Wedoany.com Report-Sept. 19, Madrid-based Asterion Industrial Partners has expanded its European energy portfolio with a new investment in liquefied natural gas (LNG) infrastructure. The company announced the acquisition of a 25% stake in FluxDune, which translates into an indirect ownership of around 15% in the Dunkerque LNG terminal in Dunkirk, France.

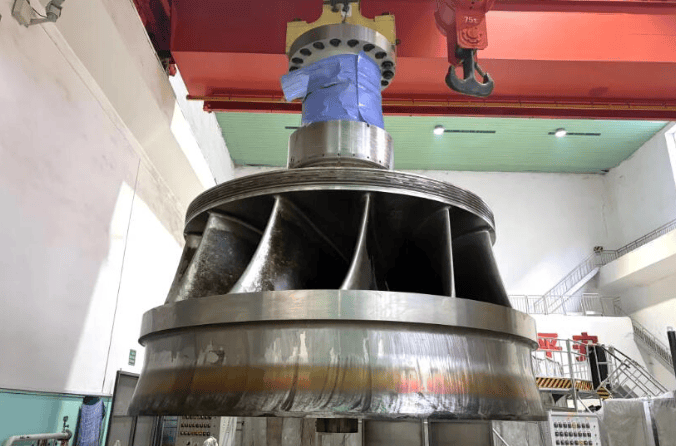

The Dunkerque terminal, operational since January 2017, is recognized as France’s largest LNG receiving and regasification facility and one of the largest in continental Europe. With an annual capacity of 13 billion cubic meters, it is also the only terminal in Europe directly connected to two markets—France and Belgium. This dual access is seen as a key advantage for meeting the region’s energy security needs.

Asterion highlighted the advanced technical design of the terminal, noting its modern infrastructure and emphasis on minimizing environmental impact. One example is its use of recycled warm water from a nearby nuclear plant in the regasification process, which reduces emissions and energy consumption.

This transaction marks the fourth investment for Asterion’s Fund III and creates a new partnership with Fluxys, a major European infrastructure group that holds the majority stake in the terminal. The partnership aims to strengthen operational efficiency and reinforce the asset’s role within the European energy landscape.

Jesús Olmos, Founding Partner and CEO of Asterion Industrial Partners, stated: “We are excited to partner with Fluxys and other shareholders on this critical infrastructure asset. We look forward to contributing our commercial and technical skillset to the Company’s long-term operational success story and prominence in the European energy landscape.”

Fluxys also welcomed the development, with Managing Director and CEO Pascal De Buck saying: “Fluxys is proud of the progress achieved since becoming a core shareholder in the Dunkerque LNG terminal. We are delighted to welcome Asterion as a partner and are excited to work together to build upon this success, and further cement the terminal’s position as a key infrastructure in the future European energy landscape.”

Asterion emphasized that global demand for natural gas, alongside the diversification of supply routes, has accelerated the growth of LNG imports. In this context, European regasification facilities such as Dunkerque are playing an increasingly vital role, experiencing higher utilization rates and offering access to diversified energy supplies. This is viewed as strengthening Europe’s resilience against potential supply disruptions while supporting the shift toward cleaner energy sources.

The investment also reflects Asterion’s broader strategy of expanding its footprint in France and other European markets, combining industrial expertise with execution speed and market insight. The company underlined that the acquisition aligns with its approach of developing assets that balance energy security, efficiency, and sustainability.

By entering into this partnership, Asterion reinforces its position as a significant investor in European energy infrastructure, while the Dunkerque LNG terminal strengthens its role as a strategic hub in securing reliable energy supplies for the continent.