Wedoany.com Report-Oct. 20, ChemOne Holdings is seeking a $600 million private credit loan to support the construction of its chemical processing complex in Malaysia, sources familiar with the matter said. The proposed loan would have a tenor of up to 10 years and feature high single-digit pricing. Several Korean institutional investors have committed around $150 million to the financing. A company representative declined to comment.

The deal reflects the growing global trend of using private credit for project financing.

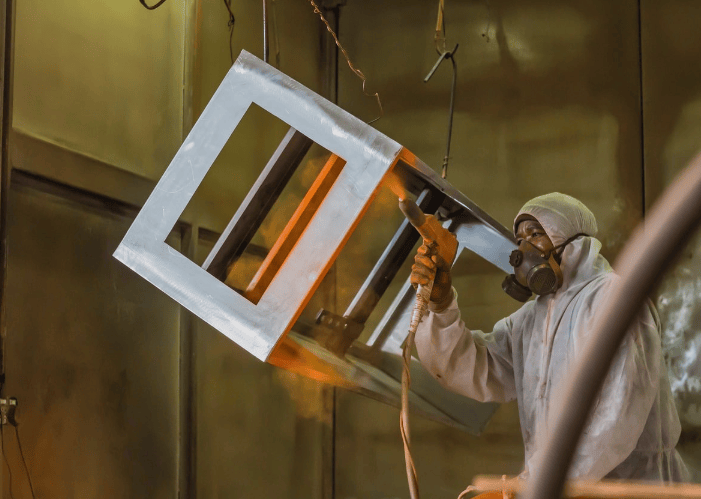

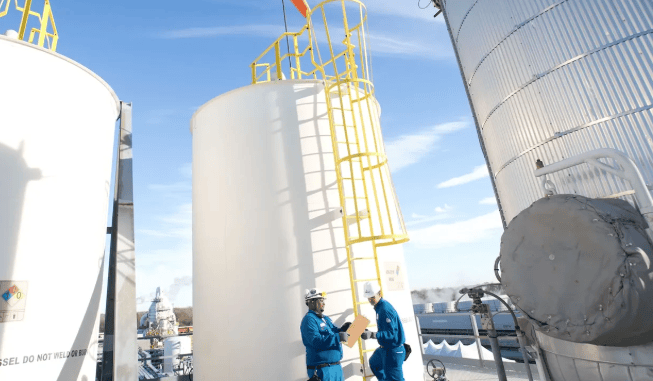

The private credit deal will be subordinated to ChemOne’s existing $3.5 billion senior debt facility, launched late last year and now fully subscribed. Both financings aim to fund the Pengerang Energy Complex in Johor, southern Malaysia. The complex is planned as a major oil, gas, and petrochemical hub, strategically located near international shipping lanes with deep-water access capable of accommodating the world’s largest crude carriers. The low-carbon facility is expected to produce 5.6 million metric tons annually of aromatic and energy products.

Lenders to the $3.5 billion facility include export credit agencies such as the Export-Import Bank of the United States, Euler Hermes AG, and the Export-Import Bank of Malaysia.

The proposed private credit arrangement reflects a global trend of using alternative financing to support large-scale projects. In the US, state and local infrastructure projects increasingly rely on private credit as pandemic-era stimulus diminishes and government spending is moderated. In Asia, private credit is being tapped for developments including data centers, electric vehicle charging networks, and industrial complexes.

By combining the senior facility with the private credit loan, ChemOne aims to secure funding to complete the Pengerang Energy Complex on schedule. The project is expected to enhance Malaysia’s position as a regional energy and petrochemical hub while supporting the global supply of low-carbon chemical products.

The move highlights growing investor interest in structured project financing for large-scale industrial projects. With backing from both traditional export credit agencies and private investors, ChemOne demonstrates confidence in the long-term prospects of the complex and the strategic value of Malaysia’s location for global trade.

Completion of the Pengerang Energy Complex is anticipated to strengthen the regional chemical and energy market, providing a modern, low-carbon production facility capable of meeting both domestic and international demand. The integration of private credit into the project’s funding structure also reflects the evolution of global financing practices, offering long-term, flexible capital solutions for strategic industrial developments.

Overall, the $600 million private credit loan, combined with the existing $3.5 billion senior facility, is positioned to provide ChemOne with the financial capacity to deliver a state-of-the-art chemical processing hub, supporting Malaysia’s energy infrastructure and enhancing the competitiveness of its petrochemical industry in the Asia-Pacific region.