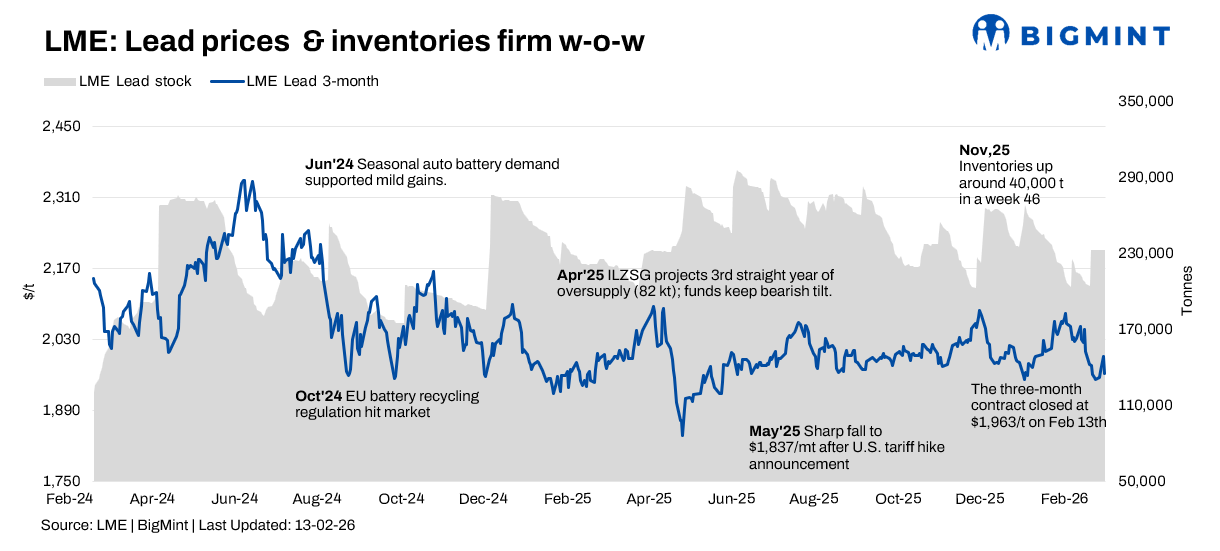

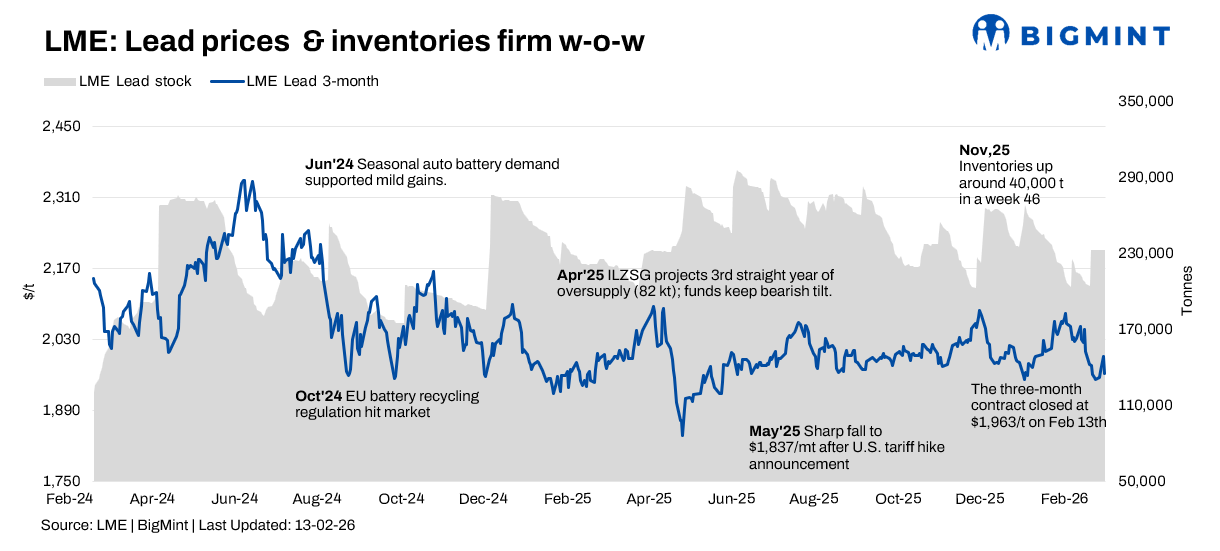

For the week ending February 13th, the London Metal Exchange (LME) lead price showed a slight upward trend, broadly supported by strength in the non-ferrous metals complex, although profit-taking towards the week's end capped further upside. Unlike the significant inventory builds seen previously, LME lead stocks remained largely stable this week, providing a relatively balanced physical backdrop for the market.

On the price front, LME cash lead opened at $1,903 per tonne on February 9th, rose to a weekly high of $1,949/t on February 12th, and ultimately settled at $1,918/t on February 13th, marking a weekly gain of 0.6%. The three-month lead contract climbed from $1,954/t to a peak of $1,997/t, closing at $1,963/t for a 0.7% weekly increase. The contract made another attempt to breach the key psychological resistance level of $2,000/t but failed to hold above it, leading to fund-led profit-taking activity emerging by the weekend.

LME lead inventories edged down slightly from 232,750 tonnes at the start of the week to 232,650 tonnes on February 13th, a decrease of just 100 tonnes. The pace of weekly inflows slowed markedly compared to the surges seen in prior weeks, indicating a temporary halt to large-scale deliveries. Although current stock levels remain above the year's lows, the lack of fresh additions has eased bearish pressure on the market.

On India's MCX exchange, the March 2026 lead contract followed global market movements but lacked domestic momentum, trading in a range between ₹189,000 and ₹193,000 per tonne. The contract settled at ₹189,150/t on February 13th, down 0.9% for the week, with subdued volumes reflecting cautious procurement from the battery sector.

The US dollar-denominated Shanghai Futures Exchange (SHFE) lead price rose from $2,377/t to $2,415/t, indicating firmer sentiment against a backdrop of low mine treatment charges and potential supply tightness. The strong performance on the SHFE narrowed the spread with the LME, although import arbitrage opportunities mostly remained unworkable.

Looking ahead, lead prices are likely to consolidate within a $1,900-$2,000/t range in the near term. Steady exchange inventories reduce immediate downside risks, but high stock levels and weak physical demand may limit price advances unless sustained buying support emerges. Cross-metal momentum and macro factors are expected to remain key drivers.