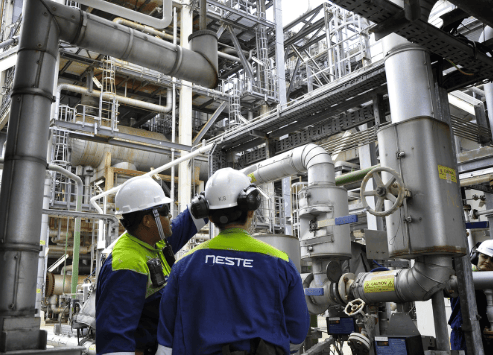

Wedoany.com Report on Feb 13th, Since February 2024, the European chemical industry has continued to face operational pressures. Data shows that 101 production facilities in the industry have already closed, resulting in a total loss of 25 million tons of chemical production capacity and a reduction of over 75,000 related jobs. It is estimated that the cost to rebuild these closed facilities is approximately €70 billion.

Industry analysis suggests that high energy costs, increasing carbon tax burdens, and insufficient effectiveness of trade protection tools are the main factors leading to the current situation. Currently, industrial electricity and natural gas prices in Europe are about four times those in the U.S. market, directly impacting the global competitiveness of energy-intensive industries such as chemicals.

The shift in production capacity has also led to changes in emission patterns. As production activities move to regions with higher carbon emission intensities, such as the United States and China, global carbon dioxide emissions have increased by over 20 million tons compared to before the shift. This trend reflects the discrepancy between regional emission reduction policies and the actual global emission outcomes.

To address these challenges, the industry has proposed three policy recommendations: reduce the anti-dumping duty ruling cycle from the current period to six months, suspend carbon taxes for five years, and implement targeted measures to lower industrial energy prices. These proposals aim to provide adjustment space for domestic chemical production and create conditions for subsequent investment.

Industry representatives stated that the chemical industry provides critical material support for fundamental sectors such as healthcare, water supply, and energy supply. Relevant companies and institutions have begun communicating with the European Commission and member state governments to seek feasible pathways that both protect climate goals and maintain the industrial foundation.