Wedoany.com Report-Nov. 12, Tactical Resources (TSXV: RARE) announced on Monday that U.S. asset manager Yorkville Advisors Global has agreed to provide up to $140 million in financing to support the company’s rare earths project in Texas, contingent on the completion of its planned merger with Plum Acquisition, expected by December 31. The package includes $40 million in convertible debt and a $100 million standby equity purchase agreement.

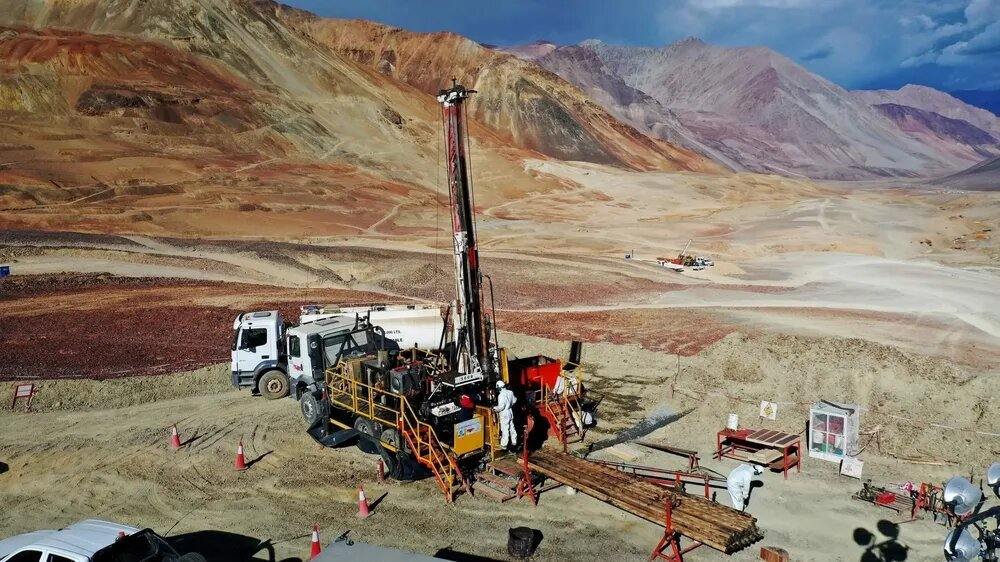

A view of the Sierra Blanca quarry.

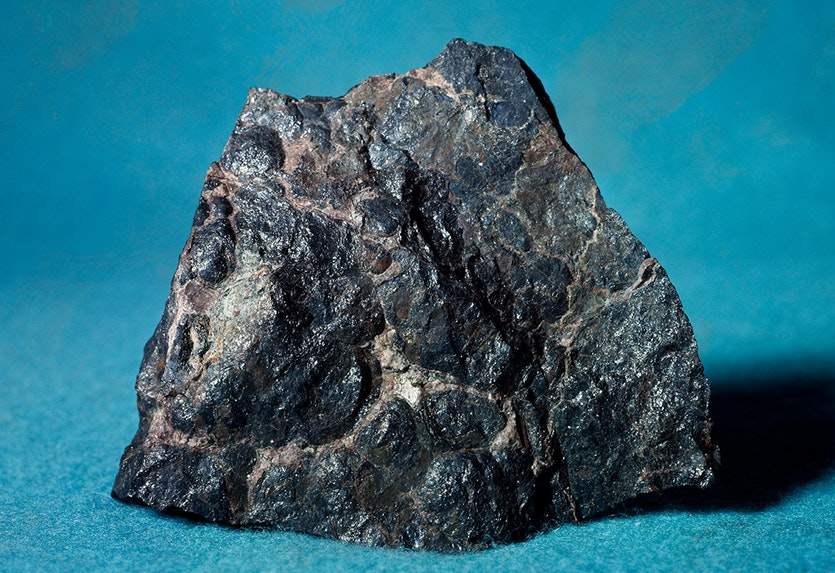

Vancouver-based Tactical holds rights to tailings inventory at the Sierra Blanca quarry, which could serve as immediate feedstock for rare earth element (REE) processing. The Peak project aligns with U.S. efforts to boost domestic REE production, critical for high-powered magnets, fuel cells, and superconductors. CEO Ranjeet Sundher said: “This financing package validates the assets and business plan that Tactical is developing, and provides a clear path to potentially becoming the second at-scale U.S. supplier of rare earths in the U.S.” He added: “Our existing tailings inventory fundamentally changes the economics and timeline of rare earth production, and we aim to move directly to processing rather than spending 10 or more years in the long-lead mine development and construction phases.”

The merger with Plum will allow the combined company to list on the Nasdaq. The deal, initially announced in August 2024, gives the pro-forma company an enterprise value of about $589 million. Under the terms, Yorkville’s $100 million in equity financing would be available within three years after the closing. Tactical is also seeking additional funding from strategic investors.

Sierra Blanca, located about 113 km southeast of El Paso, currently produces ballast material for the Union Pacific railway. Tactical’s agreement grants access to tailings potentially enriched with REEs, with an option to purchase the mining lease and quarry operations. The Peak project sits on the northwest side of the Sierra Blanca laccolith, composed mostly of tertiary rhyolite porphyry. REE minerals occur within biotite in the rhyolite units.

Tactical plans to advance a sampling and testing program at Peak to evaluate its REE potential, which will support future exploration work for a maiden mineral resource. Plum chairman and CEO Kanishka Roy said: “While many companies claim to be a rare earth supplier, we believe Tactical is only the second U.S. company to already have existing potential feedstock at scale, and thus a much clearer potential near-term path to supplying rare earths to multiple vertical industries critical to the U.S. economy.” He added: “As the United States prioritizes domestic critical minerals production, Tactical is positioned to become a cornerstone of America’s rare earth supply chain into the next century.”

Following the announcement, Tactical shares initially rose as much as 6% but closed down 3.3% at C$1.45 in Toronto, giving the company a market value of about C$53 million ($38 million). The stock has traded between C$0.19 and C$2.05 over the past year.

This financing and merger plan positions Tactical to leverage existing feedstock and advance rapidly toward processing rare earths, supporting U.S. domestic production goals and supplying key industries with critical materials.