Zuari Industries recently released its financial results for the third quarter of FY2026, demonstrating robust performance. This was primarily driven by sugar crushing reaching a historical high, reduced borrowing costs, and positive developments in business segments such as real estate, Engineering, Procurement & Construction (EPC), and financial services.

In Q3 FY2026, the company's standalone total revenue stood at INR 25.47 billion, with EBITDA at INR 3.63 billion. Pre-tax profit before exceptional items increased to INR 450 million, up from INR 260 million in the same period last year. For the nine-month period, standalone total revenue was INR 72.76 billion, EBITDA rose to INR 12.57 billion, and pre-tax profit surged significantly to INR 2.40 billion from INR 420 million in the corresponding period last year.

On a consolidated basis, total revenue for the quarter was INR 30.15 billion. Consolidated profit after tax was negative INR 2.64 billion, compared to negative INR 2.52 billion in the same quarter last year. However, for the nine-month period of FY2026, consolidated profit after tax saw a strong recovery to INR 13.74 billion, whereas a loss of INR 7.36 billion was reported in the corresponding period last year. The company noted that the benefits from a decline in average borrowing costs continue to accrue.

The Sugar, Power, and Ethanol segment performed strongly. Sugar crushing operations commenced on October 26, 2025, marking the earliest start in history and achieving the company's highest-ever third-quarter crushing volume of 6.728 million quintals. Sugar and ethanol production increased by 13.7% and 4.8% year-on-year respectively, while the average sugar realization price rose by 5.9% year-on-year.

In the bioenergy space, through its joint venture with Envien International, Zuari Envien Bioenergy Pvt. Ltd., the company commissioned a 180 KLPD ethanol distillery, marking a key milestone in capacity expansion.

Zuari Infraworld India Limited reported an EBITDA of INR 3.2 billion for Q3 FY2026. The ultra-luxury project, The St Regis Residences, Dubai, is approximately 93.4% complete and is expected to be delivered in April 2026. The company is also seeking development management assignments in cities like Bengaluru, Hyderabad, and Kolkata as part of its asset-light strategy.

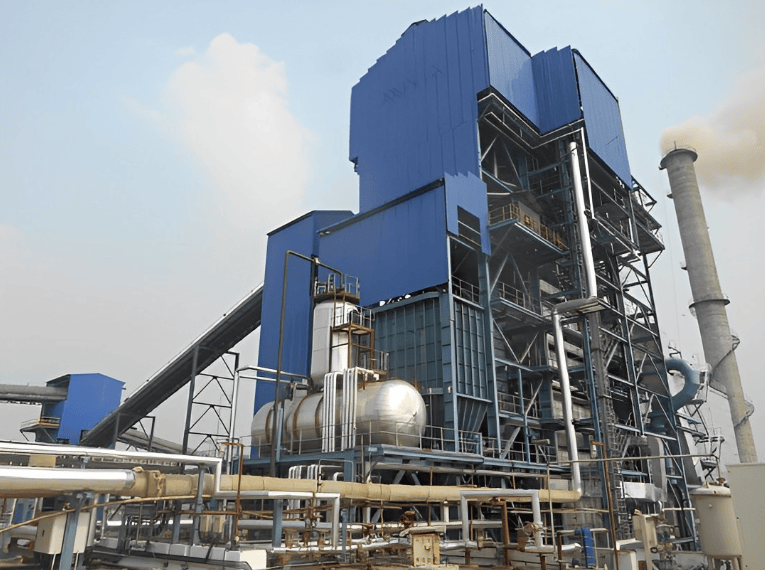

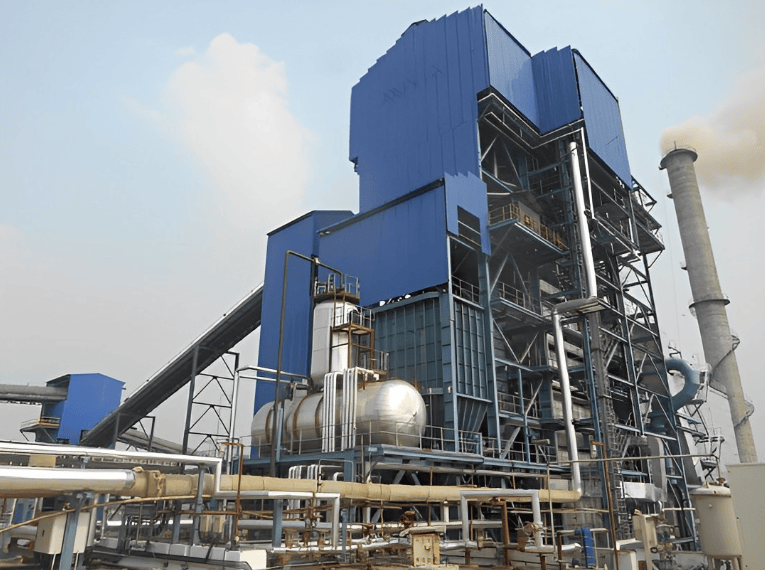

The EPC arm, Simon India Limited, commissioned the fifth evaporator project for Paradeep Phosphates Limited and is executing orders worth approximately INR 10 billion. The company stated it is deepening expertise through global technology partnerships while investing in AI-driven solutions to accelerate the digital transformation of this segment.

Zuari Finserv Limited and Zuari Insurance Brokers Limited reported revenue growth of 20.0% and 7.6% year-on-year respectively, reflecting the sustained appeal of customer-centric initiatives and platform enhancements.

Commenting on the performance, Athar Shahab, Managing Director of Zuari Industries Ltd., said, "The third quarter reflects robust operational progress in our Sugar, Power, and Ethanol segments, supported by strong on-ground execution during the crushing season."

"We achieved the earliest-ever start to crushing and recorded the highest-ever third-quarter crushing performance, reflecting improved preparedness and operational efficiency. Ethanol operations remained steady during the period, and we continue to strengthen financial discipline through lower borrowing rates and reduced finance costs throughout the year."