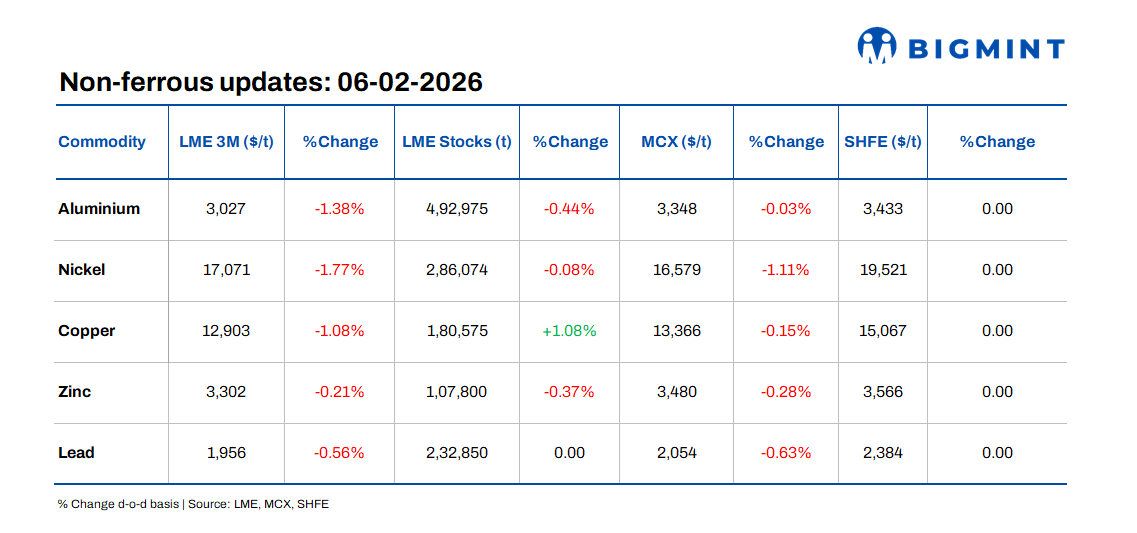

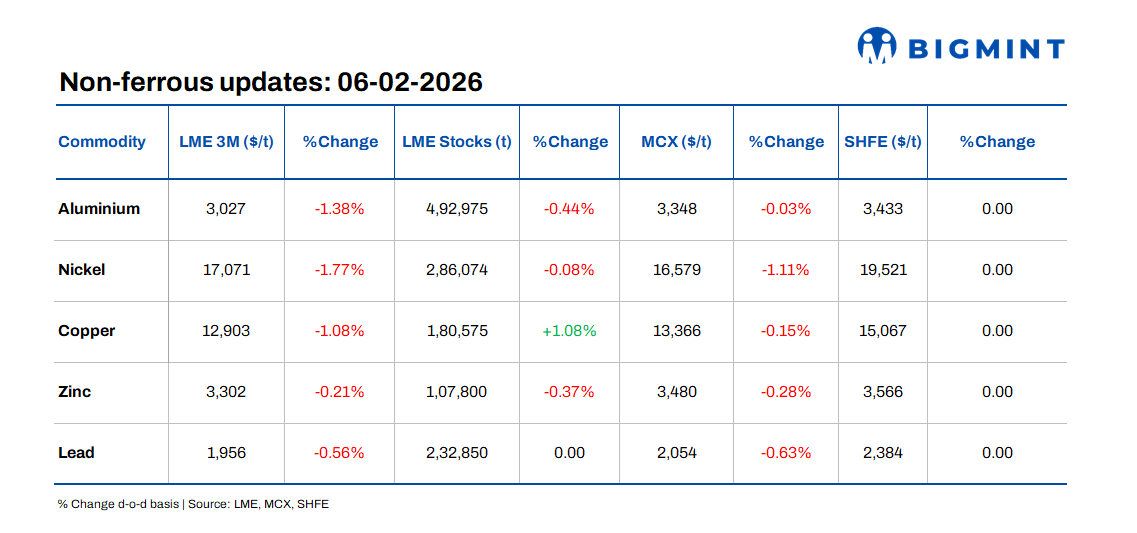

Wedoany.com Report on Feb 7th, Base metal prices on the London Metal Exchange (LME) generally fell in the last trading session as market risk appetite weakened. Aluminum prices dropped 1.38% to $3,027 per ton, while nickel prices slid 1.77% to $17,071 per ton. Copper prices declined 1.08% to $12,903 per ton, zinc prices edged down 0.21% to $3,302 per ton, and lead prices decreased 0.56% to $1,956 per ton, dragging down overall market sentiment.

LME warehouse inventories showed diverging trends. Aluminum stocks decreased by 0.44% to 492,975 tons, zinc stocks fell by 0.37% to 107,800 tons, and nickel stocks dipped slightly by 0.08% to 286,074 tons. In contrast, copper inventories increased by 1.08% to 180,575 tons, while lead stocks remained unchanged at 232,850 tons, indicating differences in supply conditions.

In the Indian non-ferrous scrap market, aluminum Tense scrap prices held steady, with ex-Delhi prices at ₹211,000 per ton and ex-Chennai prices at ₹216,000 per ton. Copper armature scrap prices in Delhi fell by ₹25,000 to ₹1,155,000 per ton.

Indian aluminum was not included in the recent India-US and India-EU trade agreements, but the impact is likely limited. Exports to these regions remain low under current tariffs and the Carbon Border Adjustment Mechanism. Downstream opportunities are emerging; reduced import duties on automobiles may boost demand for aluminum-intensive components. Indian companies could leverage excess processing capacity to benefit from automotive and value-added manufacturing demand.

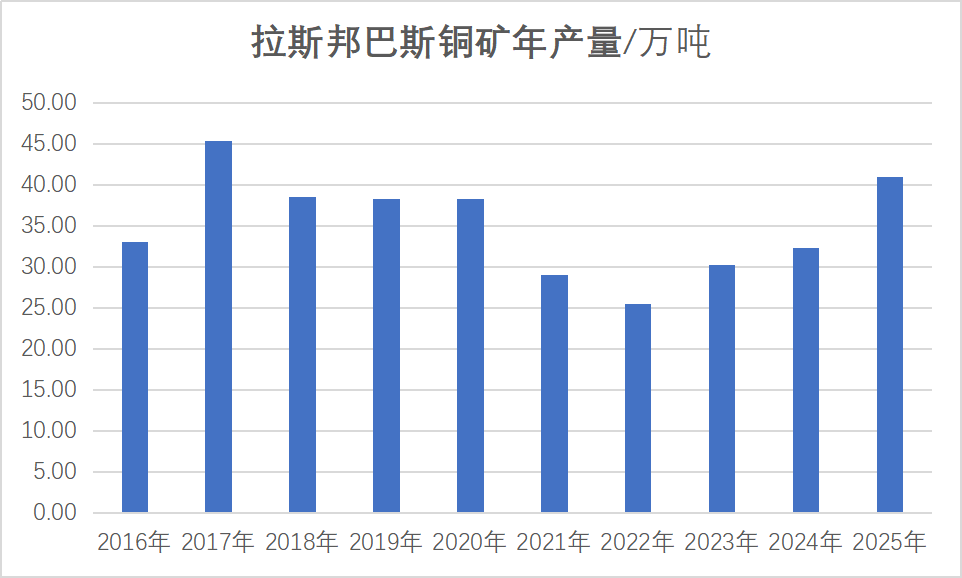

Copper prices face pressure from increased Chinese supply, with refined output expected to grow by about 5% this year and inventories rising at key hubs. LME stocks reached a March high due to material shifting from the US to Asia, while SHFE stocks increased week-on-week. Despite recent weakness, the long-term outlook is supported by resilient demand, a weaker US dollar, and geopolitical risks, with the Chilean Copper Commission raising its 2026 price forecast.