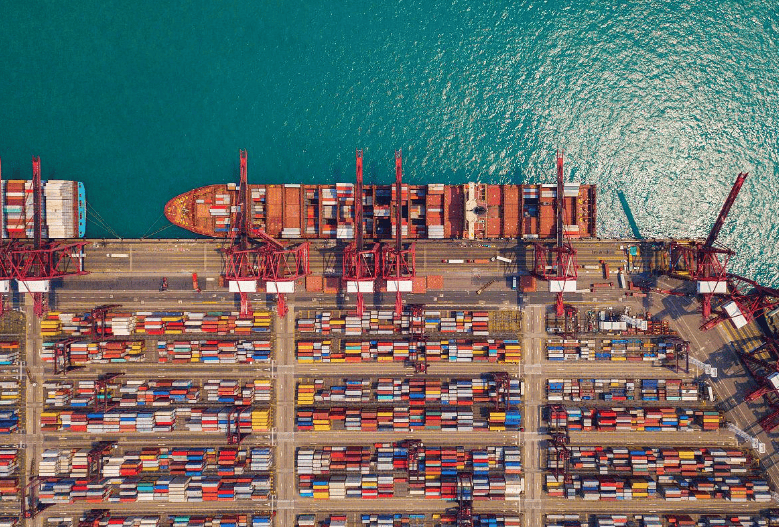

Wedoany.com Report on Feb 7th, French shipping and logistics group CMA CGM and US infrastructure investment fund Stonepeak jointly announced the formation of a global joint venture, United Ports, at the end of January 2026, marking a significant step in port consolidation. The new entity will consolidate and manage ten container terminals owned by CMA CGM in North America, South America, Europe, and Asia, with an overall valuation of approximately $9.6 billion. The transaction is expected to be completed in the second half of 2026, pending regulatory approval.

Under the agreement, CMA CGM retains a 75% stake and full operational control, while Stonepeak invests $2.4 billion for a 25% equity interest. This structure is designed to ensure management continuity, integrate the terminals with the group's shipping schedules, and support its overall operational strategy.

For CMA CGM, the establishment of United Ports is a key move in its vertical integration strategy. The group already directly controls 41 terminals and holds stakes in an additional 21 terminals through its joint venture Terminal Link. Creating an independent platform helps attract external funding for asset modernization and development while maintaining control over critical supply chain nodes.

United Ports' asset portfolio covers major global trade routes. In the United States, it includes Fenix Marine Services in Los Angeles and the Port Liberty terminal in the Port of New York and New Jersey. Its core asset in South America is the Santos Brasil terminal at the Port of Santos in Brazil. The European segment encompasses four terminals in Spain. In Asia, it integrates terminals in key growth markets such as India, Taiwan, and Vietnam.

For Stonepeak, this investment represents a strategic allocation into infrastructure assets with long-term concession rights and stable cash flows. The agreement also allows Stonepeak to invest an additional $3.6 billion in the future for joint development projects, supporting the long-term growth of United Ports.

The formation of United Ports comes at a time when port infrastructure is receiving widespread attention. By bringing in capital from Stonepeak, this move aligns with the trend of strengthening control over strategic logistics assets. It not only advances CMA CGM's transformation from a shipping company to an integrated logistics operator but also further solidifies its control over critical links in the global supply chain.

Overall, the establishment of United Ports is a significant step for CMA CGM in deepening its strategic positioning. By creating this independent platform, the company aims to attract external investment and optimize its asset portfolio, thereby continuously driving port consolidation on a global scale.