Wedoany.com Report-Sept. 10, Electric Hydrogen, a U.S.-based electrolyzer manufacturer, has completed the acquisition of hydrogen project developer Ambient Fuels in a move designed to expand its project pipeline and strengthen its capability to co-develop clean hydrogen facilities with customers. The transaction closed in May 2025 and is supported by a strategic partnership with Generate Capital, an infrastructure investment platform and former investor in Ambient Fuels.

As part of this partnership, Electric Hydrogen and Generate Capital will offer up to $400 million in hydrogen project finance solutions worldwide. This collaboration is intended to link Electric Hydrogen’s electrolyzer technology with project financing, lowering the cost of hydrogen production and enabling the company to originate, purchase, and sell large-scale clean hydrogen projects.

Raffi Garabedian, CEO and Co-founder of Electric Hydrogen, stated: “Clean hydrogen is poised for significant growth in the years ahead, supported in part by the RED-III compliance framework in the E.U. and the 45V hydrogen production tax credit in the U.S. We believe this new integration will both enable the industry to scale faster and give Electric Hydrogen even more ways to serve our diverse array of customers – from those who want to do it all themselves, from power procurement all the way to the finished clean-fuel – to those who prefer a partner to finance and develop the hydrogen plant so they can remain focused on their business outcomes. We’re excited to add this new capability with Ambient Fuels and Generate Capital.”

Jacob Susman, former CEO of Ambient Fuels and now leading project development at Electric Hydrogen, said: “We’re thrilled to join the Electric Hydrogen team. With this unique project finance capability from Generate Capital, our team is well positioned to support Electric Hydrogen customers who prefer to buy renewable hydrogen as a process input rather than building and operating their own renewable hydrogen plants. We believe this is a key ‘unlock’ for the nascent renewable hydrogen and renewable fuels industries that will help customers get to scale faster, enabled by Electric Hydrogen’s leading technology.”

Scott Gosselink, Managing Director at Generate Capital, added: “Generate Capital is determined to accelerate the transition to low-carbon molecules by offering leading project finance capabilities in close collaboration with skilled developers and innovative technologies. Working with Electric Hydrogen, we can help solve current finance and bankability challenges and reduce LCOH, enabling more hydrogen projects to reach Final Investment Decision.”

Electric Hydrogen confirmed that project capital deployment is targeted to begin in 2026. The integration of Ambient Fuels’ development expertise with Generate Capital’s financing is expected to strengthen Electric Hydrogen’s position in the growing clean hydrogen market.

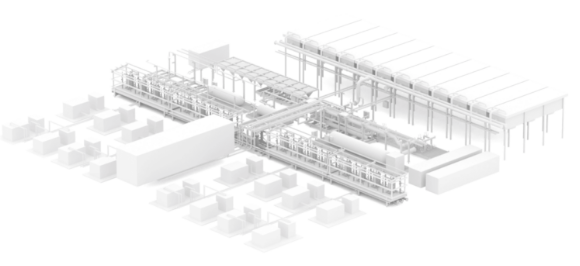

Separately, Norway-based classification society DNV recently completed a technical review of Electric Hydrogen’s turnkey electrolyzer solution, HYPRPlant. The review verified compliance with current industry standards for process design, safety, and manufacturing. The HYPRPlant uses the company’s proprietary proton exchange membrane (PEM) electrolyzer technology to deliver renewable hydrogen, further reinforcing Electric Hydrogen’s technology credentials.