Wedoany.com Report on Feb 3rd, Argentina's Mendoza province, renowned for its majestic Aconcagua mountain and premium Malbec wines, is now emerging as a new focal point for mining investment. Since Javier Milei took office as president, the metal mining sector has become one of the fastest-growing areas of the economy, expanding into historically contentious regions like Mendoza.

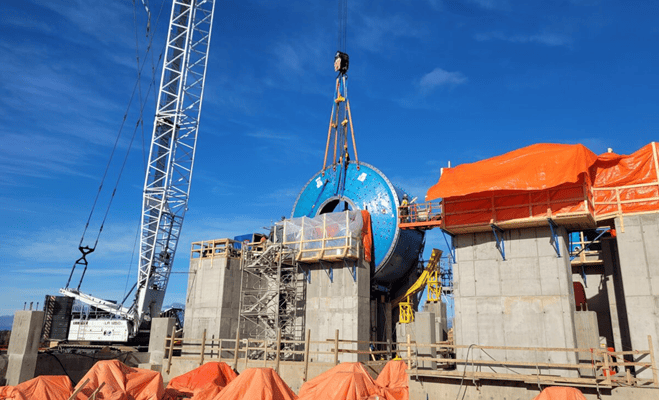

In 2025, Mendoza approved its first copper project, PSJ Cobre Mendocino, scheduled to commence construction in 2026 with an expected annual export capacity of 40,000 tons by 2030. This project, along with six other major projects being revived in neighboring provinces, forms part of Argentina's mining expansion strategy, aiming to transform the country into an exporter of critical minerals needed for electric vehicles and artificial intelligence. The Milei administration is accelerating this production transformation through policies like tax incentives.

Although Argentina ranks 107th out of 110 countries in a mining contribution index, with mining accounting for less than 2% of GDP, the sector's export value reached $6.037 billion in 2025, a 29.2% year-on-year increase, marking a 15-year high. Gold exports constitute over 80% of metal mineral exports, while lithium production has surged from 34,000 tons in 2022 to over 120,000 tons currently, with the number of producing companies increasing from two to seven.

Industry investment enthusiasm is high, with over a dozen projects having applied for the Large Investment Incentive Program (RIGI) launched by the Milei government, which offers 30-year tax, customs, and exchange rate benefits. Canada's McEwen Cooper plans to invest $2.7 billion in its Los Azules copper project in San Juan province. CEO Michael Meding stated: "Copper demand primarily comes from construction and urbanization, especially in China. The energy transition means electric vehicles use twice as much copper as internal combustion engine vehicles. Combined with military demand, this is driving sustained price increases."

Meding noted that the government change has brought new opportunities: "We have a president who supports openness and business. Financing has become easier, and legal security and investment protection have been strengthened." The RIGI regime aims to rebuild trust lost over the past two decades in Argentina by providing predictability. Any changes to mining companies' tax burdens, restrictions on profit repatriation, or violations of agreements could face international lawsuits.

Argentina's mining development has not been smooth. The Bajo La Alumbrera copper-gold-molybdenum mine, which began operations in 1997, closed after 21 years. The project was controversial due to water consumption and environmental pollution. In 2015, the Veladero gold mine experienced a cyanide solution leak, but no one was convicted a decade later. Near the former Bajo La Alumbrera site, Glencore plans to develop the Agua Rica project. Despite initial community opposition, employment needs have gradually shifted some residents' attitudes.

Mendoza faces water resource challenges, as the region's drinking water, agricultural irrigation, and mining operations all depend on water from the Andes. Environmental groups have submitted judicial applications attempting to block the PSJ Cobre Mendocino project, but all have been dismissed. Energy and Mining Minister Jimena Latorre stated that the province has established a mining environmental police force to oversee corporate compliance. PSJ Cobre Mendocino CEO Fabián Gregorio emphasized: "This is a project that meets international standards. We bear significant responsibility."

Roberto Cachola, President of the Argentine Mining Business Association, estimates that large-scale copper projects could increase annual exports by $15 billion, but their progress depends on reforming the Glacier Law. Enacted in 2010, this law protects glaciers and periglacial environments as strategic freshwater reserves. The Milei government proposes shifting to a provincial assessment system based on hydrological function. Cachola argues: "The current law protects some small ice bodies without hydrological function."

Environmentalists oppose amending the law. Lawyer Jorge Daneri stated: "This law is the result of years of dialogue and social consensus. Now there's an attempt to dismantle it in one or two months, creating sacrifice zones to serve the energy transition of developed nations." Although protests in Mendoza and Andalgalá have continued since 2019, their momentum has waned. Argentina's mining sector is accelerating, becoming a crucial pillar for economic growth in the country's northeast.