Wedoany.com Report-Sept. 18, BHP (ASX, NYSE, LSE: BHP) will close its Saraji South joint venture coal mine in Queensland, Australia, in November, with around 750 employees to be laid off, according to reports from the Australian Broadcasting Corporation and The Wall Street Journal. The closure follows weak coal prices and higher state royalties, which have affected the viability of operations.

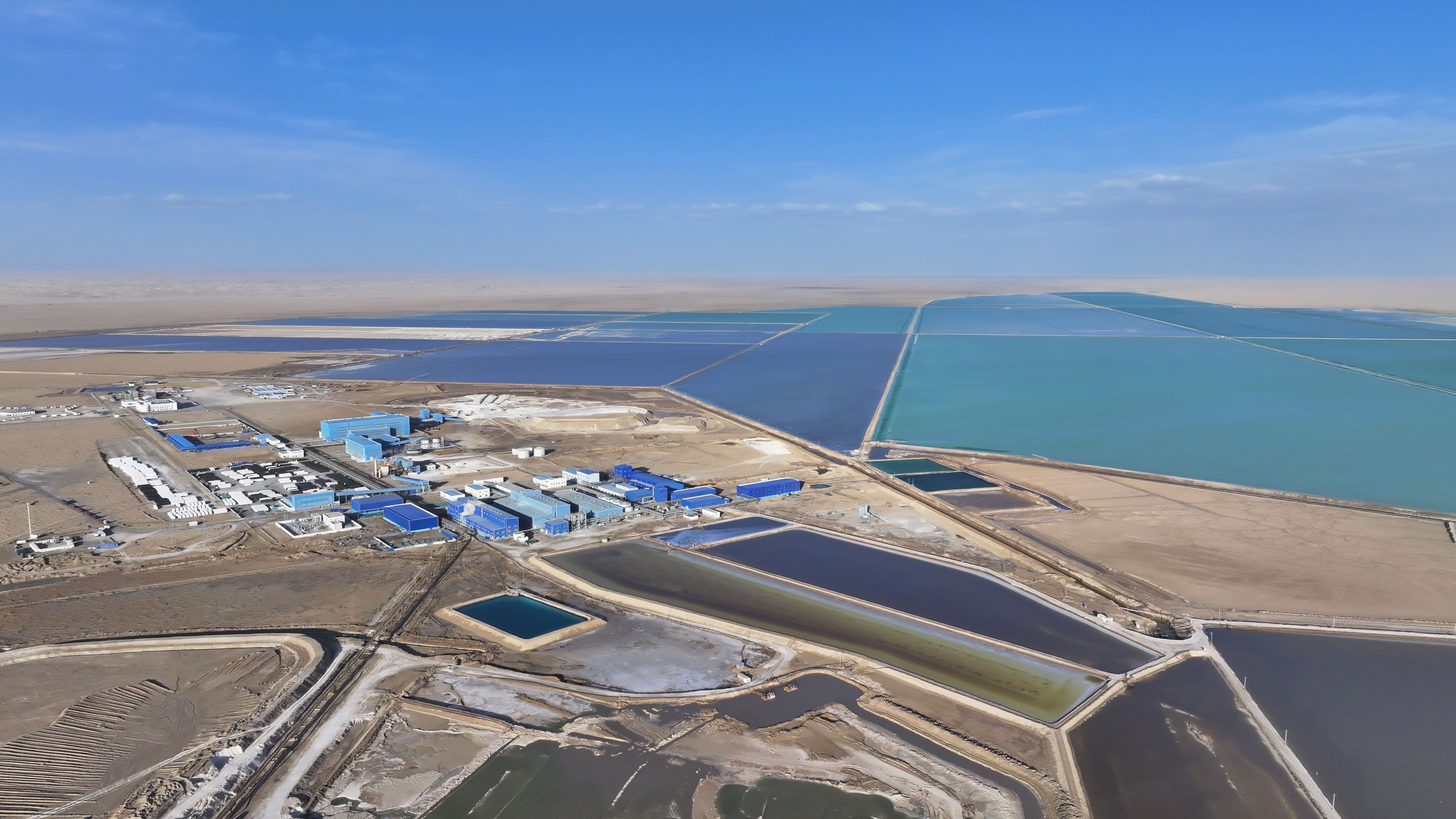

The Saraji South cola mine in Queensland.

Saraji is one of five steelmaking coal mines operated by BMA, a 50-50 joint venture between BHP and Mitsubishi Development Industry. Located near Dysart in central Queensland, the Saraji South mine contributes only a small portion of the joint venture’s overall output. BMA President Adam Lancey said in a video published by The Australian: “The state government’s coal tax has seen BMA pay A67¢ for every dollar in royalties, or about eight times what the company made in profit, which is unsustainable.”

BHP also intends to review its FutureFit mining training academy in Mackay. Queensland’s Deputy Premier Jarrod Bleijie criticized the move, stating the company should continue to support young people seeking careers in mining. The closure marks the company’s second major downsizing in Australia within a year, following the temporary suspension of its nickel operations in Western Australia last October due to low prices and oversupply.

On Wednesday, BHP shares fell 1.1 percent to A$40.31 (C$37.03) in Sydney, valuing the company at US$204.73 billion. The stock has traded between A$33.25 and A$46.23 over the past 12 months. Spokespeople for BHP did not immediately respond to requests for comment.

Steelmaking coal was priced at US$101.75 per ton on Wednesday, Trading Economics reported. This represents a decline of about 40 percent compared with 2023, when coal averaged US$400 per ton. Analysts attribute the fall to weaker demand in Europe and some Asian markets. The Saraji Complex as a whole produced 8.1 million metric tons of coal in the year to June, but Saraji South accounts for only a minor share of this total, suggesting its closure may have limited impact on BMA’s fiscal 2026 or medium-term production levels.

The coal price downturn has also pressured other Queensland producers. In July, Bowen Coking Coal announced it would place its Burton Mine Complex into administration after failing to secure a deferral of royalty payments from the state. Industry stakeholders have raised concerns about the impact of current royalty structures on competitiveness.

Janette Hewson, Chief Executive Officer of the Queensland Resources Council, commented that royalty rates combined with lower coal prices are making production “unviable.” However, Bleijie reiterated that the state government had committed before taking office not to adjust the royalty framework.

The developments reflect broader challenges facing the coal industry, where producers must contend with fluctuating international demand, commodity price volatility, and regulatory frameworks. While the Saraji South closure highlights cost pressures in Queensland, BMA’s diversified operations and production scale may limit its overall financial effect in the near term.