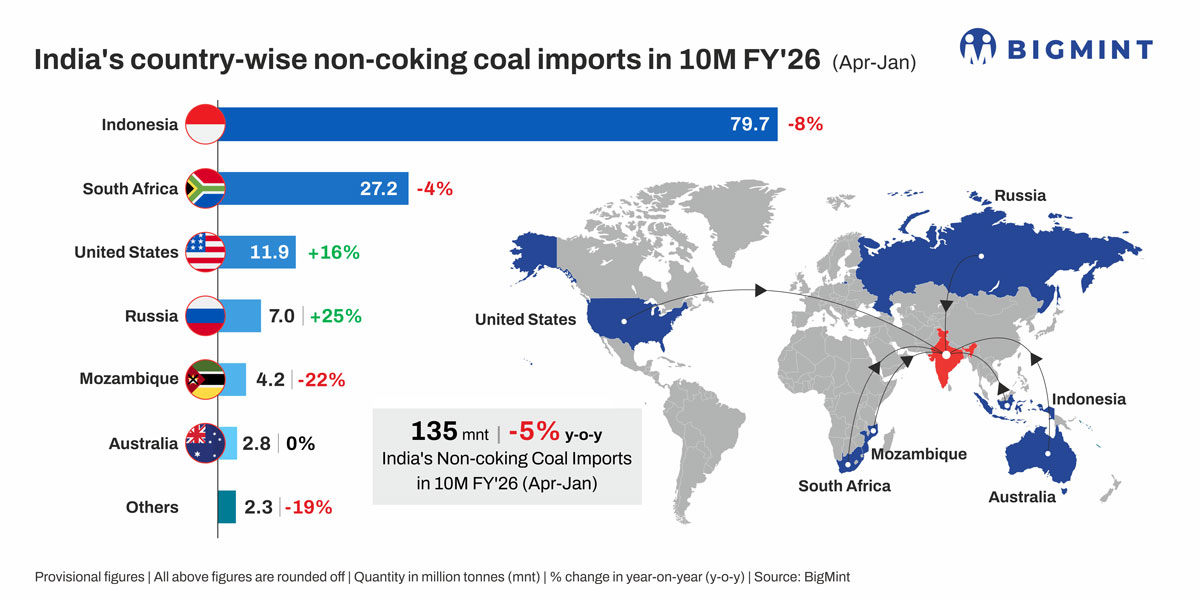

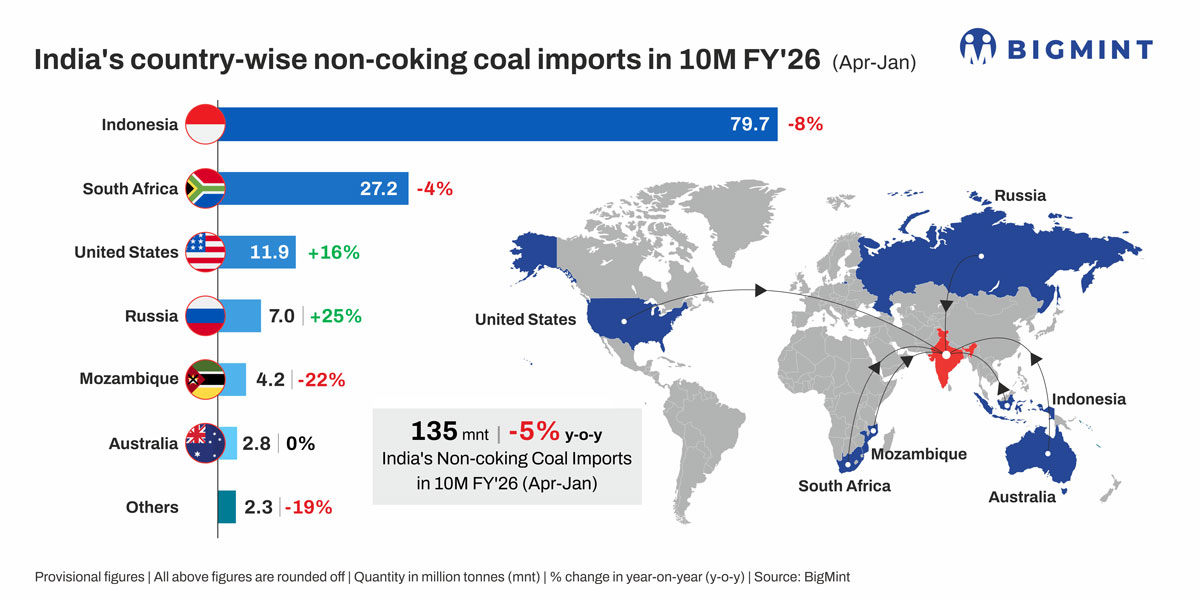

According to BigMint data, India's non-coking coal imports from April 2025 to January 2026 (the first 10 months of FY26) fell 5% year-on-year to 135 million tonnes. This decline is primarily attributed to an 8% drop in imports from Indonesia to 80 million tonnes, coupled with only a marginal increase in overall power consumption.

During the first 10 months of FY26, coal-based power generation fell 4% year-on-year to 105.5 billion units, reducing demand for Indonesian thermal coal primarily used in power plants. A mild summer and extended monsoon season limited cooling demand, with overall power consumption growing only 0.9% to 14 trillion units, largely met by renewable energy. Domestic coal demand also remained weak, with coal procurement by the power sector falling 4% to 662 million tonnes, while domestic production remained stable at 830 million tonnes.

Renewable energy generation grew 22% during the same period, with solar and wind power increasing by 19% and 30% respectively. From January to November 2025, renewable capacity addition reached a record 41 GW, while coal capacity addition was only 9 GW. As of November 2025, renewables' share in India's installed capacity mix rose to 40%, while coal's share shrank to 43%.

Production restrictions in Indonesia could impact India's thermal coal supply. Despite the decline in imports from Indonesia, they still account for 8% of the domestic market and 60% of total imports. Indonesia is considering implementing production cuts of 40-70%, and spot export trading has been suspended. In January 2026, Indonesian thermal coal exports fell 20% month-on-month to 36.1 million tonnes, with shipments to India down 12% to 6.6 million tonnes. With sluggish domestic production growth, Indian miners may struggle to fill the gap left by reduced imports. Furthermore, the El Niño phenomenon could boost power demand, potentially increasing domestic coal usage despite the rise in renewables.