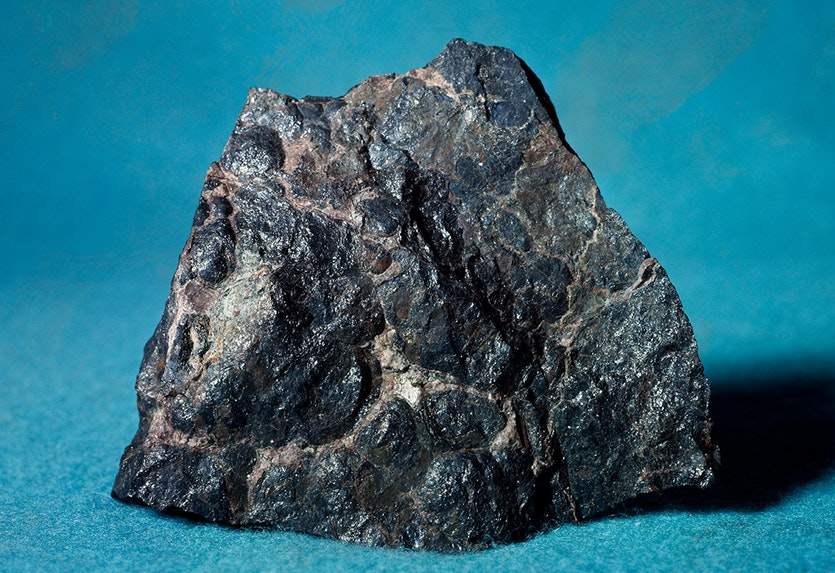

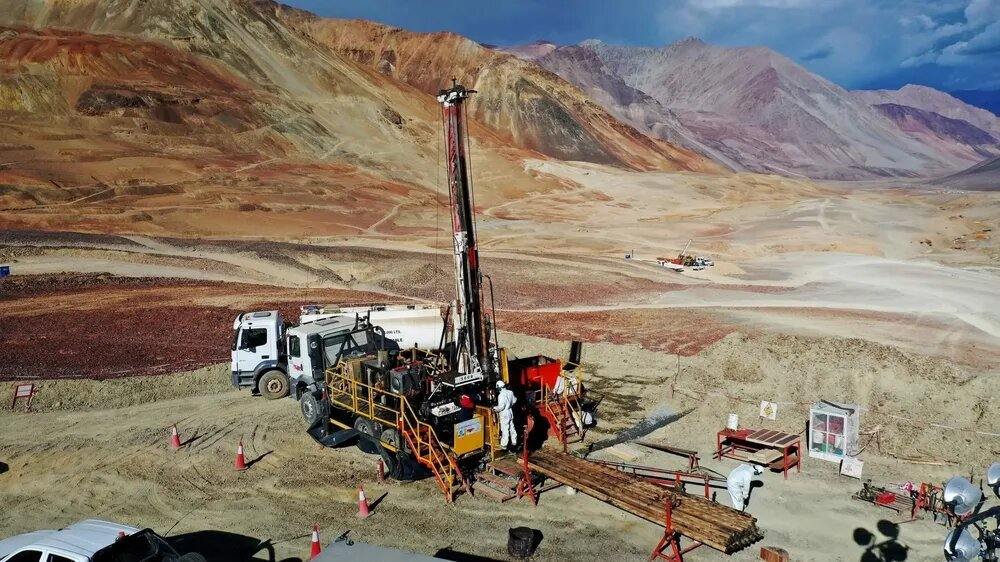

Wedoany.com Report-Nov. 12, Guinea plans to accelerate the development of alumina refineries and iron-ore pellet plants to reduce decades of raw ore exports, Mines Minister Bouna Sylla told reporters. The announcement comes as the country prepares for first shipments from the massive Simandou iron-ore mine this week.

Domestic alumina and iron-ore processing could boost Guinea’s economy by creating industrial jobs and reducing reliance on commodity price swings, the World Bank noted in July. Currently, Guinea exports around 60% of its bauxite, a key feedstock for aluminum, to China, while about one-third of Simandou’s iron ore is shipped to Chinese mills.

Conakry has already signed its first alumina refinery deal with China’s State Power Investment Corporation (SPIC), with construction underway and completion targeted by end-2027, Sylla said. Additional projects are in advanced discussions with Chinalco and France’s Alteo, and ongoing talks continue with Compagnie des Bauxites de Guinée and Alcoa.

Sylla remarked: “We are the biggest bauxite producer in the world now… but we don't have any refineries built since colonial times. That will change.” Guinea aims to build five to six alumina refineries by 2030, increasing domestic processing capacity to around seven million metric tons annually.

The West African country recently revoked a bauxite concession awarded to a unit of Emirates Global Aluminium after the firm failed to construct a promised local refinery. Allison Ju of SMM noted that Guinea’s alumina projects will not reduce China’s dependence on its minerals, as exports will shift from bauxite to alumina. Guinea’s low-silica bauxite, suitable for low-temperature refining, supports about 25% of global aluminum output.

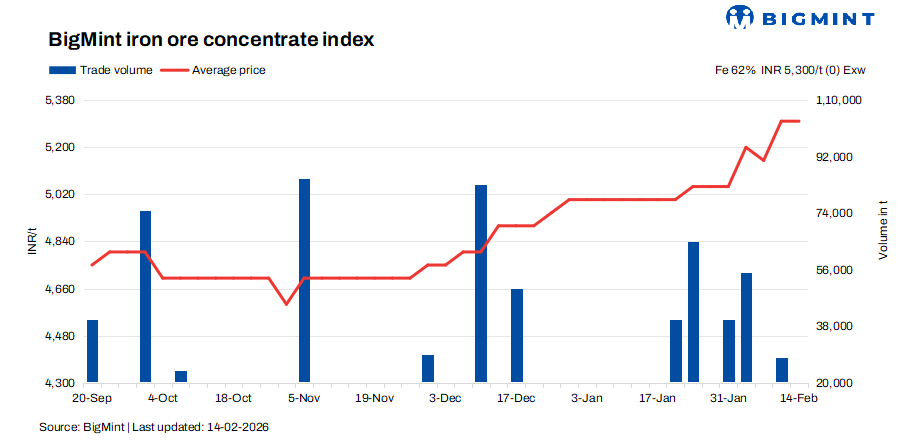

Beyond alumina, Guinea is targeting domestic iron-ore processing. Current agreements with Rio Tinto and the Winning Consortium Simandou require feasibility studies for either a 500,000-ton steel plant or a two-million-ton pellet facility within two years of first exports, Sylla said. Djiba Diakite, chief of staff to the president, added that if the partners fail to meet the deadline, Guinea can hire a top global firm at the expense of Compagnie du Transguineen, the joint venture managing Simandou’s rail and port services.

Sylla explained: “We believe we have identified the minimum capacities to design this facility based on sound economic principles.” Rio Tinto’s Simfer venture confirmed its commitment to a pellet plant feasibility study, while WCS did not immediately comment.

Guinea’s location near Europe and the US offers a logistics advantage over Middle Eastern hubs, Sylla said, noting that producing pellets and direct reduced iron for green steel is the preferred path. Energy remains a key challenge, but Guinea is seeking hydro, solar, and liquefied natural gas investments, including a US-backed LNG import plan for power plants.

With these steps, Guinea aims to shift from raw mineral exports to value-added processing, supporting industrial growth, job creation, and enhanced economic stability while meeting rising global demand for aluminum and iron-ore products.