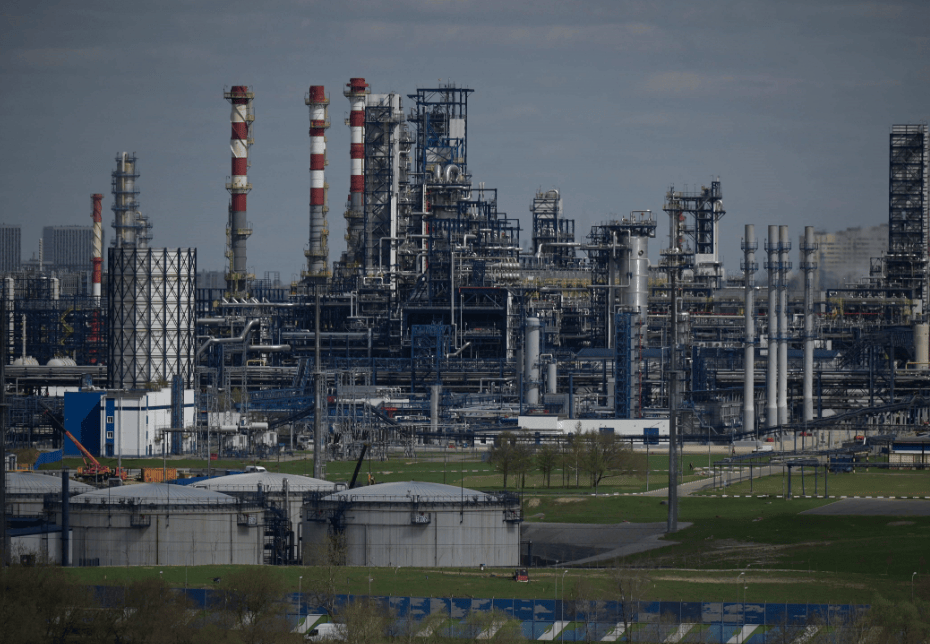

Yara International achieved stronger earnings in the fourth quarter and full year of 2025, primarily attributed to improved nitrogen fertilizer margins, increased business volume, and reduced fixed costs. Excluding special items, the fourth-quarter EBITDA grew to $709 million, up from $519 million in the same period last year, with net profit reaching $344 million, compared to a loss of $290 million in the fourth quarter of 2024.

Since the second quarter of 2024, Yara has successfully reduced fixed costs by over $200 million. The full-year performance benefited from increased delivery volumes and production, as well as the execution of cost and capital expenditure reduction plans. Yara's board has proposed an annual dividend of approximately $2 per share, which, at the current exchange rate, equates to 22 Norwegian kroner per share.

At the Capital Markets Day in January 2026, Yara outlined the next phase of its improvement plan, aiming to achieve an additional $200 million in EBITDA improvement by the end of 2027 and a further $150 million by the end of 2030. These gains are expected to come from enhanced asset utilization, optimized logistics, seizing market opportunities, and strict capital allocation.

Yara is also committed to diversifying its energy risk exposure and mitigating rising carbon costs to strengthen long-term resilience and returns. The company continues to advance its ammonia project with Air Products, with a final investment decision expected in mid-2026.

CEO Svein Tore Holsether stated, "The company's flexible operating model allows us to manage geopolitical and regulatory uncertainties." He added that Yara will maintain strict capital prioritization to support cash flow growth and shareholder returns throughout the cycle.