Wedoany.com Report-Nov. 4, Rio Tinto (ASX: RIO) and Canada Growth Fund (CGF) have announced a joint initiative to expand the production of scandium oxide at Rio Tinto’s Critical Minerals and Metallurgical Complex in Sorel-Tracy, Québec. Under the agreement, CGF, a C$15 billion independent investment fund operating at arm’s length from the Government of Canada, will invest around C$25 million to support the facility, increasing its nameplate capacity to nine tonnes per year. This expansion strengthens Canada’s critical minerals supply chain and secures North America’s sole source of scandium oxide.

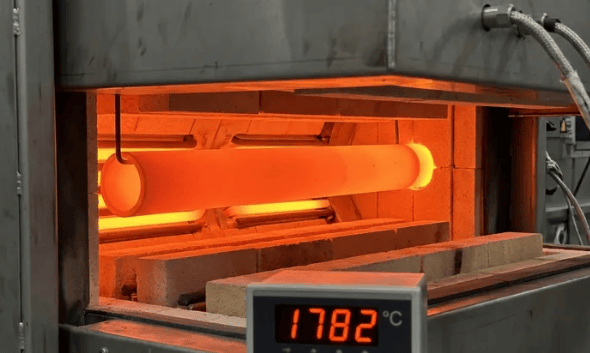

Rio Tinto’s metallurgical complex in Sorel-Tracy.

Rio Tinto’s demonstration plant, which began production in 2022, currently supplies all of North America’s scandium and is one of the few meaningful sources within the OECD. Scandium is a rare metal critical to high-performance aluminum alloys, solid oxide fuel cells, and other emerging technologies. Countries including the United States, Canada, Australia, and members of the European Union classify scandium as a critical mineral due to its enabling role in improving material performance beyond conventional limits.

In September 2025, the US Defense Logistics Agency announced plans to purchase up to $40 million of scandium oxide over five years from Rio Tinto to add to the national stockpile, highlighting the metal’s strategic importance. Rio Tinto has developed a breakthrough process to extract high-purity scandium directly from titanium dioxide production waste at its Québec operations, reducing the need for new mining and limiting environmental impact.

“Rio Tinto is pleased to partner with CGF and the Government of Canada to expand our Canadian production of scandium oxide, a high-performance material used for advanced manufacturing and energy generation,” said Sophie Bergeron, Managing Director of Rio Tinto Iron and Titanium and Diamonds. She added: “This project leverages an innovative process developed in Canada by our scientists, fully supplied from our domestic mining and metallurgical assets to provide a secure, North American supply of this critical mineral.”

CGF CEO Yannick Beaudoin highlighted the fund’s strategic role: “With its unique investment mandate, CGF invests into innovative transaction structures that directly support projects of strategic priorities. This transaction, completed alongside an established operating partner, enables us to unlock new models for risk-sharing and value creation that advance Canada’s supply chain resilience strategy.”

Scandium’s strategic importance is expected to grow as global industries shift toward electrification, carbon neutrality, and high-performance materials. While the global market remains small, China currently produces most of the world’s refined scandium, making North American production increasingly significant for regional supply security.

The expansion in Québec not only reinforces North America’s access to this rare mineral but also exemplifies sustainable innovation by utilizing existing waste streams. The project positions Canada as a reliable supplier of scandium, supporting advanced manufacturing, energy generation, and critical mineral security across the continent.

Overall, the collaboration between Rio Tinto and CGF represents a key step in securing North America’s critical mineral supply, advancing domestic production, and supporting the strategic development of high-performance materials essential for emerging technologies.