Recently, the China Nuclear Energy Association released the 63rd issue of the "CNEA International Natural Uranium Price Forecast Index (February 2026)".

Short-term - Monthly Spot Price Forecast Index (Monthly Update)

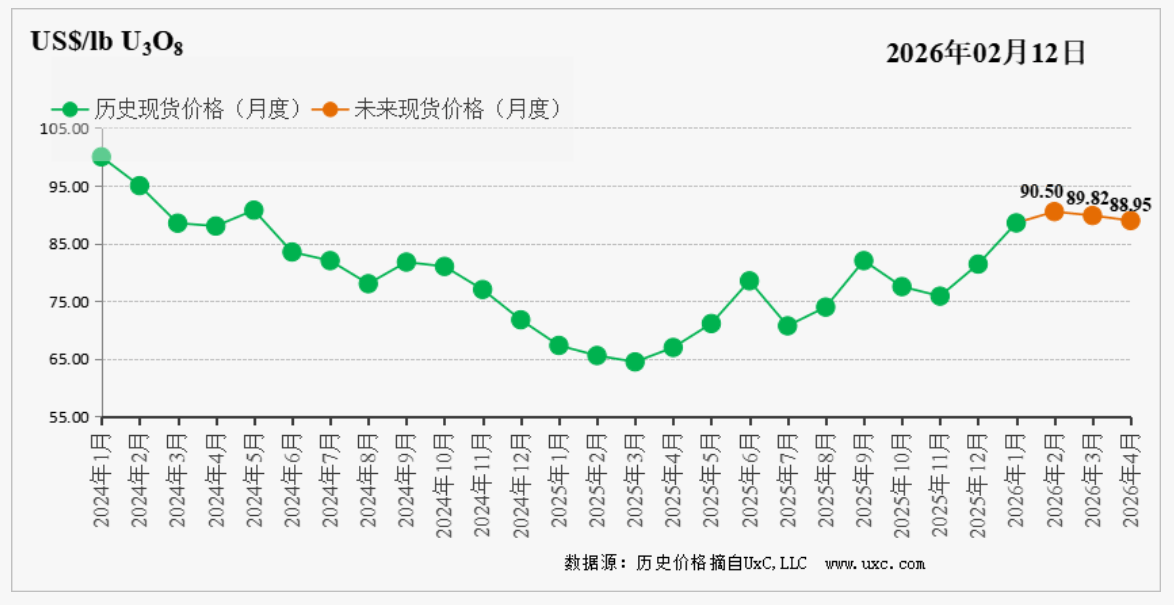

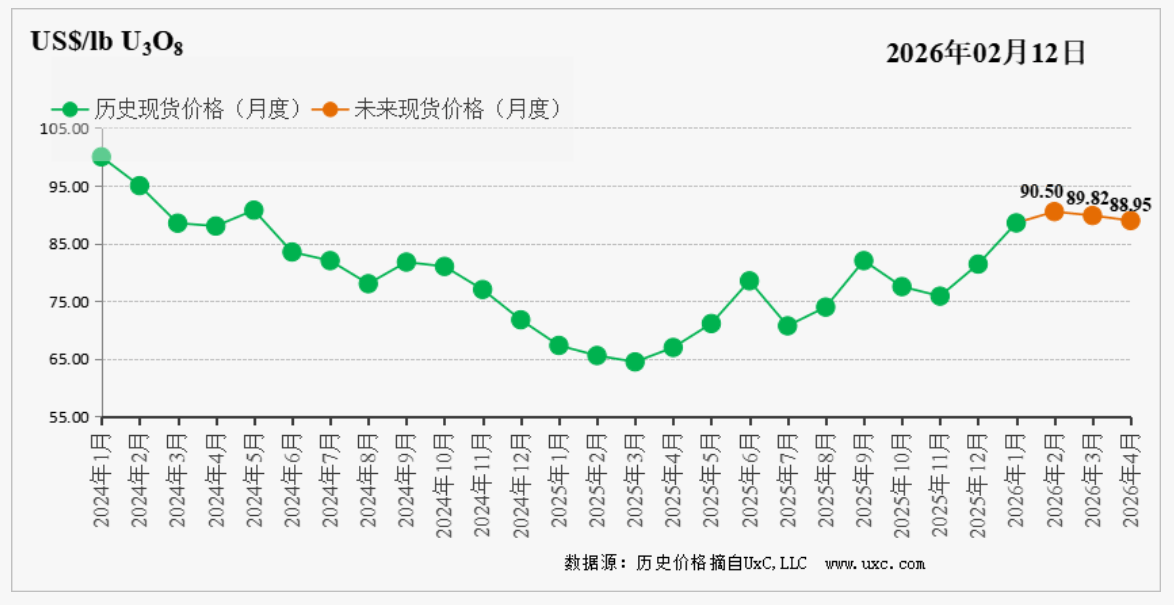

The conclusion of the previous forecast was: Supported by positive news such as the SPUT investment fund's continued financing and technology companies signing nuclear power purchase agreements, the market may continue its optimistic sentiment. However, after experiencing an increase and approaching the long-term price, the spot price may gradually become less attractive to market participants. Meanwhile, considering the fluctuating expectations for the Federal Reserve's interest rate cuts, the spot price may experience volatility, with an expected fluctuation range of $77-$87 per pound. Assuming no other major unexpected events occur in the future, based on URC's short-term ARIMA model, the spot price is expected to rise and then fall back over the next three months.

January Market Review: In January, the spot price showed an overall upward trend, with trading volume significantly higher than the previous month. In early January, the market was generally stable, with some buyers making sporadic purchases, and the spot price remained around $82.00 per pound. Starting from mid-January, supported by news such as the SPUT investment fund's newly announced financing plan and Meta signing a nuclear power purchase agreement, market optimism surged. The SPUT investment fund entered the market for large-scale procurement, driving the spot price to rise rapidly, reaching $101.25 per pound on January 29th. On January 30th, impacted by news of the new Federal Reserve chair nomination, the spot price dropped to $98.60 per pound.

Looking ahead, factors affecting the spot price over the next three months (February 2026 – April 2026) include:

Investment Fund Actions – Slowing Procurement Pace. Since the beginning of this year, the SPUT investment fund has continuously expanded its financing scale and intensified spot procurement in the market, with a single-day peak purchase reaching 539 tU. It is estimated that the SPUT investment fund still holds some cash and has the capacity for continued procurement. However, influenced by the uncertainty surrounding the Federal Reserve's interest rate cut path, its procurement pace may show a slowing trend.

Nuclear Power Plant Owners and Producer Actions – Continued Wait-and-See. Currently, the spot price has risen to a level comparable with the long-term price, reaching a relatively high point, which has reduced its attractiveness to nuclear power plant owners and producers. Considering that owners and producers face less pressure to replenish inventories at the beginning of the year and have no urgent demand for spot material, they are expected to temporarily maintain a wait-and-see attitude, with more cautious procurement actions.

Trader Actions – Opportunistic Market Entry for Procurement. Amid the volatile spot price conditions, traders, to ensure a continuous and sufficient supply for sale, may opportunistically enter the market for procurement when prices pull back, providing some support to the price.

The conclusion of this forecast is: In summary, over the next three months, the Federal Reserve's interest rate cut outlook faces significant uncertainty, which will likely intensify market wait-and-see sentiment, potentially affecting the SPUT investment fund's financing and procurement. The current spot price is already largely on par with the long-term price, leaving limited room for further increases in the absence of other positive news stimuli. Subsequently, volatility may persist, with an expected fluctuation range of $84-$94 per pound. Assuming no other major unexpected events occur in the future, based on URC's short-term ARIMA model, the spot price is expected to experience a slight decline over the next three months.

The Medium-to-Long-term - Annual Spot and Long-term Price Forecast Index (Quarterly Update) will be updated and released in early April 2026.