Wedoany.com Report-Nov. 12, SoftBank Group (9984.T) reported a surge in quarterly profit on Tuesday, driven by strong valuation gains in its OpenAI holdings, highlighting CEO Masayoshi Son’s “all in” strategy on the AI developer. The Japanese technology investor posted second-quarter net profit of 2.5 trillion yen ($16.6 billion), more than double the 1.18 trillion yen earned in the same period last year. This marks SoftBank’s strongest quarterly result since July-September 2022.

The company’s OpenAI stake, valued at 2.16 trillion yen for the quarter, has been a major contributor to the profit jump. SoftBank plans to increase its total investment in OpenAI to approximately $34.7 billion by the end of December 2025. In March, SoftBank led a funding round of up to $40 billion for OpenAI at a $300 billion valuation, and in October it participated in a consortium acquiring $6.6 billion of shares from OpenAI employees at a $500 billion valuation.

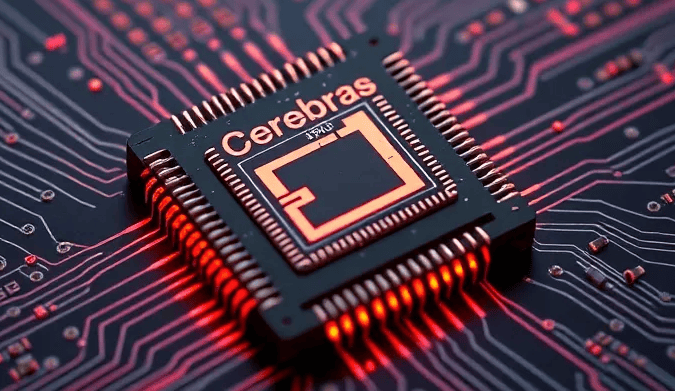

To fund these AI-related initiatives, SoftBank has accelerated fundraising activities. In October, it sold its remaining 32.1 million Nvidia (NVDA.O) shares for $5.83 billion and also divested part of its T-Mobile (TMUS.O) stake for $9.17 billion. The company has additionally issued bonds in three currencies totaling 620 billion yen, $2.2 billion, and 1.7 billion euros ($1.98 billion), and arranged bridging loans of $8.5 billion for OpenAI and $6.5 billion for its pending acquisition of semiconductor design company Ampere.

Asked about the timing of the Nvidia sale, Chief Financial Officer Yoshimitsu Goto said the company needed to deploy existing assets to finance its large OpenAI investment. Analysts noted that Son’s move reflects his confidence in AI while reallocating capital. Wong Kok Hoi, founder and CEO of APS Asset Management in Singapore, said: “Son is a savvy investor so selling the entire stake must mean that he is no longer optimistic about the share price. Big tech companies may continue to invest heavily in GPU chips but not at this year’s level for many years.”

SoftBank’s stock has nearly quadrupled over the past six months, prompting a four-for-one stock split to make shares more accessible. The company’s Vision Fund unit posted an investment gain of 3.5 trillion yen, largely from OpenAI.

Despite the profit surge, concerns over an “AI bubble” persist, with some investors questioning whether high levels of capital investment in AI infrastructure will generate returns to justify valuations. Sources indicated that OpenAI is experiencing mounting losses even as its valuation rises. Goto said at a Tokyo briefing: “There are various opinions but SoftBank's position is that the risk of not investing is far greater than the risk of investing.”

SoftBank’s current AI-focused strategy is its most ambitious since launching Vision Fund vehicles in 2017 and 2019, requiring substantial capital deployment. CEO Masayoshi Son has a mixed record of leveraged bets on transformative technologies, with notable successes such as Alibaba and challenges like WeWork. Nevertheless, the latest results demonstrate the financial benefits of his high-conviction investment approach in AI.