Wedoany.com Report-Jun 21, Dundee Precious Metals (DPM) has announced an agreement to acquire all issued shares of Adriatic Metals in a transaction valued at approximately $1.3 billion (C$1.77 billion). The acquisition aims to strengthen DPM’s production profile and extend its mineral reserve base through full ownership of the Vareš mine in Bosnia and Herzegovina.

This move is anticipated to generate enhanced cash flow and provide significant cash generation to fund DPM’s growth and capital returns programme.

Under the agreement, Adriatic Metals shareholders will receive 0.1590 of a DPM common share and 93 pence in cash for each Adriatic share. Based on the exchange rates as of 11 June 2025, this values Adriatic shares at £2.68 ($3.62) and CHESS Depository Interests at A$5.56 ($3.62). The transaction will proceed through a scheme of arrangement under the UK Companies Act 2006.

Following the completion of the deal, DPM shareholders will hold around 75% of the combined company, while former Adriatic shareholders will own approximately 25%. The acquisition is expected to enhance cash flow and support DPM’s ongoing growth and capital return strategy.

David Rae, President and CEO of DPM, stated: “Adding Adriatic’s Vareš operation to our strong asset portfolio creates a premier mining business with a peer-leading growth profile, high-quality development and exploration pipeline and a robust platform to deliver above-average returns. Vareš is a logical fit with our portfolio, as it significantly increases DPM’s mine life while adding near-term production growth, a highly prospective land package and cash flow diversification.”

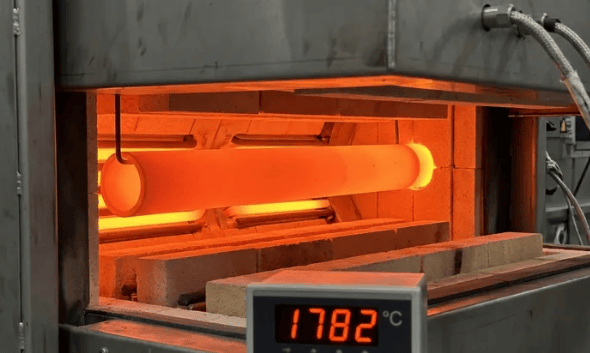

The Vareš project, located near Sarajevo, includes an underground mine and an offsite processing plant. It began producing concentrate in 2024 and is being ramped up toward full-scale operations. The site spans 4,400 hectares and has an estimated 15-year operating life. A technical report by SRK Consulting (UK), dated 1 April 2025, outlines an all-in sustaining cost of $893 per ounce of gold equivalent, with expected production reaching up to 425,000 gold equivalent ounces annually by 2027.

Laura Tyler, Managing Director and CEO of Adriatic Metals, commented: “Vareš remains firmly on track to become a low-cost precious metal producer, underpinned by a long mine life, a high-grade deposit and strong exploration potential. This transaction brings together complementary strengths to create a dynamic and diversified mining company with meaningful scale. We see clear synergies between the asset portfolios of DPM and Adriatic, supported by DPM’s strong financial capacity and proven operational expertise.”

The deal is subject to regulatory approvals from Adriatic shareholders, the court, the Toronto Stock Exchange, and the Bosnian Competition Council. The transaction is expected to close by 31 December 2025.

In a related move, DPM sold its Tsumeb smelter in Namibia to a subsidiary of Sinomine Resource Group in September last year for $20 million.