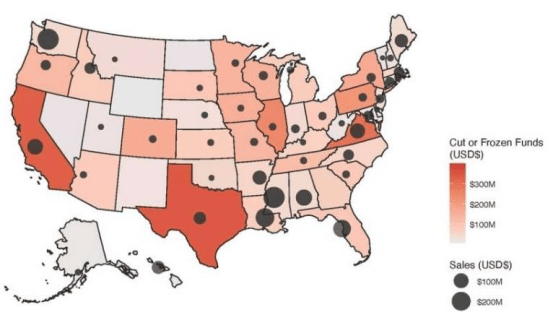

A new paper finds that increases in natural gas production could unintentionally slow investment in clean energy and lead to higher carbon emissions in the long run.

In 2015, 195 nations gathered in Paris and signed a global agreement aimed at reducing carbon emissions. A key part of that plan was to cut the amount of coal used for electricity generation. A decade later, coal consumption has fallen sharply. Countries like South Korea and Germany have phased out coal power entirely. Yet in this rush to retire the most polluting fuel, climate-conscious nations may be making a critical mistake.

In many parts of the world, the go-to replacement for coal has been natural gas—a fossil fuel with roughly half the carbon emissions of coal. Shifting more countries to natural gas can reduce emissions in the short term. But this transition carries unexpected consequences.

In a new paper, Bård Harstad, Professor of Political Economy at Stanford Graduate School of Business, and Katinka Holtsmark, Assistant Professor of Economics at the University of Oslo, show that natural gas exports suppress investment in renewable energy. Ultimately, this leads to higher carbon emissions over the long term—a dilemma the authors call the "natural gas trap."

"The natural gas trap means that countries that care a lot about climate change may end up producing even more natural gas," Harstad says. "The more they care about climate, the more they want to outcompete coal. But this well-intentioned action ends up reducing investment in renewables and ultimately increasing emissions."

Harstad hopes to alert policymakers and show them how to avoid the trap. "We want this paper to serve as a wake-up call," he says. "Unless countries find ways to curb or regulate natural gas production, their eagerness to compete with coal may do more harm than good."

Like many climate problems, this one starts with coal. Scientists agree that to avoid catastrophic global warming, coal must be replaced with cleaner renewables such as wind, solar, and hydropower. But these technologies require massive investment and years of development before they can fully compete with coal.

For now, renewable energy markets cannot respond to supply and demand shocks as quickly as coal mines can. Coal mines can ramp production up or down in response to market pressures. While renewables will eventually become just as flexible and price-competitive as coal, they are not there yet.

A temporary solution has been natural gas—often called a "bridge fuel." Switching to it gives countries time to build more solar panels and wind farms while meeting electricity demand in a cleaner way. To encourage other nations to buy gas, exporters flood the market, driving down both gas and coal prices.

Harstad and Holtsmark built a model of how competition between coal and natural gas affects renewable investment, using Norway as an example. They found that cheap natural gas reduces the incentive for countries to build renewables—such investments simply aren't profitable when energy prices are so low. This further delays the transition to clean energy.

Although these countries burn fuel with lower carbon intensity than coal, their emissions end up higher in the long run than if they had shifted to renewables faster. Ironically, Harstad notes, "the climate problem itself is the source of the problem."

Harstad and Holtsmark suggest that an alternative is for gas producers to make credible commitments to cut production, so investors looking beyond the next year can see that renewables will be profitable in the longer term. Fossil fuels aren't always the cheapest option, but Harstad says renewables may need several years to catch up and build capacity.

The authors propose three policies that could effectively limit natural gas production and boost renewable markets. First, gas-producing countries should invest heavily in renewables themselves. Harstad says this can work well where renewable technology is scarce and construction costs are low. However, it's not feasible in Norway, where building large solar arrays is prohibitively expensive.

Another solution is to tax exploration and surveying for natural gas. The authors write: "Closing new exploration areas or even limiting the number of exploration licenses in already open areas will necessarily affect future extraction and may therefore constitute a commitment mechanism."

Since developing new gas fields takes a year or longer, such restrictions reassure investors that future energy markets will remain tight and renewable investments will pay off. The Biden administration in the U.S. has taken a similar approach by restricting new export terminals for liquefied natural gas.

Finally, Harstad and Holtsmark suggest forming an OPEC-like cartel of gas-producing nations to jointly regulate prices. The cartel could include countries that lack strong climate ambitions but would benefit from higher gas prices and increased export revenues. By providing greater financial incentives for the renewable transition, this arrangement might help more nations escape the "natural gas trap."

Harstad stresses that the natural gas trap is not inevitable. "The natural gas trap won't last forever," he says. "We may run out of natural gas. In any case, we may reach a tipping point where renewables overtake gas."

According to his findings, Europe appears to have already fallen into the "natural gas trap." In Asia, where new coal mines are still being developed, the dilemma has not yet emerged. However, as more countries begin to focus on emissions reductions, they become more likely to fall into the same trap.