Wedoany.com Report on Feb 7th, Recently, Intel and AMD have officially notified their Chinese customers, confirming a supply shortage of server central processing units (CPUs). Intel has warned that delivery times for some product models may be extended to six months. The tight supply has already led to a general price increase of over 10% for its server products in the Chinese market, with specific increases varying depending on customer contracts.

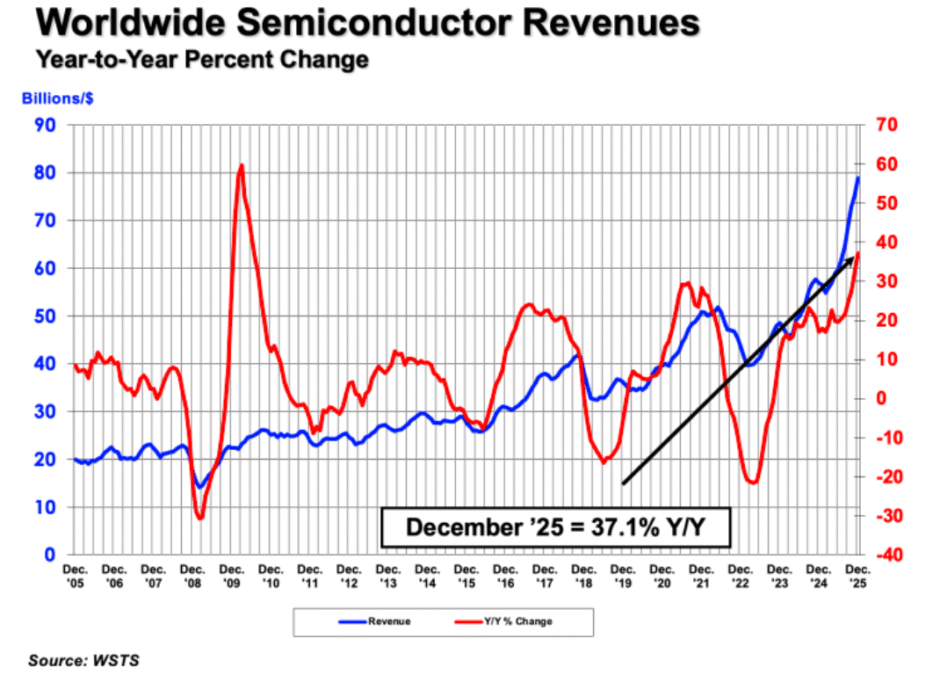

The rapid growth in AI infrastructure investment has not only significantly boosted demand for AI-specific chips (such as GPUs) but has also comprehensively impacted other parts of the supply chain. Among these, the continuous rise in memory chip prices is further exacerbating cost pressures across the entire server ecosystem.

According to industry insiders, recent notifications sent to Chinese customers indicate that the CPU supply shortage is intensifying. This could bring more operational challenges to AI companies, cloud service providers, and other manufacturers that rely on data center expansion, potentially even affecting their business deployment and project timelines.

In the Chinese market, the supply of Intel's 4th Generation (Sapphire Rapids) and 5th Generation (Emerald Rapids) Xeon processors is particularly tight, and the company has resorted to rationing product deliveries. The backlog for these mainstream models is quite severe, with delivery cycles significantly extended, and some customers even face the risk of order delays.

AMD has also informed customers of the tight supply situation. Sources indicate that delivery times for some AMD EPYC server processors have been extended to eight to ten weeks. While this situation is slightly better than Intel's, it remains significantly higher than normal levels.

Intel mentioned CPU supply issues during its January earnings call. The company stated in a subsequent announcement: "The rapid adoption of AI is driving strong demand for traditional computing." The announcement further mentioned: "We anticipate inventory will be low in the first quarter, but we are actively addressing this and expect supply to gradually improve from the second quarter through 2026."

AMD reiterated its stance from the earnings call, stating it has increased supply capacity to meet market demand. The company stated: "Based on our strong supplier agreements and supply chain, including our partnership with TSMC, we remain confident in our ability to meet customer demand globally."

These two companies dominate the global server CPU market. According to a UBS report released in January, Intel's market share has declined from over 90% in 2019 to around 60% in 2025, while AMD's share has grown from about 5% in 2019 to over 20% last year, indicating a structural shift in the competitive landscape.

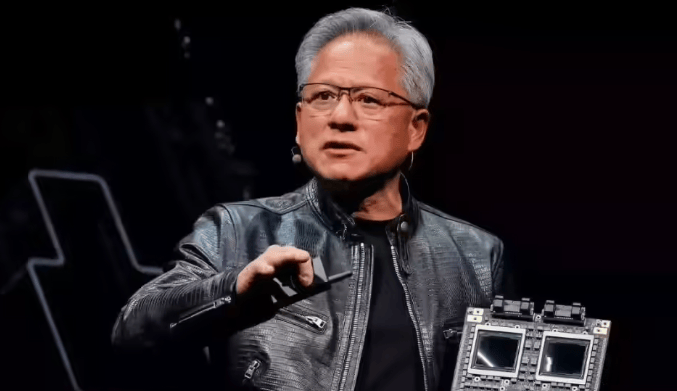

The current CPU supply shortage stems from a confluence of multiple factors: Intel faces manufacturing yield challenges in increasing production, while AMD outsources production to TSMC, which must prioritize capacity for AI chips (such as NVIDIA GPUs), objectively limiting the production space for CPUs. Simultaneously, memory chip shortages are also affecting the server supply chain – during the period of rising memory prices in China late last year, many customers accelerated CPU purchases to lock in lower prices, further depleting inventory. Additionally, growing market demand for agent-based AI systems capable of performing complex operations, which typically require CPU and GPU collaboration, continues to increase pressure on CPU supply.

Overall, the server CPU shortage reflects the comprehensive surge in computing power demand driven by the AI wave, as well as the tense situation faced by the global semiconductor supply chain under the intertwining of multiple factors. Supply is expected to remain tight in the short term, and prices may stay elevated. Related industries need to actively adjust procurement and production strategies to meet these challenges.