Wedoany.com Report-Nov. 14, During a Capital Markets Day media conference call on November 13, Gold Fields CEO Mike Fraser outlined the company’s production and growth strategy. The gold miner aims to increase output incrementally over the next five years, targeting around three million ounces annually by the end of the decade. From 2031 to 2035, Gold Fields plans to sustain production between 2.5 million and 3 million ounces per year.

Fraser said: “Our ambition to be a 2.5-million- to 3-million-ounce-a-year producer – we can quite comfortably demonstrate that for the next number of decades, given our existing reserve profile and the opportunities in front of us.” The call followed Gold Fields’ Capital Markets Day on November 12, which provided shareholders with an update on strategic initiatives aimed at enhancing the quality and value of the company’s portfolio.

Despite inflationary pressures, including producer currency inflation, higher royalties from rising gold prices, and general industry inflation, Fraser stated that Gold Fields expects to maintain all-in sustaining costs flat in real terms over the next five years. He also noted that the company intends to reinvest discretionary capital into the business to support sustainable long-term growth.

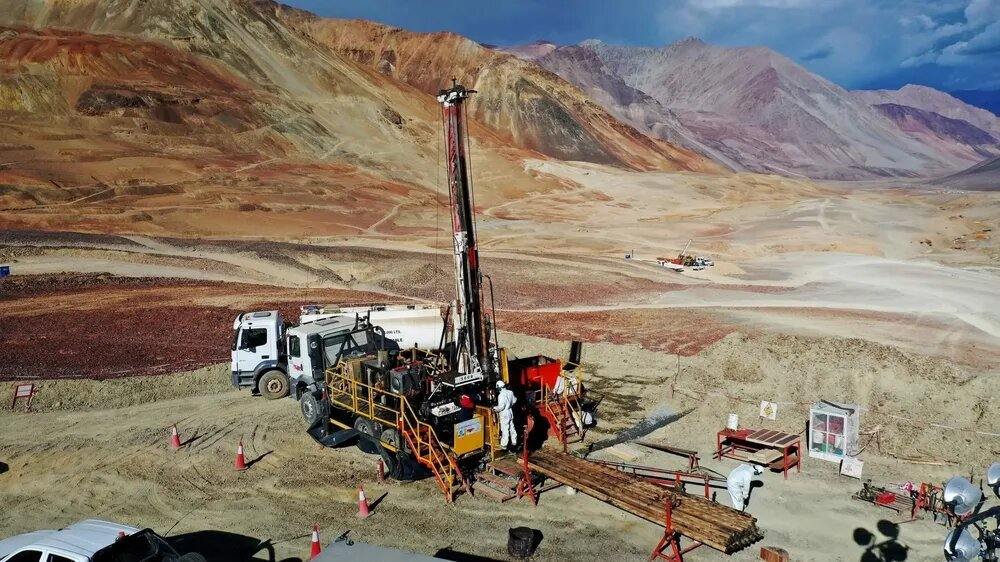

The CEO explained that approximately $2 billion has been allocated to unlock opportunities for extending mine life and reducing costs. This investment is intended to strengthen the company’s operations and position it for future growth.

Gold Fields also announced a refined capital allocation framework, including a revised dividend policy. In a Sens release, the company said its board approved a base dividend targeted at 35% of free cash flow before discretionary growth investments, with a minimum dividend of $0.50 per share, paid semi-annually at $0.25 per share. This is subject to maintaining an adjusted net debt-to-adjusted EBITDA ratio below 1 times. Fraser clarified: “Should this minimum be lower than the targeted 35% of free cash flow before discretionary growth investments, Gold Fields will make a top-up payment to reach the target.”

In addition to the base dividend, based on operating and financial performance in 2025 and current cash flow projections, the company expects to deliver up to $500 million in additional shareholder returns over a two-year period. These returns will take the form of share buybacks and/or special dividends, with timing and structure to be confirmed alongside the 2025 final dividend declaration.

Gold Fields’ plan reflects a clear focus on disciplined capital management, sustainable production growth, and enhanced shareholder returns, while maintaining cost efficiency and strategically reinvesting in its portfolio.