Wedoany.com Report-Nov. 5, The Sizewell C project, planned to build two EPR reactors on England’s east coast, has reached Financial Close, including GBP5 billion (USD6.5 billion) in export credit financing from BpifranceAE and debt funding from the UK’s National Wealth Fund, EDF announced.

How the new plant could look

Under the financing structure, EDF will invest a maximum of GBP1.1 billion during construction, holding a 12.5% stake. The UK government holds 44.9%, La Caisse 20%, Centrica 15%, and Amber Infrastructure 7.6%. EDF stated: "EDF will not invest new cash at financial close due to the reimbursement of the development costs incurred since 2015 and a payment in return for the Hinkley Point C project expertise that Sizewell C benefits from, as well as the series effect."

Thirteen banks supported the GBP5 billion debt raise, including ABN Amro, BBVA, Santander CIB, BNP Paribas, Crédit Agricole, CaixaBank, Citibank, Crédit Industriel et Commercial, HSBC, Lloyds, NatWest, Natixis, and Societe Generale. Sizewell C said: "This landmark moment sees funding for the project beginning to flow, unlocking full-scale construction of the Suffolk-based plant."

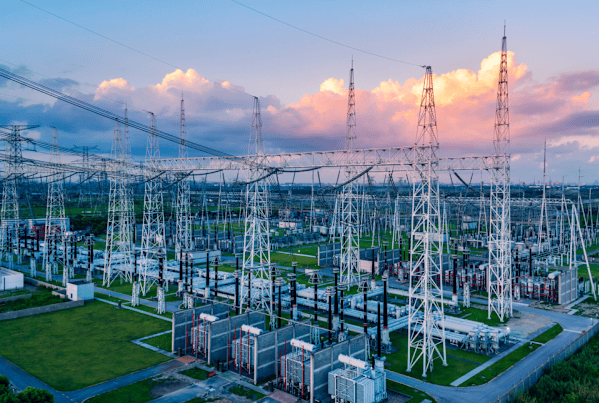

The plant is estimated at GBP38 billion and will feature two EPR reactors producing 3.2 GW of electricity, sufficient to power approximately six million homes for at least 60 years. The design mirrors the two-unit Hinkley Point C plant in Somerset, with the aim of building faster and at lower cost due to prior experience. A final investment decision was taken in July 2025.

Sizewell C is using the Regulated Asset Base (RAB) funding model, allowing consumers to contribute during construction. EDF explained: "The financing model attracts private investment that would not otherwise be possible. Government estimates that using the RAB can save consumers GBP30 billion, compared with other models, as a result of lower financing costs."

UK Energy Secretary Ed Miliband said: "By backing nuclear we are creating thousands of high-quality jobs across the country, supporting British supply chains and keeping the lights on with homegrown energy for generations to come."

Tom Greatrex, CEO of the Nuclear Industry Association, added: "Reaching financial close for Sizewell C is a landmark moment for the UK's clean energy future. It proves that new nuclear can attract significant investment – a vital step towards energy security, skilled jobs, and achieving net zero. The financing model used for Sizewell C is crucial to unlocking further private investment in new nuclear projects, cutting our reliance on fossil fuels, and driving an industrial revival across Britain."

EDF highlighted the benefits for the French nuclear sector: "The EDF group will contribute to the project as a supplier of engineering studies (EDF/Edvance), the main primary circuit including the nuclear boiler, steam generators and safety control system (Framatome) and, for the conventional island, the turbo-alternator unit (Arabelle Solutions). For the French nuclear industry more broadly with some 40 French suppliers, it will help to perpetuate skills, capitalise on experience and generate economies of scale for the EPR2 programme in France."

Legal and financial advisers included Clifford Chance, Rothschild & Co, BNP Paribas, HSBC, and Santander CIB, supporting the complex capital raise and export credit-backed facility.

Sizewell C’s financial close marks a major milestone for UK nuclear power, combining private investment, government backing, and international expertise to deliver a low-carbon energy source for decades.