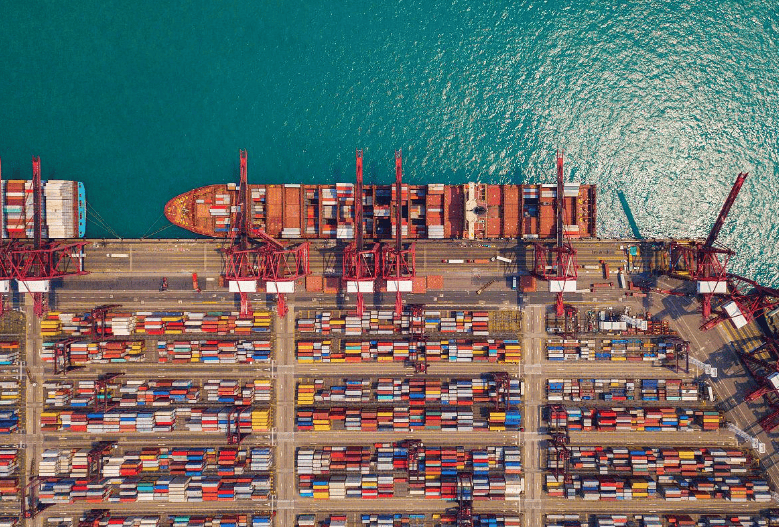

Wedoany.com Report on Feb 9th, Orion Group Holdings, Inc. recently announced the completion of its acquisition of J.E. McAmis and JEM Marine Leasing LLC for approximately $60 million (net of cash acquired). This acquisition significantly enhances Orion's capabilities in heavy marine, dock, and breakwater construction.

The transaction was announced on February 4th by Orion, a Houston-based specialty construction company, in a press release. The company stated that this acquisition aligns with its long-term growth strategy and strengthens its competitive position in the marine construction market.

Founded in 1973 and headquartered in Vancouver, Washington, J.E. McAmis specializes in marine construction projects, including dock and breakwater construction, dredging, environmental restoration, and dam and spillway work. The company primarily operates in Washington and Oregon, with projects also in Canada, Florida, Alaska, and Hawaii.

Travis Boone, President and CEO of Orion, said: "We are excited to welcome the J.E. McAmis team to Orion. McAmis is known for its outstanding safety record, on-time delivery, and solid profit margins, which align perfectly with Orion's corporate culture. The combination of our two companies will bring together a broader range of professional expertise, strategic marine equipment and real estate assets, and new service capabilities, enabling us to scale our operations and capture a wider array of market opportunities. This acquisition demonstrates our strategic commitment to becoming a leading marine construction contractor in attractive end markets and creating long-term value for our shareholders."

According to Orion, J.E. McAmis brings with it a $1.4 billion pipeline of business opportunities, strong customer relationships with the U.S. Department of Defense and the U.S. Army Corps of Engineers, and $34 million in marine and real estate assets. The acquisition also adds Jones Act-qualified marine assets to Orion's equipment fleet.

John McAmis, President of J.E. McAmis, said: "We are proud of what the J.E. McAmis team has accomplished and believe Orion is the right partner to continue this legacy. Orion's scale, capabilities, and commitment to excellence provide a solid platform for our employees and clients. We look forward to this combination driving sustainable long-term growth."

The acquisition consideration includes $46 million in cash funded through Orion's credit facility, a $12 million subordinated promissory note with a five-year term and a 6% annual interest rate, and $2 million in Orion common stock. The agreement also includes up to $10 million in contingent consideration, dependent on the profitability of backlog projects and 40% of the profit from selected recent projects.

Orion expects the acquisition to enhance its adjusted EBITDA and margins in 2026. The company plans to provide consolidated financial guidance for the full year 2026 when it reports its full-year and fourth-quarter 2025 financial results. Oppenheimer & Co. and D.A. Davidson & Co. served as M&A advisors to Orion, with Jones Walker LLP providing legal counsel for the transaction.