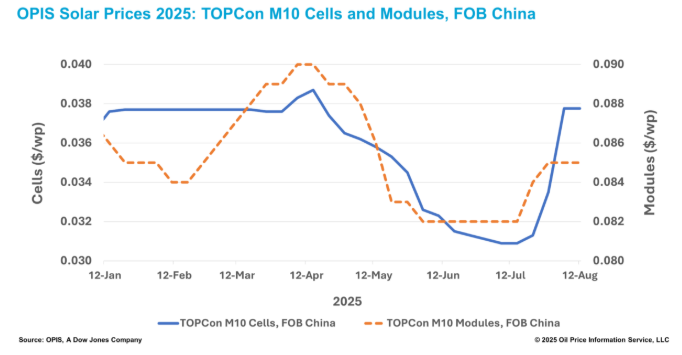

Wedoany.com Report-Aug. 18, On August 12, 2025, the OPIS Solar Weekly Report indicated that FOB China TOPCon M10 cell prices remained stable at $0.0378 per watt, with a range of $0.0347 to $0.0398 per watt. Prices have risen 22.3% since early July’s annual low, including a 12.84% increase last week, driven by market dynamics and policy expectations.

Export markets saw increased cell procurement for second-half 2025 deliveries, fueled by speculation that China may reduce or eliminate its 9% export tax rebate by September or October. Industry sources estimate this could raise cell prices by 5-9%, with costs likely shared between buyers and sellers. “The potential rebate adjustment is prompting buyers to secure contracts early,” said a market analyst.

Upstream cost pressures are pushing cell prices higher. Since July 1, 2025, China Mono Premium polysilicon prices have increased by 31.7%, and mainstream n-type M10 wafer prices have risen by 29.0%. “Higher upstream costs are driving cell producers to seek further price adjustments,” a Tier-1 manufacturer stated. However, sustained price increases depend on end-users’ ability to absorb these costs.

Conversely, weak demand in domestic and export markets is expected to limit price growth in the coming weeks. Domestic demand is projected to remain soft until September, rebounding in Q4 for the year-end installation surge. In Europe, procurement has slowed due to the summer holiday period. FOB China n-type module prices, reflected in the Chinese Module Marker (CMM) at $0.085 per watt, rose only 3.7% compared to upstream gains of over 30%.

Forward curve indications show Q4 2025 loading prices dropping 1.16% to $0.085 per watt, with a range of $0.083 to $0.088 per watt. Q1 and Q2 2026 prices held steady at $0.086 per watt, while Q3 2026 prices fell 1.15% to $0.086 per watt. Despite these declines, market sentiment for late 2025 is optimistic, driven by expectations of the export tax rebate’s potential removal, encouraging early deliveries.

Contracting practices are adapting to the rebate uncertainty. New deals include cost-sharing clauses for potential rebate reductions, and existing contracts are being renegotiated. However, transmitting upstream cost increases to module prices remains challenging, with a 1-2 month lag expected before global markets reflect these changes. “Current domestic price strength is largely policy-driven, not demand-led,” noted an industry source, highlighting weak underlying demand.

The evolving market dynamics, combined with policy uncertainties, underscore the need for strategic planning among solar cell producers and buyers to navigate cost pressures and maintain competitiveness.