Wedoany.com Report-Nov. 12, SSR Mining (Nasdaq, TSX: SSRM) announced on Tuesday that a new technical study for its recently acquired Cripple Creek & Victor (CC&V) gold mine in Colorado has extended the mine’s mineral reserve estimate and projected operational life. CC&V’s mineral reserves are now estimated at approximately 2.8 million ounces of gold, up from about 2.4 million ounces at the end of 2024. The extension supports roughly 12 more years of active mining and stacking, followed by around 14 years of residual leaching, the company said.

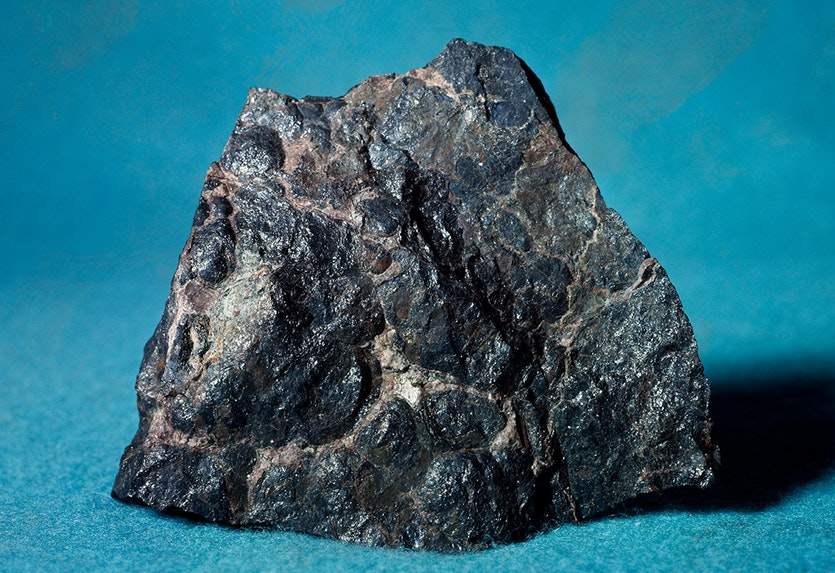

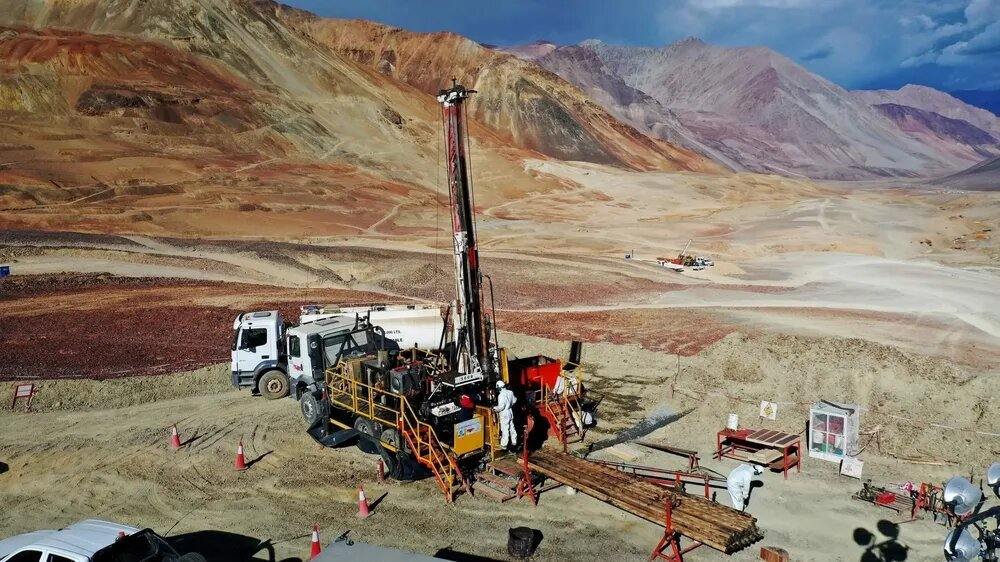

A view of the Cripple Creek & Victor (CC&V) gold mine in Colorado.

“Today’s initial life of mine plan already demonstrates a long-lived operation,” said SSR executive chairman Rod Antal.

SSR acquired CC&V from Newmont (NYSE: NEM; TSX: NGT) in February, and the mine has already generated enough after-tax free cash flow to cover the $100 million upfront payment. CC&V is expected to produce between 90,000 and 110,000 ounces of gold this year, with annual output projected to average 141,000 ounces from 2026 to 2028.

At an average gold price of $3,240 per ounce over the mine’s life, the after-tax net present value (NPV) is estimated at $824 million. If gold averages $4,000 per ounce, the NPV would rise to about $1.5 billion. Based on payments and projected cash flow, SSR estimates an implied internal rate of return of over 100% on the acquisition.

The updated technical report accounts for a proposed expansion of the mine’s open pits and leach pads. Most ore is expected to come from the Globe Hill, Schist Island, and South Cresson pits, which are currently in operation. CC&V holds 235.1 million proven and probable tonnes grading 0.37 grams of gold per tonne, containing 2.8 million ounces. Measured and indicated resources total 344.8 million tonnes at 0.44 grams per tonne, or 4.8 million ounces, with an additional 149.6 million inferred tonnes at 0.41 grams per tonne, containing 2 million ounces.

These 6.8 million ounces of additional resources are not included in the current mine plan, giving SSR “significant optionality to further extend CC&V’s mine life,” according to Scotia Capital mining analyst Ovais Habib. Habib added that CC&V is “a generational asset for the company, providing significant free cash flow with leverage to a higher gold price.”

SSR expects all-in sustaining costs to average $2,051 per ounce during 2026-28 and $2,135 per ounce for 2026-30. “The higher life-of-mine unit operating costs comes as a surprise, exceeding our estimates and actual costs realized by both SSR and Newmont to date,” Habib said.

Located about 160 km southwest of Denver, CC&V covers roughly 61 square kilometers within a prolific U.S. gold mining district. More than 2.8 million metres of drilling have been completed across more than 17,000 holes on the property.

SSR shares fell 0.2% to C$29.11 Tuesday morning in Toronto, giving the company a market capitalization of about C$5.9 billion ($4.2 billion). Over the past year, the stock has traded between C$7.30 and C$36.45.

This report positions CC&V as a cornerstone asset for SSR, with extended mine life, substantial cash flow potential, and the ability to leverage future increases in gold prices.