Wedoany.com Report-Nov. 28, Metals One (AIM and OTCQB: MOM), a London-listed resources company, has agreed to provide up to $1.8 million in funding to South African private company Lions Bay Resources (LBR) through convertible loan notes.

The capital will enable LBR to exercise a $1.36 million option on a large cogeneration plant in Newcastle, KwaZulu-Natal, and advance its redevelopment to produce power, steam, and roasted gold concentrates for regional mining operations.

LBR was formed this year and is owned by TSX-listed Lions Bay Capital, Metals One (currently 19.1%), and the Salamander Mining management team led by non-executive chairperson Graham Briggs, former CEO of Harmony Gold, and CEO Lloyd Birrell, founder and former CEO of ASX-listed Theta Gold.

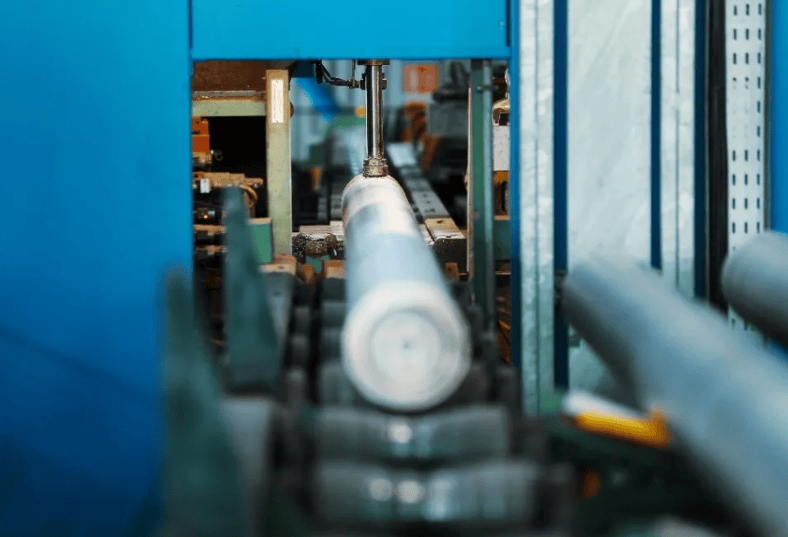

Located in the Karbochem Industrial Park, the plant features two 30 t/h Thermax boilers, a 6 MW GE-Triveni steam turbine, and supporting infrastructure. An October inspection by Terravista Solutions valued replacement cost at $39.6 million, with restart capital estimated at approximately $4.5 million.

A neighbouring chrome smelter has expressed interest in securing power and steam offtake, while LBR plans to add a gold concentrate roasting facility to serve mines within a 300 km radius, offering an alternative to exporting refractory material to overseas smelters.

Metals One MD Dan Maling said: "South Africa is historically the world's largest gold producer and we believe it has the perfect ingredients of abundant resources, infrastructure and mining expertise to become a leader once again. With the acquisition of the gold roaster and associated infrastructure, alongside the experienced mining team at Salamander, LBR has the foundations to be a significant, vertically integrated South African gold company.

"Metals One remains well financed with over £9-million in cash and liquid investments. Our network and ready access to capital enables us to facilitate downstream acquisitions such as this. We look forward to providing further updates on the growth opportunities with LBR in the coming months."

The convertible loan notes carry a 10% annual coupon and are secured by first-ranking charges over LBR's assets. Upon conversion, Metals One would hold at least 30% of LBR on a fully diluted basis, plus an immediate 5% equity stake upon execution of the agreement.

The funding will be drawn in tranches, starting with $175,000 followed by up to $1.63 million, subject to satisfactory due diligence and conditions. LBR also intends to acquire regional gold mining and tailings assets as feedstock for the planned roasting operation.