Wedoany.com Report on Feb 13th, Analyst Heiko F. Ihle of H.C. Wainwright issued a report on February 5, 2026, reiterating a Buy rating on Perpetua Resources Corp. and raising the price target from $30 to $41. This adjustment is primarily based on updated precious metals price forecasts, reflecting the continued strength in spot prices for commodities like gold.

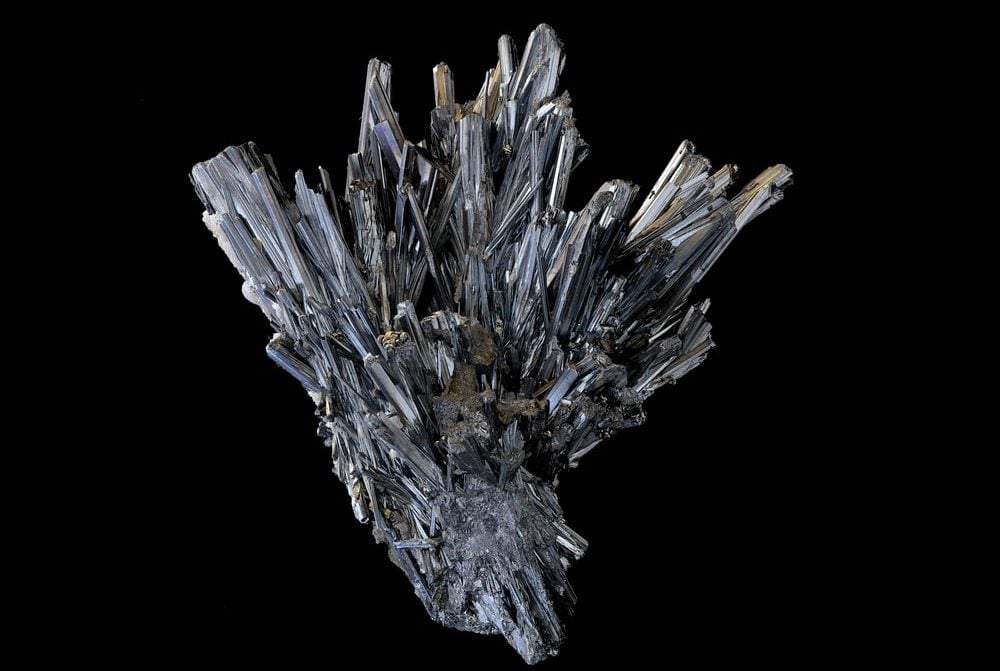

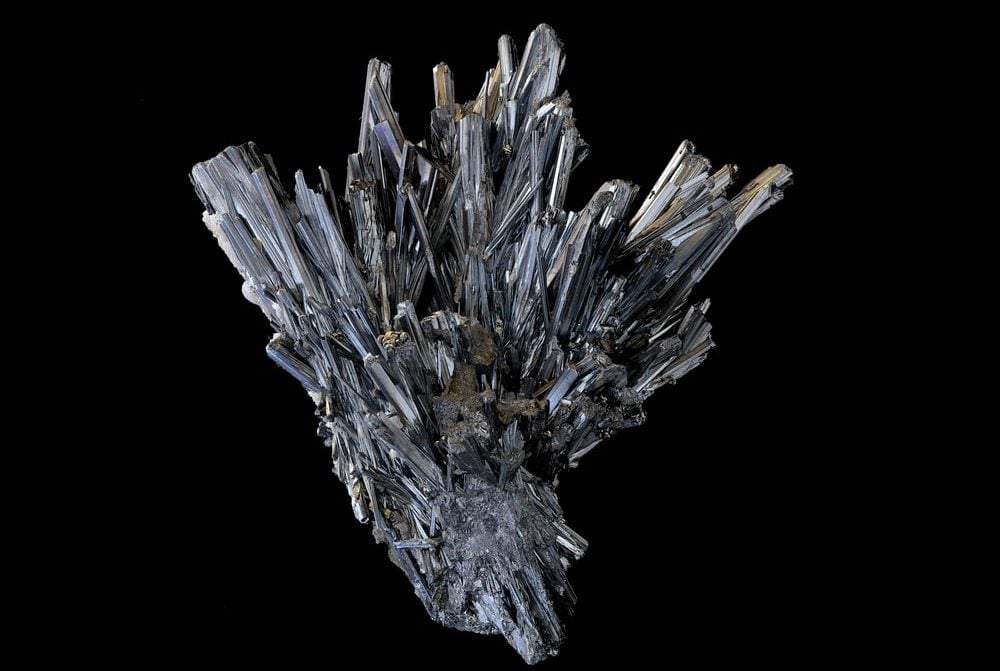

The report mentions that on February 2, 2026, there were reports indicating the U.S. plans to establish a $12 billion strategic reserve for critical minerals aimed at enhancing supply chain resilience. The analyst believes this could combine with related discussions in Europe to accelerate Western market access to critical minerals. These initiatives elevate the strategic position of Perpetua's Stibnite Gold Project, making it one of the few viable domestic sources of antimony supply. The report states that a federally backed reserve should "ultimately increase sales visibility, reduce financing risk, and enhance Perpetua's status as a critical Western supply chain asset."

H.C. Wainwright updated its long-term precious metals price forecasts effective January 1, 2026: gold increased from $3,000/oz to $3,750/oz, silver adjusted from $33.00/oz to $50.00/oz, and copper raised from $4.50/lb to $5.00/lb. These adjustments are based on macroeconomic developments over the past 12 months that have driven significant spot price appreciation. Since February 4, 2025, gold prices have risen 74.5% to $4,962/oz, silver increased 172.2% to $87.99/oz, and copper climbed 33.5% to $5.94/lb. The analyst emphasizes that current spot prices exceed the revised forecasts, and underlying demand factors support continued growth.

The $41 price target is based on a discounted cash flow analysis, evaluating the Stibnite Gold Project using a 10% discount rate. The analyst notes this rate is "consistent with other assets in similar jurisdictions, with comparable geopolitical risk and at a similar stage of development." The DCF analysis yields a combined valuation of $4.45 billion, or $34.84 per share. Adding an estimated $720 million in cash and cash equivalents and a $35 million valuation for exploration targets, and subtracting debt, the calculated value is $5.20 billion, or $40.75 per share, rounded to the $41 price target. The benefit from the higher price forecast is partially offset by a delay in the initial production timeline to the second half of 2029.

Near-term catalysts for Perpetua include progress on financing and debt funding, with management expecting decisions within the year. The analyst plans to monitor the final investment decision, noting that the Stibnite Gold Project should be profitable under current commodity price conditions. The company currently has no revenue, with a diluted EPS of -$0.22 in 2024, and estimates of -$0.38 and -$0.16 for 2025 and 2026, respectively.

Key risks to achieving the price target involve commodity prices, operational and technical factors, financial considerations, and political elements. As of February 4, 2026, Perpetua Resources' stock price was $28.47, representing approximately 44% upside to the $41 target. The company's enterprise value is approximately $2.75 billion, with a market capitalization of about $3.47 billion, an estimated $720 million in cash following recent equity financing, and a 52-week trading range of $7.81 to $35.97.