Wedoany.com Report-Dec.24, U.S. retail sales during the ongoing holiday season have shown solid growth, rising approximately 4% year-on-year based on preliminary data released by Visa and Mastercard on December 23, 2025.

These figures, derived from billions of transactions processed through the companies' networks, cover the period from November 1 to December 21 and indicate continued consumer spending resilience into late December.

Visa reported that total U.S. retail spending, excluding automobiles, gasoline, and restaurants, increased 4.2% over the same period last year. This outcome fell slightly short of the company's earlier October projection of 4.6% growth for the full November-December timeframe.

Mastercard, which includes retail and food service establishments in its analysis, recorded a 3.9% year-on-year rise in sales, surpassing its prior forecast of 3.6%. Both sets of data are unadjusted for inflation.

Shoppers approached purchases with greater care, utilizing artificial intelligence tools to identify products and compare prices, thereby making the most of available discretionary funds, Visa's chief economist, Wayne Best, said in a statement.

Michelle Meyer, chief economist at Mastercard Economics Institute, added that consumers began shopping earlier and relied heavily on promotional offers to secure favorable value.

Retailers introduced promotions ahead of the traditional peak period to attract buyers and secure early commitments.

Online sales demonstrated stronger growth than in-store transactions, benefiting from the ease of home shopping and timely discounts. Visa noted that physical stores continued to dominate, representing 73% of transactions, with online accounting for the remaining 27%.

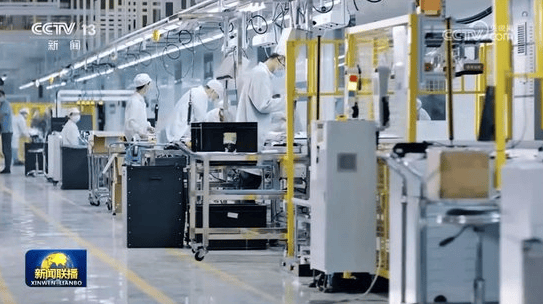

Electronics categories, including televisions and smartphones, led the way with a 5.8% increase according to Visa's data. This performance reflects demand for advanced devices amid technological advancements.

Clothing and accessories followed closely, rising 5.3%. Mastercard highlighted that seasonal promotions combined with cooler weather prompted updates to wardrobes, while jewelry purchases also saw increased interest this year.

The results point to balanced consumer behavior, where careful planning and value-seeking supported overall spending stability despite economic considerations.

These insights from payment networks provide an early view of holiday retail trends, with final figures expected to incorporate additional late-December activity.