Wedoany.com Report on Feb 10th, Jin Hui Shares announced that it plans to acquire 100% equity of Fu Sheng Mining with a full cash payment of 2.1 billion yuan. Upon completion of the transaction, Fu Sheng Mining will become its wholly-owned subsidiary, marking Jin Hui Shares' official entry into the gold mining sector and steadily advancing the diversified layout of its non-ferrous metals business.

From an industry professional perspective, this acquisition is not merely a simple asset addition, but a strategic move by Jin Hui Shares to mitigate risks associated with single-category operations and leverage regional resource endowments. Below, we analyze the rationality and foresight of this acquisition, starting with the core value of the target asset.

According to Jin Hui Shares' announcement and third-party professional verification data, the core asset of Fu Sheng Mining is the mining right for the Lao Shenggou Gold Mine in Hui County. The mining type is gold, with an approved production scale of 50,000 tons/year, a mining area of 1.2022 square kilometers, and a mining license valid until April 2035, leaving nearly 9 years of remaining mining life. As of the reserve verification base date of October 31, 2014, the mining area retains ore reserves of 771,574.28 tons, Au metal content of 1,626.43 kilograms, and an average Au grade of 2.11 grams/ton.

According to China's gold mine exploration standards, the boundary grade for gold mines should not be less than 1 gram/ton, and the industrial grade should not be less than 3 grams/ton. Fu Sheng Mining's average grade of 2.11 grams/ton is at a medium level. Combined with current mature gold mining technology, gold mines of this grade do not require high investment in beneficiation and purification costs; stable profitability can be achieved through scaled production, which aligns well with Jin Hui Shares' existing mine operation experience.

The pricing of this acquisition demonstrates full industry rationality: Jin Hui Shares commissioned a professional appraisal institution to evaluate the total equity of Fu Sheng Mining's shareholders using the asset-based method, with the appraisal base date set as January 31, 2026. The appraised value was 210.3947 million yuan, representing an appreciation of 200.4857 million yuan and an appreciation rate of 2023.27%. The final transaction price was set at 210 million yuan, slightly lower than the appraised value, a result of mutual agreement between the transaction parties, consistent with the pricing conventions for mergers and acquisitions in the gold mining industry—the core valuation of gold mining enterprises lies in resource reserves and mining right value, with the main source of appreciation in this appraisal being the scarcity of the mining right and its long-term revenue potential.

The timing of this acquisition is highly strategic, precisely aligning with the current high-growth cycle of the gold mining industry. Currently, global geopolitical risks continue to intensify, market risk aversion is rising, and global central banks are persistently increasing their gold holdings. Although the spot gold price in London experiences short-term fluctuations, it remains overall high, recently touching $5,405 per ounce, highlighting the continued resilience of gold prices. According to predictions by the China Gold Association, expectations of a Federal Reserve interest rate cut in 2026 will push down real interest rates. Coupled with the ongoing deepening of the global "de-dollarization" trend, the central price of gold is expected to rise steadily, further expanding the profit margins for gold mining enterprises. It is important to note here that, despite the prominent industry benefits, fluctuations in gold prices may still bring potential risks. Investors need to maintain rational judgment and exercise caution in their layouts to avoid asset losses.

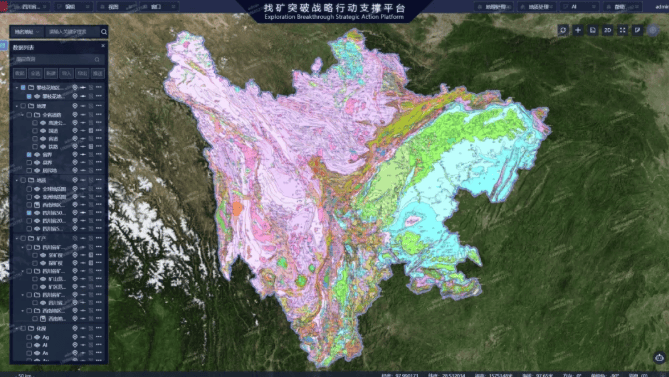

From a regional resource layout perspective, Fu Sheng Mining is located in Hui County, Longnan City, Gansu Province, situated within the Hui County-Liangdang gold metallogenic belt. This region is an important gold-rich area in Northwest China, with superior metallogenic conditions and well-developed surrounding mineral resource infrastructure. Jin Hui Shares' core business base is also rooted in Gansu. The geographical proximity of the target asset to the company's existing operational system allows for rapid synergy and reuse of management, technology, human resources, and other resources—the mature management experience, professional technical teams, and supply chain resources accumulated by Jin Hui Shares in lead-zinc mining can directly empower Fu Sheng Mining's mine operations, significantly reducing integration costs and shortening the profit cycle.

The funds for this acquisition are entirely sourced from Jin Hui Shares' own capital, using an installment payment method as follows: 40% (84 million yuan) will be paid within 7 working days after the agreement takes effect, 50% (105 million yuan) will be paid within 30 working days after the completion of industrial and commercial registration changes, and the remaining 10% (21 million yuan) will be paid within 3 months after the completion of industrial and commercial changes. As of the close on February 9, Jin Hui Shares' stock price was 16.46 yuan per share, with a total market capitalization reaching 16.098 billion yuan. The stock price has risen by 50.05% over the past year. The company demonstrates stable profitability and sufficient cash flow. The 210 million yuan acquisition price will not impose significant pressure on its financial condition nor harm the legitimate rights and interests of minority investors.

From the perspective of industry development trends, China's gold mining industry is accelerating its transformation towards intensification, diversification, and high quality. According to official statistics, as of the end of 2023, China's identified gold resource reserves were approximately 3,203.77 tons. Provinces and regions such as Shandong, Henan, Inner Mongolia, and Gansu remain the core areas for gold mining in China, with significant resource endowment advantages. Currently, leading non-ferrous metals enterprises are accelerating the consolidation of high-quality mining rights and expanding business boundaries through mergers and acquisitions to mitigate operational risks arising from fluctuations in single metal prices and to solidify their core competitiveness. Jin Hui Shares' acquisition of Fu Sheng Mining precisely aligns with this industry development trend and represents a crucial strategic move to achieve its own business breakthrough.

Prior to this, Jin Hui Shares' core business was concentrated on the mining and processing of zinc concentrate and lead concentrate (containing silver), resulting in a relatively singular business structure. The company's main business is non-ferrous metal mining and processing, with its primary products being zinc concentrate and lead concentrate (containing silver). It holds 4 mining rights, 3 exploration rights, and operates 5 mineral processing plants, with an annual mining and processing capacity of 1.78 million tons. As of the end of 2023, the company retained lead-zinc ore resources of 59.7927 million tons. This structure is susceptible to fluctuations in the prices of industrial metals like zinc and lead. Following the successful entry into the gold mining sector, the company will formally establish a dual-core business layout of "lead-zinc + gold," adding approximately 1.63 tons of gold resource reserves and an annual designed ore processing capacity of 50,000 tons. This will not only enrich the product portfolio and cultivate new profit growth points but also, by leveraging the safe-haven attribute of gold, effectively hedge against operational risks brought by price fluctuations of industrial metals like zinc and lead, further enhancing the company's sustainable development capabilities and comprehensive competitiveness.

From an objective standpoint, the gold mining industry also faces potential risks such as increasingly stringent environmental policies, rising mining costs, and fluctuations in ore grades. However, considering the asset condition of Fu Sheng Mining and the operational capabilities of Jin Hui Shares, these risks are considered controllable: Fu Sheng Mining's mining rights are complete, compliant, and fully in line with national environmental protection and safety production regulations; Jin Hui Shares has accumulated mature experience in green mine construction through long-term operations and can further reduce mining costs and improve resource recovery rates through technological upgrades; furthermore, the resource reserves and ore grades of Fu Sheng Mining have been strictly verified by professional institutions, ensuring reliable stability.