Wedoany.com Report-Nov. 30, Saudi Aramco has selected Citigroup Inc. as lead arranger for a potential multibillion-dollar stake sale in its oil storage and export terminals business, according to sources familiar with the decision.

Aramco has chosen Citigroup Inc. to help arrange a potential multibillion-dollar stake sale in its oil export and storage terminals business, according to people familiar with the matter.

The mandate was awarded to Citigroup in recent days following a competitive pitch process involving several major international banks. The appointment aligns with Citigroup CEO Jane Fraser's strategy to expand corporate and sovereign advisory business in the Middle East. In previous infrastructure transactions, Aramco had engaged JPMorgan Chase & Co. as sell-side adviser.

A formal sale process could begin as early as 2026, with strong expected interest from global infrastructure funds. Discussions remain preliminary, and details regarding timing, structure, and valuation have yet to be finalised.

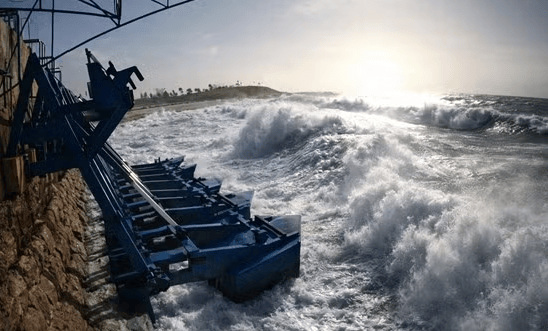

Aramco is exploring options that include selling a minority equity stake in the terminals business, which operates key export and storage facilities at Ras Tanura on the Persian Gulf and additional terminals on the Red Sea. The company also holds interests in product terminals in the Netherlands and maintains leased crude and product storage capacity in Egypt and Okinawa, Japan.

The planned transaction forms part of a broader asset monetisation programme aimed at generating capital for new investments amid lower oil prices, which have declined approximately 16 percent this year. While higher production volumes have partially offset the revenue impact, Aramco has deferred certain projects and is actively pursuing divestment opportunities, including potential sales from its real estate portfolio.

This potential deal would represent a larger and more complex transaction than earlier pipeline infrastructure stake sales. Earlier this year, a BlackRock-led consortium completed an $11 billion lease agreement for facilities supporting Aramco's Jafurah gas development.