Chipmaker Cerebras Systems recently announced the completion of a $10 billion Series H funding round, led by Tiger Global with participation from multiple investment institutions including Advanced Micro Devices and Fidelity Management. This comes just four months after the company's previous $11 billion funding round, bringing its current valuation to $23 billion.

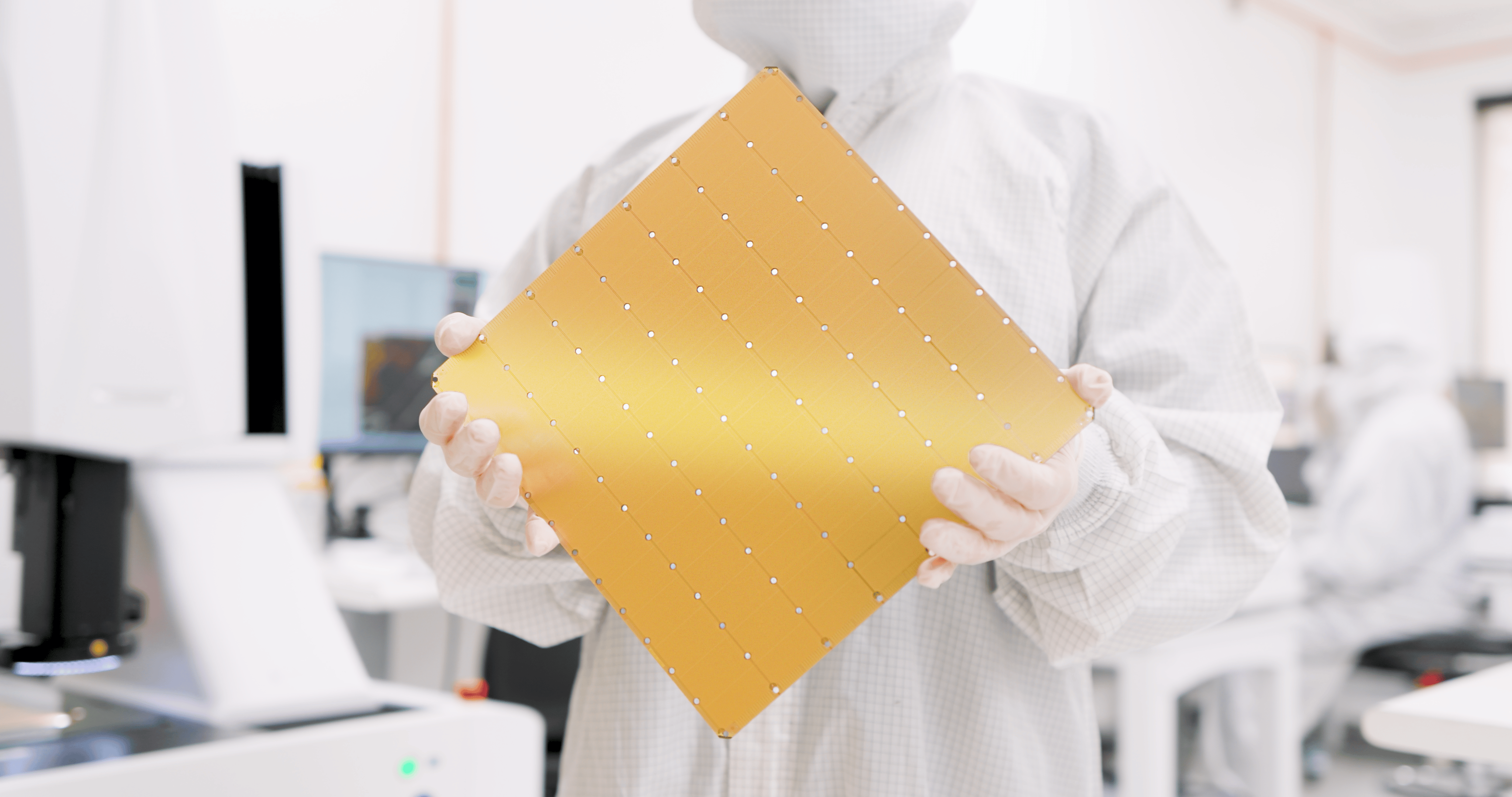

This funding coincides with Cerebras signing a supply agreement with OpenAI for AI hardware worth over $10 billion. The company's WSE-3 chip contains 4 trillion transistors, which is 19 times the number of transistors in Nvidia's Blackwell B200 GPU. Approximately half of this wafer-scale AI chip's surface area is dedicated to integrating 44GB of SRAM memory.

WSE-3 employs a single large-chip design, which improves processing efficiency compared to multiple smaller GPUs. Its large memory pool supports running multiple AI models simultaneously without needing to transfer data to off-chip HBM memory, thereby reducing latency and accelerating computation. Traditionally, wafer-scale processors have not been widely adopted due to high manufacturing difficulty, as larger chip area means higher transistor defect rates, where a single defect can render the entire chip unusable.

Cerebras addresses this technical challenge by partitioning the WSE-3 into 900,000 cores. If a manufacturing defect occurs in a core, it only affects that core's functionality, and data can be routed through other circuit paths. This architectural design ensures that local defects do not cause the entire processor to fail. This wafer-scale AI chip is delivered as part of the CS-3 water-cooled system, providing 125 petaflops of computing power per system.

According to Cerebras, customers can cluster 2,048 CS-3 devices to achieve a total computing power of 256 exaflops, sufficient for training large language models with up to 24 trillion parameters. The company filed for an IPO in September 2024, disclosing revenue of $136.4 million for the first six months, representing a more than tenfold year-over-year increase, with losses narrowing from $77.8 million to $66.6 million.

Last year, Cerebras withdrew its IPO application, stating that the filing content no longer reflected the current state of its business, partly due to significant revenue growth in 2025. The company plans to refile for listing, aiming to complete the IPO as early as the second quarter. The technological breakthrough and commercial progress of this wafer-scale AI chip provide a new solution for the high-performance computing field.