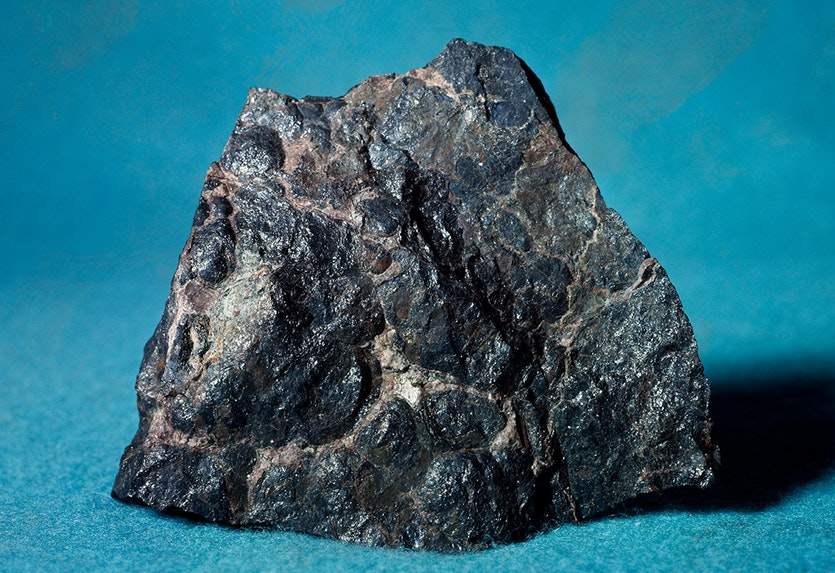

Wedoany.com Report-Nov. 12, Brazil-based mining company Vale is preparing to benefit from rising demand in India, where steel production could double by the end of the decade. The company expects higher sales to India and other Asian markets to offset slower demand in China, where steel output has plateaued at roughly one billion tonnes per year and may decline in the coming years.

Vale recently reported results for Q3 2025, with 5% sales growth and its highest iron ore output since 2018.

Vale CEO Gustavo Pimenta told Reuters: “India has 1.6 billion people, has surpassed China, and needs massive infrastructure investments, which means a lot of steel.” He added that India’s steelmaking capacity could grow to around 300 million tonnes over the next five to seven years.

Pimenta emphasized that Vale’s high-grade iron ore blends effectively with India’s lower-quality supply, offering benefits for both markets. He said: “We bring quality to the Indian mix. As steel output doubles, we see a big growth opportunity.” India is expected to import around 10 million tonnes of Vale’s ore in 2025, up from almost none in previous years, although this remains a small portion of Vale’s total sales to China, which account for about 60% of the company’s iron ore exports.

Vale also anticipates rising demand from other Asian markets. Sales to Vietnam are projected to reach 8 million tonnes in 2025, a significant increase compared with previous years.

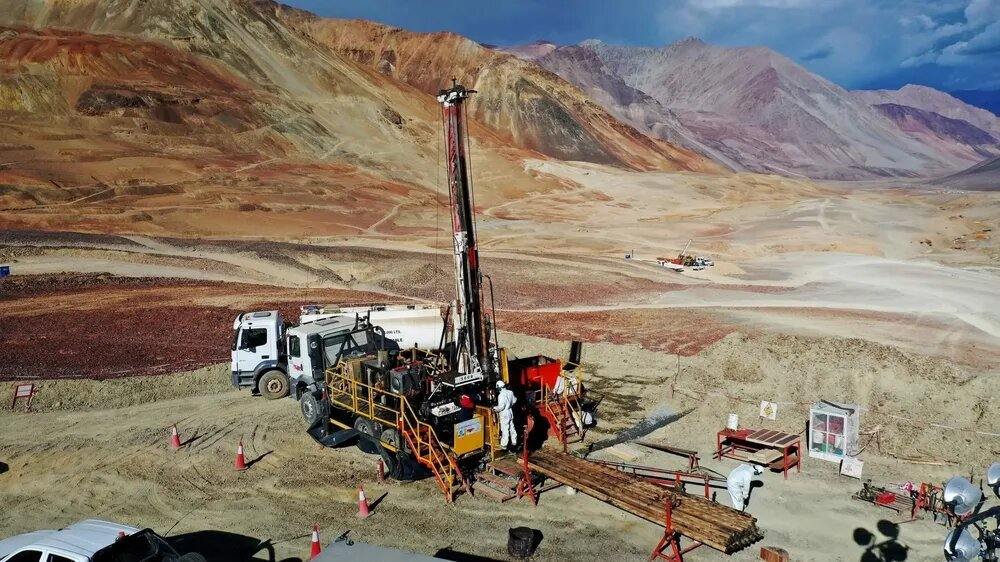

The company recently reported third-quarter 2025 results, showing 5% sales growth and its highest iron ore output since 2018. While Pimenta declined to specify new production targets, he confirmed that Vale will outline projects to expand both iron ore and copper capacity in its Northern System operations.

Vale plans to invest 70 billion reais ($13.14 billion) by 2030 in its Novo Carajas program in Brazil. This includes a project to increase annual iron ore capacity by 20 million tonnes. The initiative is now 80% complete and scheduled to start operations in late 2026. Additionally, the company aims to double its copper output by 2035.

Outside Brazil, Vale is considering the sale of its Thompson nickel mine in Canada. The decision reflects market interest and relatively weak prices, amid increased nickel output from Indonesia.

Vale’s strategy highlights a shift toward high-demand Asian markets, leveraging its high-grade iron ore and expanding production capacity. With India’s infrastructure growth and regional steel demand rising, Vale expects to capture new opportunities while maintaining its core business in China and other established markets.

This approach positions the company to strengthen its presence in key global markets, with a focus on expanding both iron ore and copper production and aligning supply with emerging demand patterns in Asia.