Wedoany.com Report on Feb 5th, Red Mountain Mining recently announced the acquisition of the Thompson Falls Antimony Project located on the border of Montana and Idaho in the United States. The project is adjacent to the Stibnite mine operated by UAMY—the second-largest known stibnite vein deposit in the US—which has been producing high-grade antimony resources since 1884.

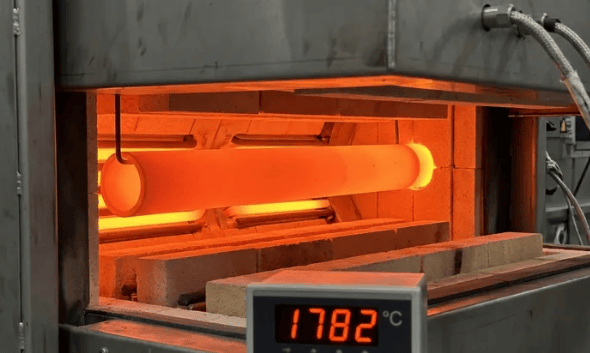

UAMY resumed production at the end of 2025 to alleviate the tight supply of antimony in the US, with its smelting facility playing a significant role in the US critical minerals supply chain. The Thompson Falls project area includes three historical underground mines and one open pit. Preliminary assay results indicate high-grade antimony ore associated with gold, with specific data including: 36.5% antimony with 0.48 g/t gold, 21.0% antimony with 0.65 g/t gold, and 13.7% antimony with 0.14 g/t gold.

The project is situated at the eastern end of the Coeur d'Alene mining district in Idaho and holds exploration potential for silver in addition to antimony. Historically, this region has contributed approximately 18% of the total silver production in the US, yielding over 1.25 billion ounces of silver between 1884 and 2020, along with 7.8 million tons of lead, 3 million tons of zinc, 1.1 million ounces of gold, 191,000 tons of copper, and over 160,000 tons of antimony.

Red Mountain Mining stated that this acquisition complements its critical minerals asset portfolio in Utah, Idaho, and New South Wales, Australia, establishing a unique Western resource platform poised to benefit from policy support provided by the US and Australian governments to secure supply chains. The US government recently launched a $12 billion Strategic Minerals Reserve Program, and this project holds geographical advantages in the potential supply of antimony and silver.

The company noted that Thompson Falls may also contain silver-rich polymetallic veins, a typical geological feature of the Coeur d'Alene mining district. More assay results will be obtained this quarter, followed by further exploration and sampling to locate unrecorded historical mining works and mineralized outcrops. The US team plans to conduct detailed inspection and sampling of the underground mines, with a drilling program to be formulated after clarifying the mineralization characteristics.

In addition to Thompson Falls, Red Mountain Mining holds three other antimony assets in the US: the Utah Antimony Project in southern Utah, and the Yellow Pine and Silver Dollar projects in central Idaho. The company's Armidale Antimony-Gold Project in northeastern New South Wales, Australia, plans to conduct initial drilling on the high-grade Oaky Creek target in the first half of 2026.