Wedoany.com Report on Feb 13th, According to the financial reports for the fourth quarter of 2025, Qualcomm and MediaTek have achieved stable growth in mobile revenue, driven by demand for high-end smartphones. However, with increasing competition, more in-house chip development by major device manufacturers, and emerging memory supply constraints, the market outlook for 2026 faces uncertainty.

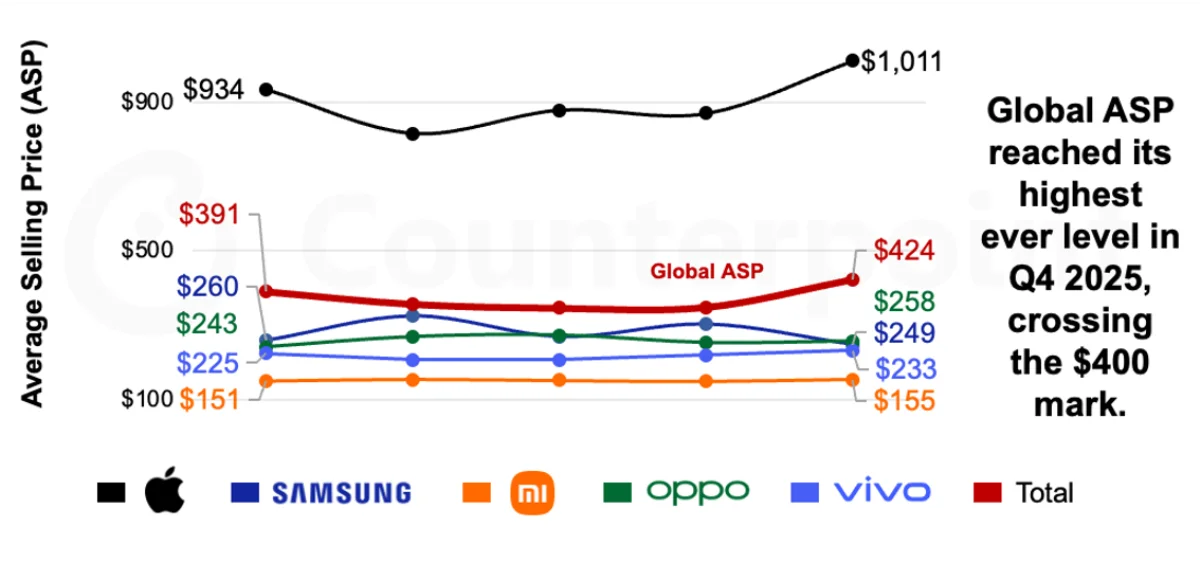

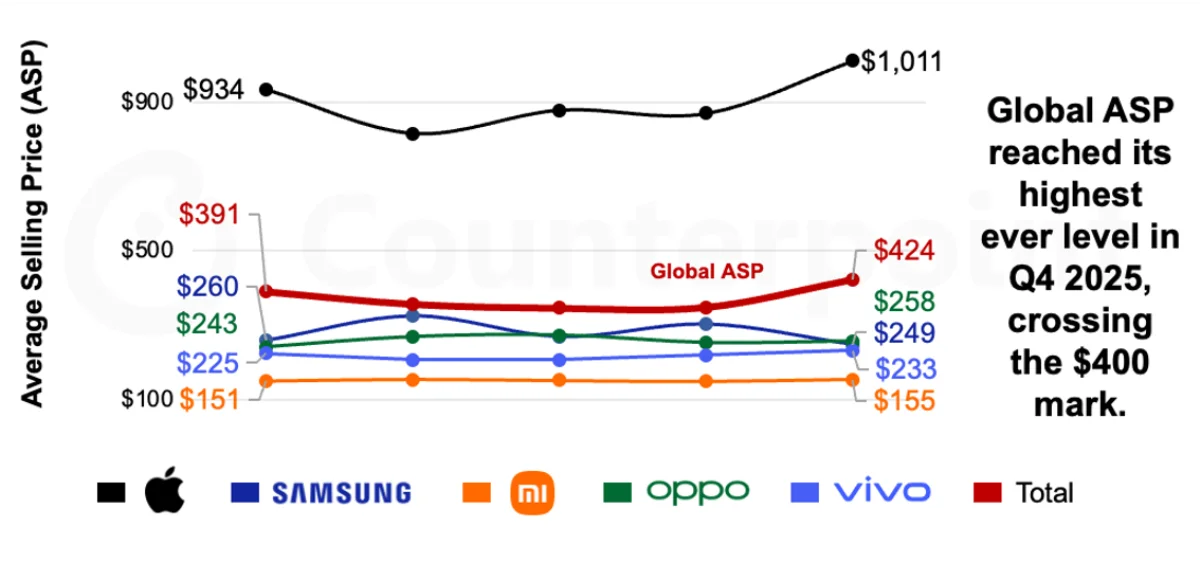

The growth in high-end smartphone demand has become the primary driver of mobile revenue. Both chip manufacturers have benefited from the global premiumization trend, with Qualcomm's mobile revenue growing 3% year-over-year and MediaTek achieving a 13% increase. This growth is mainly driven by higher average selling prices and the widespread adoption of flagship chipsets. Data from Counterpoint Research shows that the global average selling price for smartphones exceeded $400 for the first time in the fourth quarter of 2025, with significant contributions from Qualcomm's Snapdragon 8 Elite and MediaTek's Dimensity 9500 and 8500 series.

In the U.S. market, MediaTek faces challenges as Qualcomm, Samsung, and Google are gaining market share, impacting MediaTek's positioning in both entry-level and high-end segments. Samsung is accelerating its in-house chip strategy, using Exynos processors in models like the Galaxy A16 and A17, and plans to continue this approach, potentially limiting MediaTek's opportunities in the low-end market. Samsung's SoC sales volume increased by 200% year-over-year in 2025, and Google's Pixel 10 series is also gaining attention. These factors are weakening MediaTek's position in the U.S. Android chipset market.

Memory shortage has emerged as a new challenge for smartphone growth in 2026. Rising DRAM prices are expected to put pressure on manufacturers, potentially leading to price adjustments and design compromises. Qualcomm remains relatively stable in the high-end market, particularly in the U.S., where carrier subsidies and interest-free installment plans help mitigate cost pressures. MediaTek, on the other hand, is more oriented towards lower price tiers. In the fourth quarter of 2025, 69% of smartphones using its chipsets in the U.S. were priced below $600, making them more vulnerable to rising memory costs.

The K-shaped economic recovery in the U.S. market may also impact entry-level smartphone sales. High-income consumers continue to purchase premium devices, while budget-sensitive buyers are extending their replacement cycles, which could suppress demand for low-end models. Overall, Qualcomm and MediaTek enter 2026 with strengths in the high-end smartphone segment, but increased in-house chip development, intensified competition, and fluctuating memory prices will test the business performance of both companies.