Wedoany.com Report-Nov. 5, Advanced Micro Devices (AMD) projected fourth-quarter revenue above market expectations on Tuesday, supported by expanding demand for artificial intelligence chips driven by large-scale data center investments. The company expects revenue of about $9.6 billion, plus or minus $300 million, compared with analysts’ average estimate of $9.15 billion, according to LSEG data.

An AMD logo and a computer motherboard appear in this illustration created on August 25, 2025.

AMD has attracted substantial investments in AI hardware from major players including ChatGPT creator OpenAI and the U.S. Department of Energy. Investors anticipate that spending on advanced processors will continue, though some remain cautious about whether the AI surge can generate sufficient long-term returns.

Following the earnings announcement, AMD’s shares fell about 3% in extended trading, despite having more than doubled in value this year. Michael Schulman, chief investment officer at Running Point Capital, noted that the decline may reflect short-term profit-taking, while investors continue to assess overall market conditions and chip stock valuations.

In the third quarter, AMD reported revenue of $9.25 billion, surpassing the consensus estimate of $8.74 billion. Its data center segment, which includes AI processors, grew 22% year-on-year to $4.3 billion, exceeding forecasts of $4.09 billion. Executives said the company received licenses to sell modified versions of its MI300 AI chips in China but has not yet begun sales. Nvidia has also obtained similar licenses.

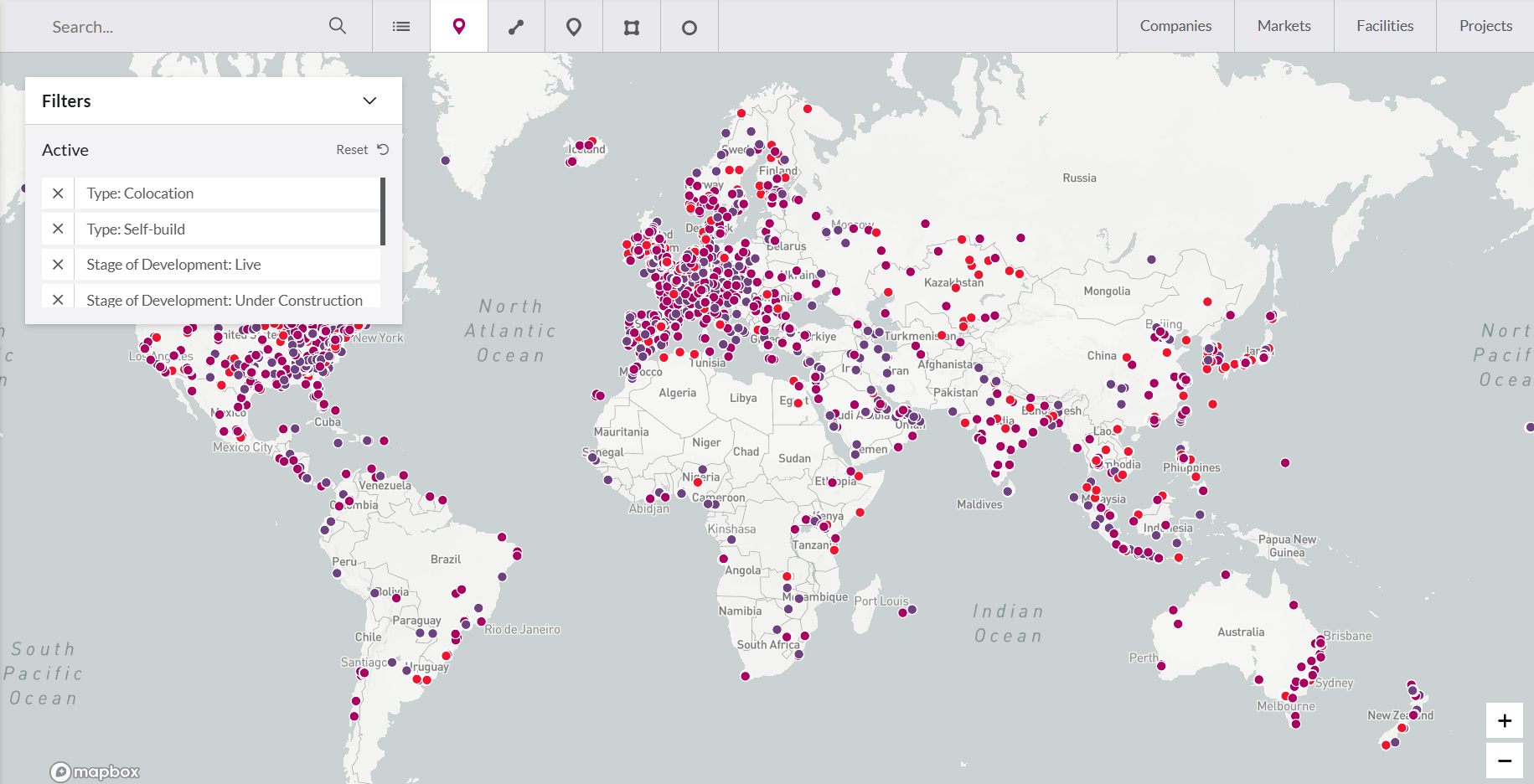

Tech companies such as Microsoft, OpenAI, and Nvidia are expanding data center capacity and investing heavily in AI chips, benefiting suppliers like AMD. Microsoft, a key AMD customer, reported record capital expenditure of nearly $35 billion in its fiscal first quarter, with about half directed toward chip-related investments. Rising demand for server CPUs has also strengthened AMD’s position in the data center market, where it continues to gain share from Intel.

In the client segment, which focuses on personal computers, AMD’s sales rose 46% to $2.8 billion in the third quarter. Global PC shipments increased 8% during the same period, supported by upgrades to AI-enabled PCs and a new Windows cycle that stimulated replacement demand.

For the fourth quarter, AMD expects an adjusted gross margin of 54%, slightly below analysts’ expectations of 54.5%. In the third quarter, adjusted gross margin also reached 54%, modestly surpassing forecasts. Adjusted earnings per share came in at $1.20, ahead of estimates of $1.16.

AMD recently signed a multi-year agreement to supply AI chips to OpenAI, with potential annual revenue in the tens of billions of dollars. The deal allows OpenAI to purchase up to roughly 10% of AMD’s shares and includes the deployment of hundreds of thousands of GPUs—equivalent to the energy consumption of 5 million U.S. households.

While AMD’s growth outlook remains strong, analysts note that Nvidia continues to dominate the GPU market. Nonetheless, AMD’s expanding role in AI infrastructure positions it as an increasingly competitive force in the evolving global semiconductor industry.