Wedoany.com Report on Feb 7th, Recently, MMG Limited announced that, benefiting from the operational performance of its two world-class mines—the Las Bambas copper mine and the Dugald River zinc mine—as well as the positive impact of high copper and precious metal prices, the company expects its unaudited after-tax net profit attributable to equity holders for 2025 to be approximately $5 billion to $5.2 billion. This represents a significant increase from the $1.62 billion recorded in 2024.

In 2025, MMG achieved significant growth in its production of key metals, setting multiple historical records.

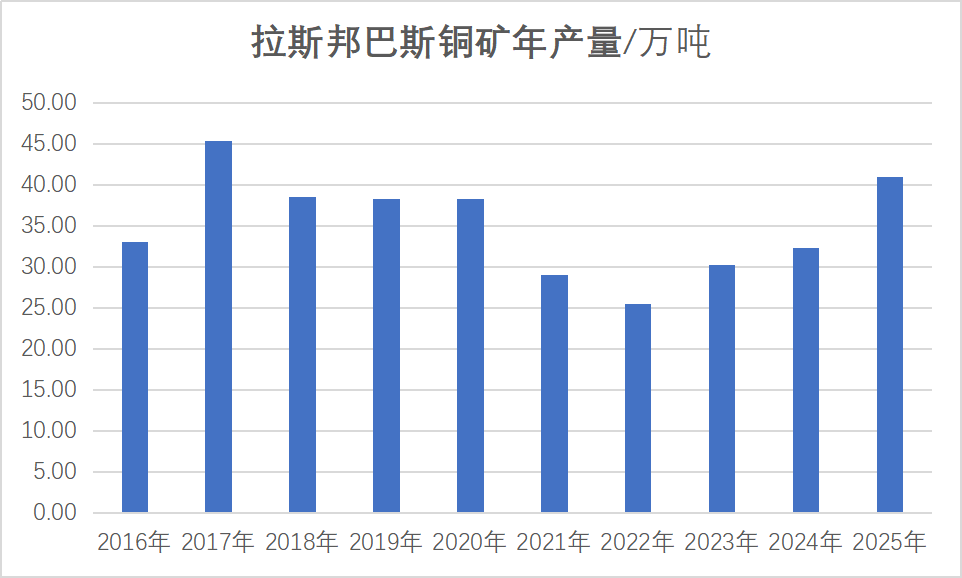

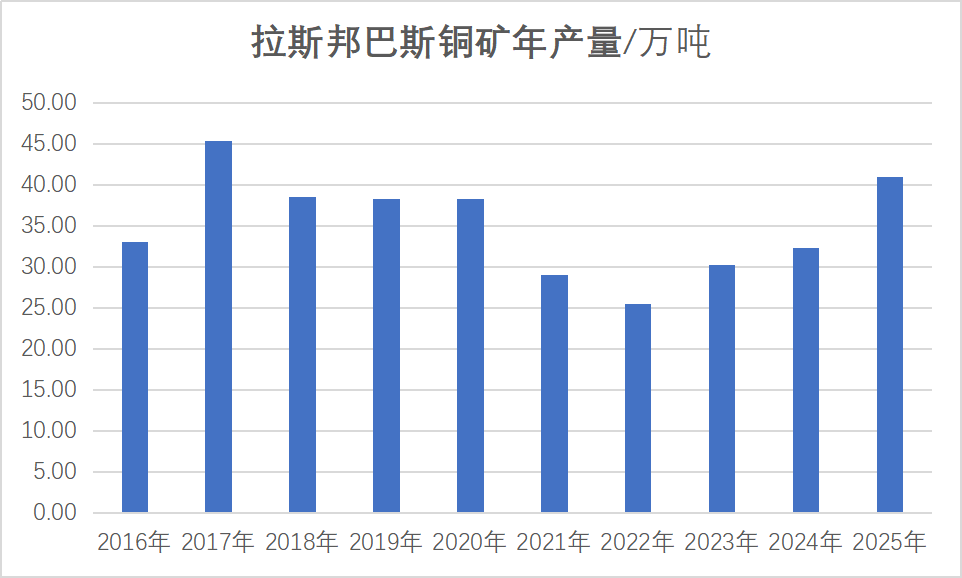

In the copper segment, MMG's copper production (including refined copper) reached 507,000 tonnes, a 27% year-on-year increase, marking the highest level since 2018. Among its core assets, the Las Bambas copper mine in Peru produced 410,800 tonnes in 2025, a 27% year-on-year increase, setting the second-highest annual production record since its commissioning.

In August 2014, when a consortium led by China Minmetals Corporation acquired the Las Bambas copper mine from Glencore for a transaction value of $7.005 billion (approximately RMB 44.38 billion), the international mining community was astonished. With subsequent construction investments, the project's total cost reached approximately $10 billion. At a time when global copper prices were low, the deal was mockingly referred to as "money buried in the mountain."

In July 2016, the Las Bambas copper mine commenced commercial production, producing 330,000 tonnes of copper that same year. In 2017, it completed its first year of full-capacity operation, producing 454,000 tonnes of copper, which accounted for 76% of MMG's total copper production of 598,000 tonnes that year—a record high. Subsequently, the mine faced severe community issues, even leading to conflicts, causing production to decline year by year. By 2022, output had dropped to 255,000 tonnes. However, with the resolution of community problems, Las Bambas' copper production has steadily increased for three consecutive years. To date, the cumulative copper production has exceeded 3.5 million tonnes. From the start of commercial production in 2016 to April 2025, the mine has generated cumulative sales revenue of RMB 161 billion, total profit of RMB 31.7 billion, and net profit of RMB 21.2 billion.

The Las Bambas copper mine has become a "cash cow" for MMG and a key victory in China's efforts to address its copper resource shortage.

In the zinc segment, zinc prices in 2025 followed a "first decline then rise" trend, but overall fell by approximately 9.94% for the year. However, as a strategic resource jointly recognized by the U.S. Critical Minerals List and the EU Critical Raw Materials List, zinc is becoming an invisible pillar for the energy transition and infrastructure construction. From anti-corrosion coatings for wind turbine towers to galvanized steel for photovoltaic brackets, and from battery casings for new energy vehicles to grid facilities for long-distance power transmission, all rely on this bluish-white metal.

In 2025, MMG's zinc production reached 232,000 tonnes, a 6% year-on-year increase. Among its assets, the Dugald River Mine, located in Queensland, Australia, is a wholly-owned zinc project of MMG and ranks among the world's top ten zinc mines. It primarily produces zinc, accompanied by lead, silver, and other metals. In 2025, the Dugald River Mine produced 183,500 tonnes of zinc and 21,700 tonnes of lead, both exceeding production targets and setting a historical annual production record.

In other segments, MMG's gold production reached 118,000 ounces (approximately 368.6 kg), a 22% year-on-year increase. Silver production reached 10.56 million ounces (approximately 32.8 tonnes), a 17% year-on-year increase. Although the production volumes are not large, these high-value by-products significantly reduce mine operating costs and enhance overall profitability.

Currently, the feasibility study and design plan for the Phase II expansion of the Khoemacau copper mine in Botswana, which MMG acquired, have been approved. Upon completion, the mine's annual copper-in-concentrate production capacity will increase to 130,000 tonnes, with an average annual by-product silver production capacity exceeding 4 million ounces, consolidating MMG's position in the global copper and silver markets. The company is steadily progressing toward its goal of becoming one of the world's top ten copper mining companies. Additionally, MMG is advancing the acquisition of Anglo American's nickel business in Brazil to expand its footprint in the nickel metal sector.