On February 12, 2026, First Atlanta Nickel Corp. announced that due to anticipated participation from strategic investors and strong market demand, the company has expanded the size of its non-brokered private placement. This financing will issue up to 21,666,667 common shares at a price of $0.18 per share, aiming to raise a maximum of $3.9 million to support the development of the company's nickel-cobalt project in Newfoundland.

The participation of strategic investors demonstrates confidence in the company's growth strategy and is expected to maintain a maximum ownership of 9.99%. The financing is conducted under the Listed Issuer Financing Exemption of Canadian securities regulations and is offered to residents of Canada, excluding Quebec. The shares are expected to be free from statutory hold periods. Offering documents are available on the company's website and the SEDAR+ platform, and investors should review them before making decisions.

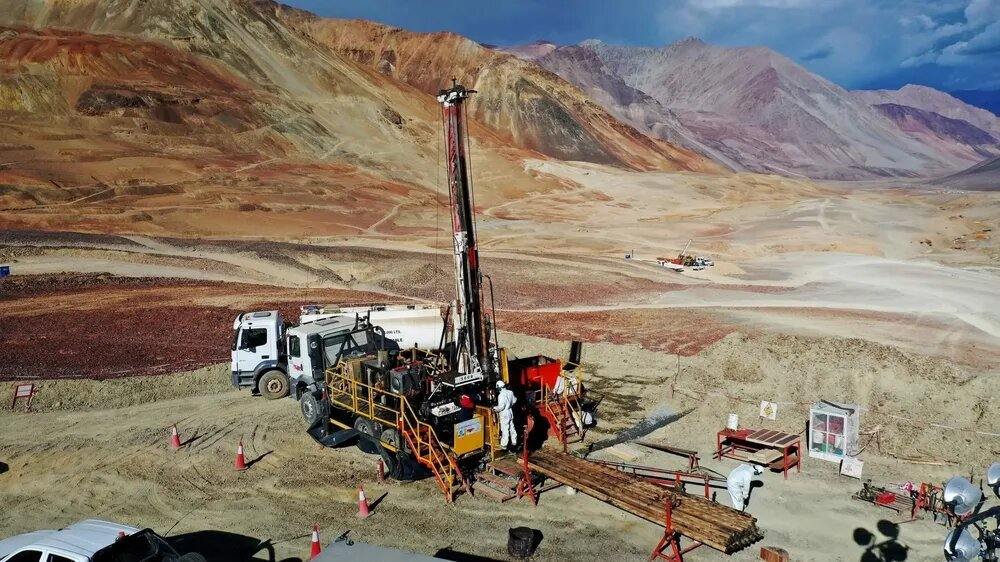

The company plans to use the net proceeds from the financing to advance the Pipestone XL and Ophiolite-X projects, fulfill option payment obligations, maintain mineral claims, and cover administrative and working capital. The first tranche of the financing is expected to close on or about February 18, 2026, subject to regulatory approvals including from the TSX Venture Exchange.

Concurrently, the company completed the acquisition of mineral claims within the Island Bay Ophiolite Complex in western Newfoundland, named the Ophiolite-X Project, involving 18 mining licenses and 500 mineral claims. This project has multi-commodity potential, including resources such as nickel, cobalt, and chromium. As consideration, the company issued 4,710,000 common shares, subject to a net smelter return royalty.

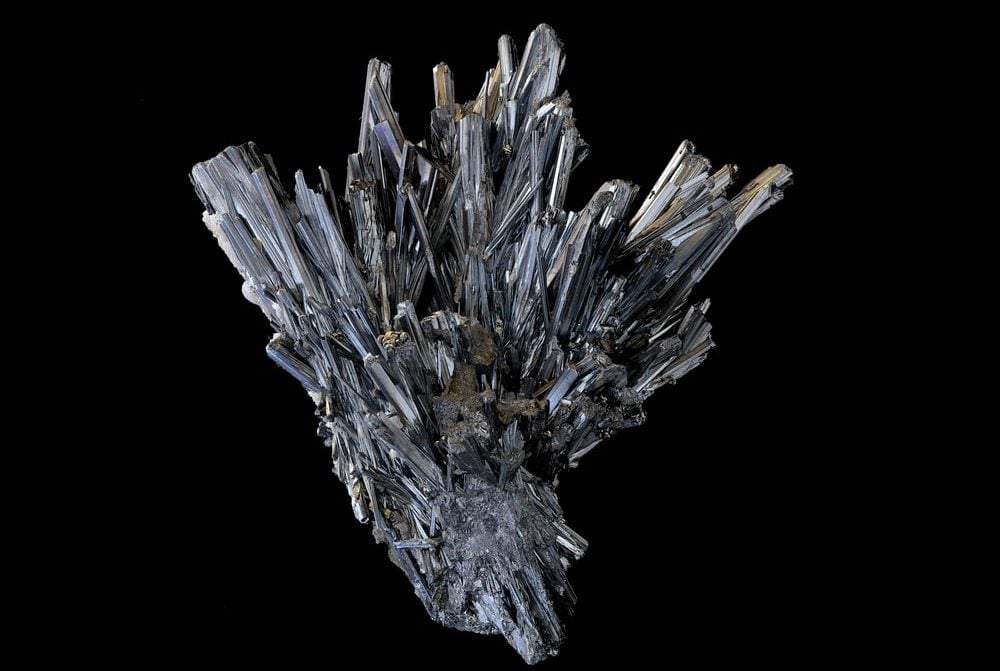

First Atlanta Nickel is focused on developing awaruite nickel-iron-cobalt alloy in Newfoundland, whose magnetic properties can simplify processing and reduce reliance on external infrastructure. The company's shares trade on multiple exchanges, and investors can obtain the latest information through its official website.