Wedoany.com Report-Nov. 4, According to preliminary data from financial firm LSEG, the United States became the first country to export 10 million metric tonnes (mmt) of liquefied natural gas (LNG) in a single month. In October, U.S. LNG exports reached a record 10.1 mmt, up from a revised 9.1 mmt in September. The U.S., already the world’s largest LNG exporter, achieved this record following four months of continuous export growth in 2025.

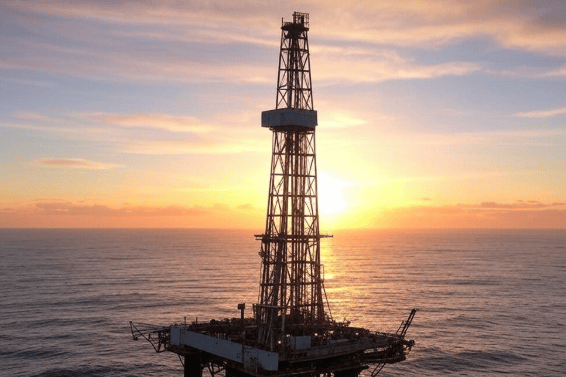

A view of the Freeport LNG facility in Quintana, Texas, U.S., June 23, 2025.

The increase was largely driven by new production capacity from Venture Global’s Plaquemines export facility in Louisiana and Cheniere Energy’s Corpus Christi Stage 3 project in Texas. According to LSEG data, the Plaquemines plant sold 2.2 mmt in October, exceeding its previous record of 1.6 mmt in September. Cheniere’s Corpus Christi plant also reached a new high, exporting 1.6 mmt. Combined with output from its Sabine Pass facility, which exported 2.6 mmt, Cheniere accounted for a total of 4.2 mmt, representing 42% of total U.S. LNG exports.

Venture Global and Cheniere together contributed about 72% of U.S. LNG shipments in October, LSEG reported. Cheniere CEO Jack Fusco stated in a recent earnings call that once the Corpus Christi Stage 3 expansion is complete, the company will be able to export more than 50 million tonnes per year starting in 2026.

Europe remained the primary destination for U.S. LNG, importing 6.9 mmt in October—nearly 69% of total U.S. shipments—up from 6.22 mmt in September. The continent continued to build gas inventories ahead of the winter season. Exports to Asia also increased to 1.96 mmt from 1.63 mmt the previous month. In contrast, exports to Latin America declined to 0.57 mmt from 0.63 mmt in September as countries in the region entered warmer weather. Egypt purchased five cargoes totaling 0.43 mmt, compared to 0.5 mmt in September, while Senegal received two shipments totaling 0.1 mmt. Two additional cargoes were still awaiting customer orders, according to LSEG ship-tracking data.

Meanwhile, Russia’s second-largest oil producer Lukoil announced plans to sell its international assets. In the European benchmark Dutch Title Transfer Facility (TTF), gas prices averaged $10.88 per million British thermal units (mmBtu) in October, slightly down from $11.13 in September. At Asia’s Japan Korea Marker (JKM), the monthly average price was $11.11, compared with $11.32 the previous month.

The close price gap between TTF and JKM offered limited incentive for U.S. exporters to redirect cargoes from Europe to Asia. As global LNG trade patterns stabilized, the U.S. maintained its strong export position, supported by rising production capacity and consistent demand across major import markets. The country’s performance in October highlighted its growing influence in the international LNG sector, marking a milestone in global energy trade.