Wedoany.com Report on Feb 6th, Alphabet (Google's parent company) recently released its Q4 and full-year 2025 financial report, showing robust performance growth, particularly in the fields of artificial intelligence and cloud computing. This highlights the leading position and continued commitment of the tech giant in the wave of AI.

According to the financial report data, in the fourth quarter of 2025, Alphabet achieved revenue of $113.8 billion, a year-on-year increase of 18%, exceeding market expectations. This growth was primarily driven by its core search and advertising business, along with its rapidly expanding cloud computing business. Meanwhile, the company's total annual revenue surpassed the $400 billion mark for the first time in history, marking a new stage of development for the company founded by Larry Page and Sergey Brin in 1998.

Looking at the various business segments, Google Search and other advertising businesses remain the company's most important revenue pillar, contributing $82.3 billion in revenue for the quarter, demonstrating stable performance. YouTube advertising revenue also continued to grow, rising from $10.5 billion in the same period last year to $11.4 billion. Notably, Google Cloud continued its rapid growth trajectory, with quarterly revenue soaring 48% to $17.7 billion, making it one of Alphabet's most important growth engines.

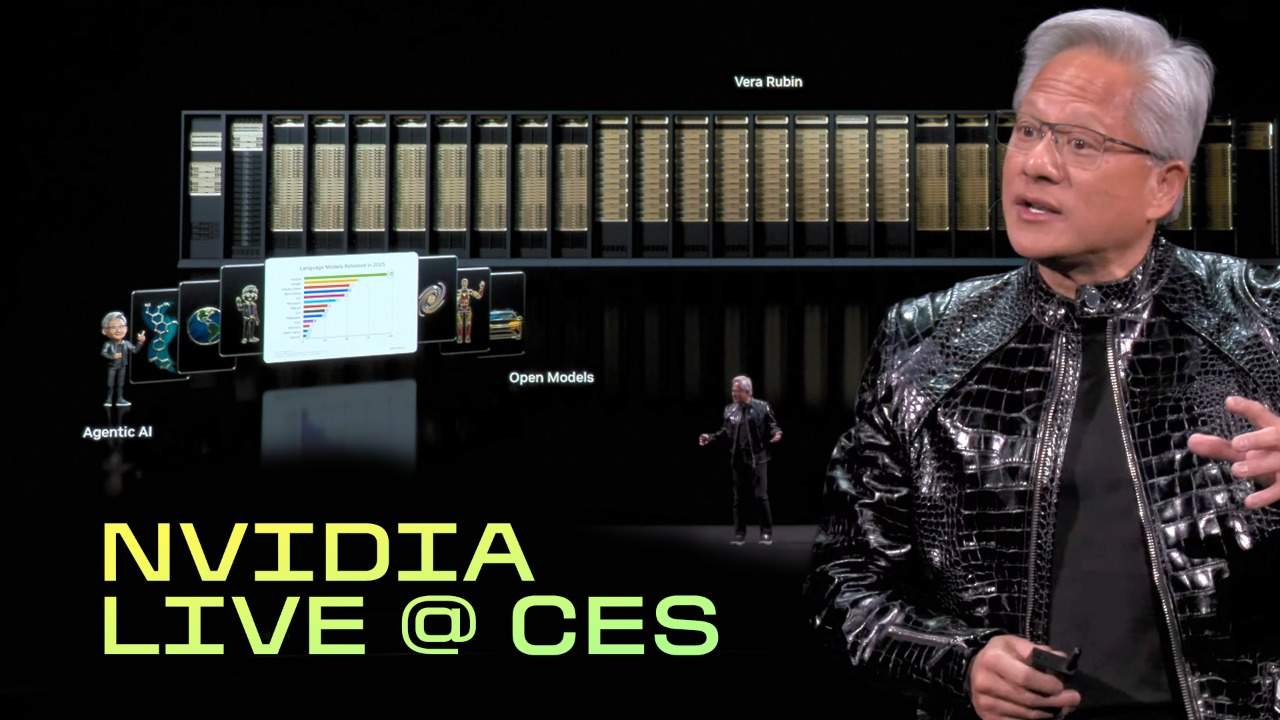

Artificial intelligence was the key driver of this quarter's performance. Alphabet CEO Sundar Pichai emphasized during the earnings call: "We see AI investments and infrastructure driving revenue and growth across the board." The monthly active users of the company's Gemini AI platform have reached 750 million, demonstrating the rapid adoption of its AI products among users. Additionally, the number of paid subscribers for Google's consumer services has exceeded 325 million, reflecting the continued appeal of its service ecosystem.

To continuously expand its leading advantage in the AI field, Alphabet announced it will significantly increase capital expenditures. The company expects its 2026 capital expenditures to be between $175 billion and $185 billion, approximately double the 2025 level. These investments will primarily focus on AI computing infrastructure, data center construction, technology research and development, and talent acquisition to meet the growing market demand for artificial intelligence products.

Despite the overall impressive performance, the financial report also shows that some of the company's experimental business units (including autonomous driving unit Waymo, life sciences unit Verily, etc.) are still in the investment phase. These units recorded an operating loss of $3.6 billion for the quarter, with revenue of only $370 million. This reflects that while maintaining profitability in its core businesses, the company is still actively positioning itself in future technology sectors.

Boosted by the strong financial report, Alphabet's stock price rose more than 2% in after-hours trading. This report card not only demonstrates the direct impact of AI investments on the company's short-term revenue but also reflects the intense competition in the global tech industry within the AI domain—major giants are building moats through massive capital expenditures to vie for dominance in the next generation of technology. With its profound technological accumulation, vast user base, and clear AI commercialization path, Alphabet has already secured a favorable position in this round of competition.