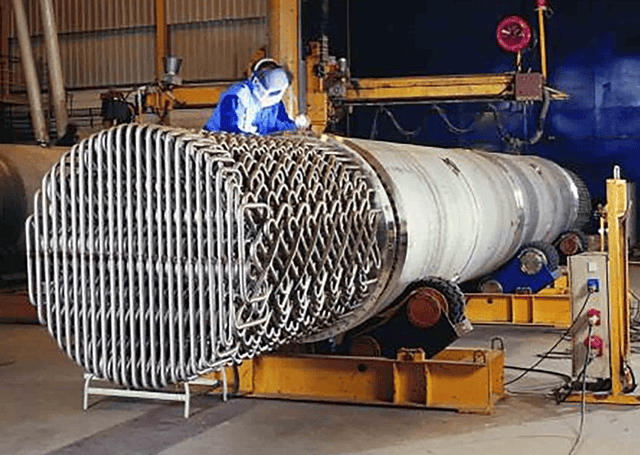

Wedoany.com Report-Nov. 7, PetroChina announced plans to phase out production at 19 outdated and inefficient units across its refining and petrochemicals facilities as part of efforts to address overcapacity in China’s downstream sector. The company, the country’s second-largest refiner after Sinopec, will permanently shut an aging refining and chemical unit that failed to meet safety standards, while phasing out an additional 18 units that have been in operation for over 20 years, analysts attending PetroChina’s Q3 earnings call on Thursday reported.

The move comes amid persistent low margins across China’s refining and petrochemical industries, caused by overcapacity and weak domestic demand for road transportation fuels. Chinese authorities have been pushing to reduce excess production that has led to losses for refiners and thin margins for petrochemical producers, contributing to a surplus of units across the Asian market.

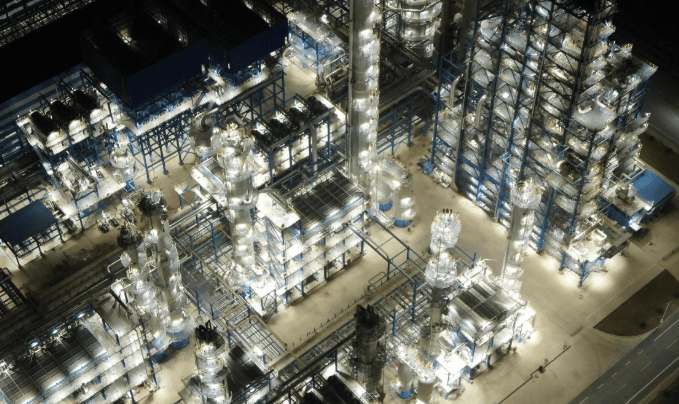

PetroChina’s Q3 earnings report highlighted that gasoline production fell by 4.8% from January to September compared with the same period last year, while diesel output remained flat. Jet fuel was the only transportation fuel with rising output, increasing by 9.5%, reflecting growing demand in the aviation sector. The company emphasized that it continues to “advance its transition toward the mid-to-high end of the refining-chemicals new materials value chain.”

The challenges facing PetroChina reflect broader trends in China’s refining and chemicals sectors, where companies have experienced “involution,” referring to intense competition over limited resources and market opportunities that results in self-defeating business practices. Overproduction and slow domestic fuel demand have intensified this pressure, making profitability difficult for many refineries and chemical producers.

Chinese authorities have signaled ongoing efforts to address structural overcapacity in both oil refining and steel-making industries, aiming to stabilize markets and reduce inefficient competition. The government’s measures include encouraging closures of outdated units and promoting consolidation, while supporting the development of higher-value and technologically advanced refining and chemical products.

PetroChina’s planned unit closures are expected to reduce surplus capacity and improve operational efficiency, enabling the company to focus on more profitable segments and modern technologies. Analysts noted that the restructuring aligns with the company’s broader strategy to shift toward higher-margin products and strengthen competitiveness in the mid-to-high-end refining and chemical materials sector.

Overall, PetroChina’s strategy highlights the company’s response to structural challenges in China’s downstream energy markets. By phasing out aging and inefficient units, the company aims to improve margins, streamline operations, and position itself for sustainable growth amid tightening industry regulations and evolving market conditions.

The Q3 report underscores the ongoing pressures in refining and petrochemicals but also indicates selective areas of growth, such as jet fuel, which may help balance production portfolios as the company transitions to higher-value segments.