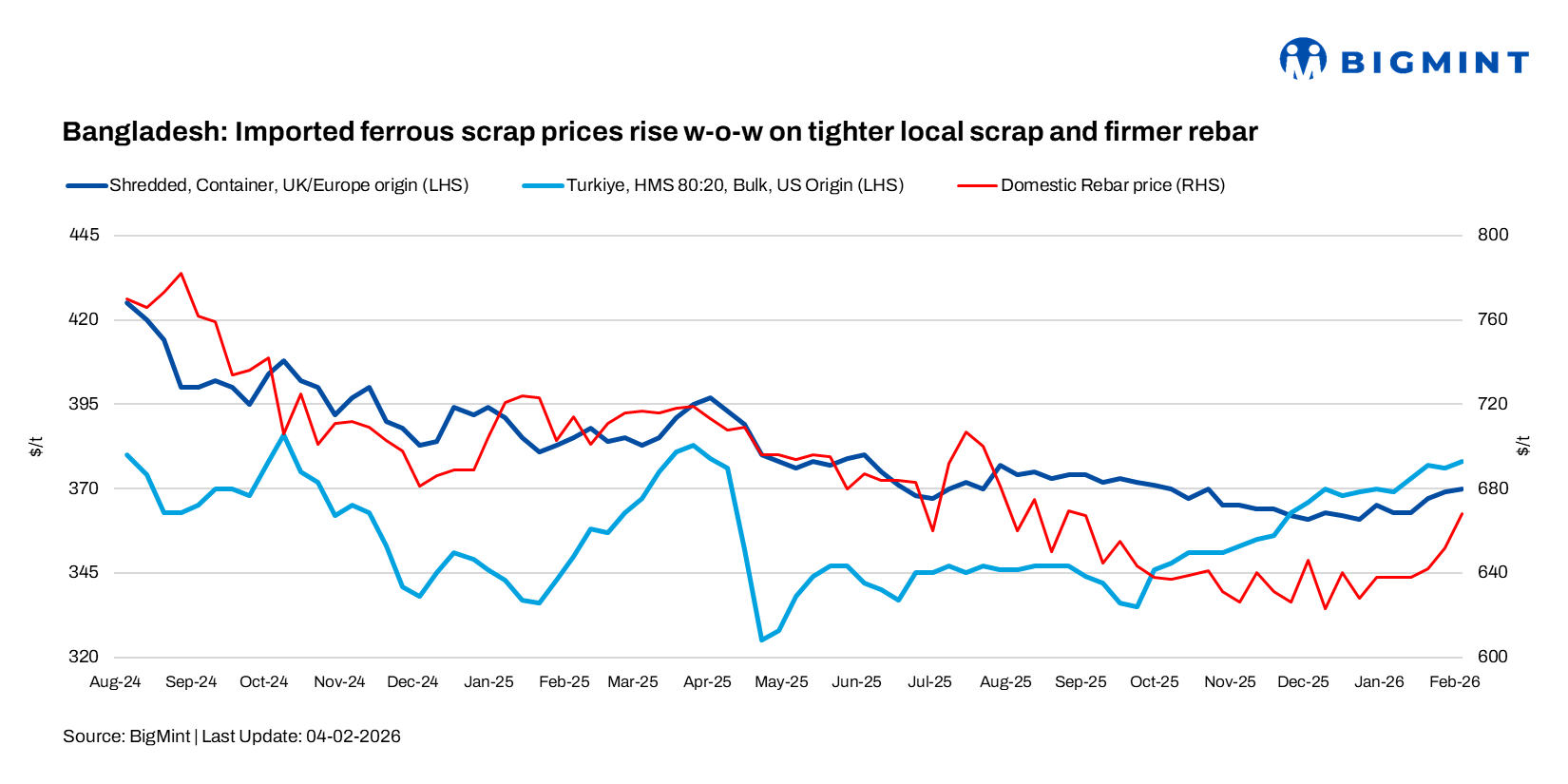

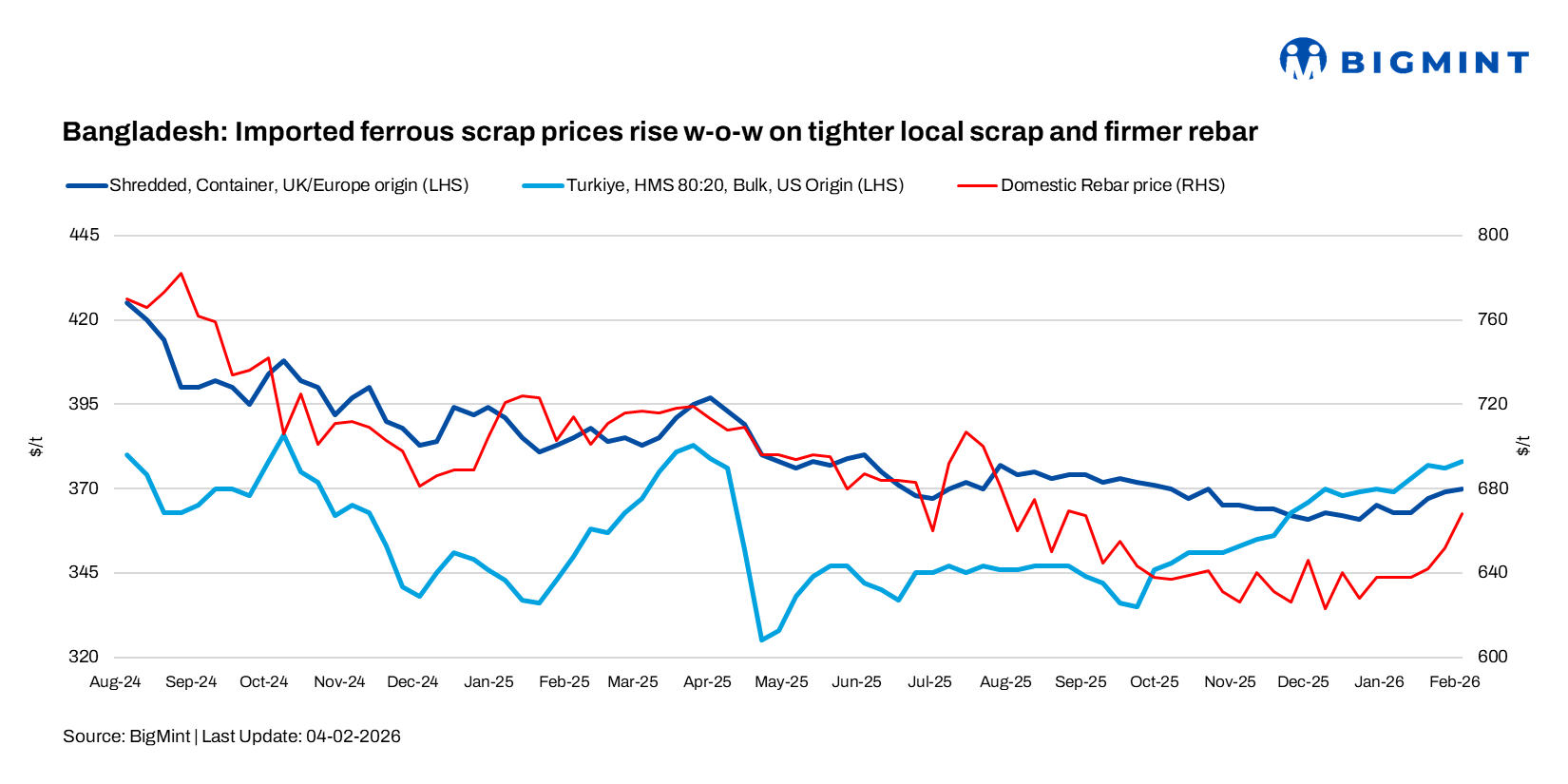

Wedoany.com Report on Feb 5th, Bangladesh's imported scrap iron prices showed a week-on-week increase. This change was primarily influenced by the dual factors of tightening global scrap supply and rising container freight costs. Market observers noted that due to reduced local scrap supply, procurement activities have become more active, providing support for recent prices and leading to a slight overall improvement in market sentiment.

According to assessment data from industry institutions, scrap prices from different origins showed divergence. European-origin HMS (80:20) prices rose slightly by $2/ton to $350/ton; European container shredded scrap increased marginally by $1/ton to $370/ton. In contrast, Japanese-origin H2 bulk cargo prices fell by $2/ton to $348/ton, while US-origin HMS (80:20) bulk cargo prices rose by $4/ton to $371/ton.

A scrap trader in Dhaka provided specific details of the local market: "Current local scrap prices are in the range of 49,000-50,000 Bangladeshi Taka/ton (approximately $401-409/ton)." In terms of finished steel, Chittagong-brand rebar prices remained stable at 81,500-83,500 Bangladeshi Taka/ton ($667-684/ton), while non-brand rebar prices increased by about 5,000 Bangladeshi Taka/ton ($41/ton), with the trading range shifting to 79,000-80,000 Bangladeshi Taka/ton ($647-655/ton). This reflects that despite weak overall demand, supply tightness and specific procurement needs can still push prices higher.

The assessed price for domestic scrap is at 52,000-53,000 Bangladeshi Taka/ton ($426-434/ton), with lower-grade material priced around 51,500 Bangladeshi Taka/ton ($422/ton). Limited local scrap supply, coupled with pre-election market positioning, jointly supports a moderate recovery in purchasing willingness, keeping pre-election market sentiment cautiously firm.

Quotations from the international market indicate that Malaysia/Singapore PNS offers are around $380/ton (CFR Chittagong), with HMS 90:10 offers close to $370/ton (CFR). A shipment of Australian-origin HMS 90:10 was recently concluded at $360/ton (CFR Chittagong). The spread between offers and buyer bids for bulk cargo from the US West Coast is narrow, with HMS 80:20 offers at $370-375/ton (CFR) and buyer bids at $360-362/ton (CFR).

In the ship recycling sector, Bangladeshi buyers have recently returned to the market, securing a Capesize bulk carrier at relatively firm prices. Recycling activity in Chittagong has increased, with several tankers arriving. However, industry fundamentals remain weak, with plate prices around $487/ton and a weakening Taka exchange rate to 122.95, squeezing profit margins. Uncertainty stemming from the general election continues to affect market sentiment, while competition for tonnage compliant with international ship recycling conventions remains intense.

Looking ahead, the Bangladesh scrap market is expected to maintain a firm but cautious pattern before the election. Pre-election positioning and ongoing tightness in local scrap supply may continue to support import prices and container shipping demand. Once the election results are clear, if the political environment remains stable, buyer confidence and market liquidity are expected to gradually recover, potentially leading to a moderate rebound in trading activity.