipeline scale; suppliers must pivot to specialized, AI-aligned solutions.

The current market adjustment can be viewed as a necessary phase in the industry's maturation. The sector is investing in next-generation memory architectures, with continuous evolution centered around HBM. When new supply comes online, the industry will have developed leaner software, more precise infrastructure, and more pragmatic workload deployment strategies.

The end of the cheap memory era marks a shift from being performance-driven to being driven by architectural complexity. The core challenge for decision-makers lies in how quickly they can adapt their planning to thrive in the new market environment dominated by HBM.