Wedoany.com Report-Nov. 14, Ivanhoe Electric (NYSE-A, TSX: IE) has secured a $200 million bridge loan from a syndicate of banks to support its Santa Cruz copper project in Arizona. The loan is backed by National Bank Capital Markets, Societe Generale, and BMO Capital Markets. Ivanhoe described the financing as “an important component” of its overall strategy, with construction expected to start in the first half of 2026.

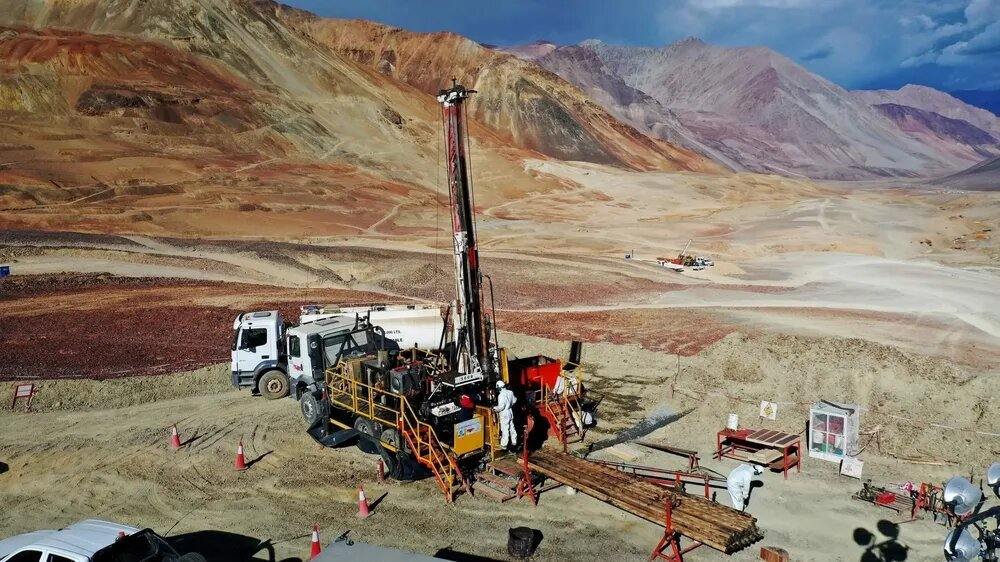

Santa Cruz copper project.

Executive chairman Robert Friedland said: “Santa Cruz is the first step in our vision to grow a new American-based and American-focused critical metals company.” He highlighted that the credit approvals from the group of “top-tier mining financiers” reflect confidence in the project. CEO Taylor Melvin added: “The bank group conducted extensive technical due diligence as part of their credit approval process, and we are grateful for their support for our company and the Santa Cruz copper project.” Melvin noted that upon closing the bridge loan, expected in December, Ivanhoe will have added over $360 million in liquidity this quarter, positioning the company in an “exceptionally strong financial position” as it enters a key development year.

Shares of Ivanhoe Electric declined slightly amid broader market weakness, trading at $12.81 per share in New York by 10:30 a.m. ET, down 3.9% on the day, giving the company a market capitalization of $1.88 billion.

The Santa Cruz project, located in Casa Grande, roughly 77 km south of Phoenix, hosts a large underground copper deposit intended as a long-term US producer of copper cathodes. Ivanhoe has been developing the project since 2022 and has delineated 3 million tonnes of indicated copper resources, about half of which are classified as mineable reserves.

Earlier this year, the company completed a preliminary feasibility study (PFS) for Santa Cruz, projecting a 23-year mine capable of producing 72,000 tonnes of 99.99% pure copper cathodes annually in the first 15 years. Using a base case copper price of $4.25 per pound, the PFS estimated an after-tax net present value (NPV) of $1.4 billion and an internal rate of return (IRR) of 20%. Initial project capital is pegged at $1.24 billion, with a capital intensity of $17,000 per tonne of copper and cash costs of $1.32 per pound, placing it in the global first quartile and lowest cost in the US.

As part of its financing strategy, Ivanhoe is in discussions with potential partners for project-level minority investments and long-term debt. This includes talks with the US Export-Import Bank, which expressed interest in providing an $825 million loan to cover construction costs.

Ivanhoe remains on track to meet its Santa Cruz project timeline, aiming to begin copper cathode production in late 2028. The bridge loan, combined with ongoing financing efforts, is intended to secure the project’s development, ensuring that the company can advance toward establishing one of the first new US copper mines in nearly two decades.